- China

- /

- Electronic Equipment and Components

- /

- SHSE:688681

What Shandong Kehui Power Automation Co.,Ltd.'s (SHSE:688681) 31% Share Price Gain Is Not Telling You

Shandong Kehui Power Automation Co.,Ltd. (SHSE:688681) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 38% in the last twelve months.

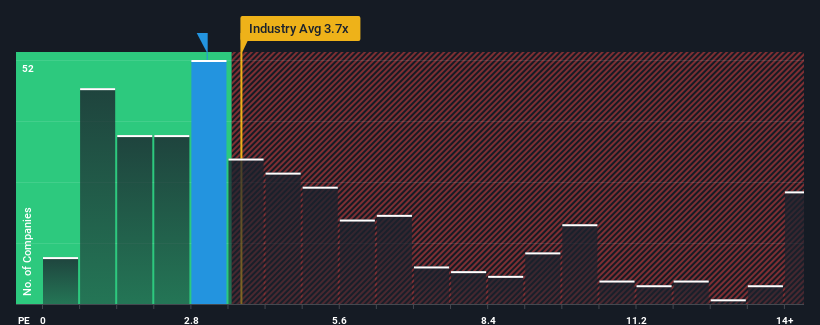

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Shandong Kehui Power AutomationLtd's P/S ratio of 3.1x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in China is also close to 3.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Shandong Kehui Power AutomationLtd

How Shandong Kehui Power AutomationLtd Has Been Performing

The revenue growth achieved at Shandong Kehui Power AutomationLtd over the last year would be more than acceptable for most companies. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Shandong Kehui Power AutomationLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Shandong Kehui Power AutomationLtd?

In order to justify its P/S ratio, Shandong Kehui Power AutomationLtd would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the industry, which is predicted to deliver 25% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that Shandong Kehui Power AutomationLtd's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Shandong Kehui Power AutomationLtd's P/S Mean For Investors?

Its shares have lifted substantially and now Shandong Kehui Power AutomationLtd's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Shandong Kehui Power AutomationLtd revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

You need to take note of risks, for example - Shandong Kehui Power AutomationLtd has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688681

Shandong Kehui Power AutomationLtd

Develops and sells cable and transmission line fault locators in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives