- China

- /

- Electronic Equipment and Components

- /

- SZSE:000020

If EPS Growth Is Important To You, Shenzhen Zhongheng Huafa (SZSE:000020) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Shenzhen Zhongheng Huafa (SZSE:000020). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Shenzhen Zhongheng Huafa with the means to add long-term value to shareholders.

See our latest analysis for Shenzhen Zhongheng Huafa

Shenzhen Zhongheng Huafa's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Shenzhen Zhongheng Huafa has managed to grow EPS by 26% per year over three years. This has no doubt fuelled the optimism that sees the stock trading on a high multiple of earnings.

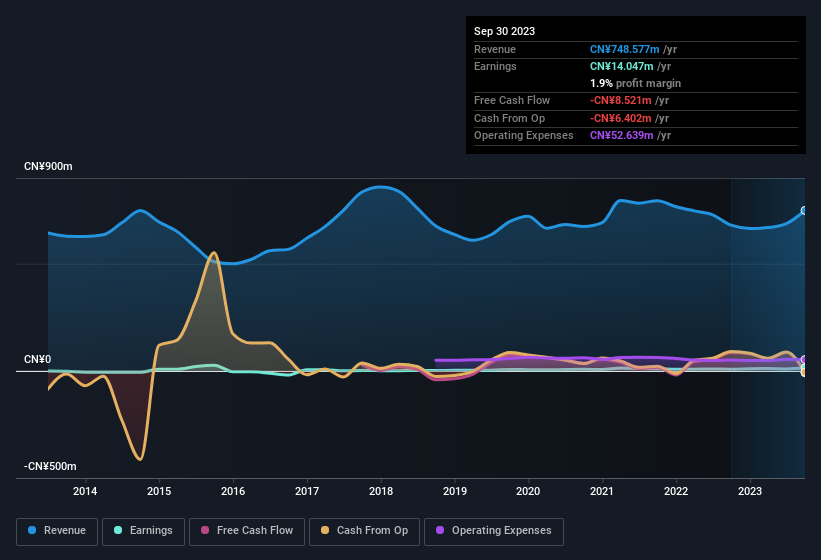

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Our analysis has highlighted that Shenzhen Zhongheng Huafa's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Shenzhen Zhongheng Huafa remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 10% to CN¥749m. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Shenzhen Zhongheng Huafa's balance sheet strength, before getting too excited.

Are Shenzhen Zhongheng Huafa Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. Our analysis has discovered that the median total compensation for the CEOs of companies like Shenzhen Zhongheng Huafa with market caps between CN¥1.4b and CN¥5.8b is about CN¥836k.

The Shenzhen Zhongheng Huafa CEO received CN¥480k in compensation for the year ending December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Shenzhen Zhongheng Huafa To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Shenzhen Zhongheng Huafa's strong EPS growth. Strong EPS growth is a great look for the company and reasonable CEO compensation sweetens the deal for investors ass it alludes to management being conscious of frivolous spending. We think that based on its merits alone, this stock is worth watching into the future. You should always think about risks though. Case in point, we've spotted 2 warning signs for Shenzhen Zhongheng Huafa you should be aware of, and 1 of them is a bit unpleasant.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000020

Shenzhen Zhongheng Huafa

Produces and sells injection molded parts, foam parts, and liquid crystal display monitors.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success