Guangzhou Fangbang ElectronicsLtd Leads 2 Other High Insider Ownership Growth Stocks On Chinese Exchange

Reviewed by Simply Wall St

As global markets navigate through fluctuating economic indicators, the Chinese stock market has shown resilience, bolstered by strong export data despite domestic challenges. In this context, companies like Guangzhou Fangbang Electronics Ltd., with high insider ownership, are particularly noteworthy as they often signal strong confidence from those closest to the company's operations and future.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Ningbo Sunrise Elc TechnologyLtd (SZSE:002937) | 24.3% | 27.7% |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.4% | 28.4% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 25.8% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| UTour Group (SZSE:002707) | 23% | 33.1% |

Let's uncover some gems from our specialized screener.

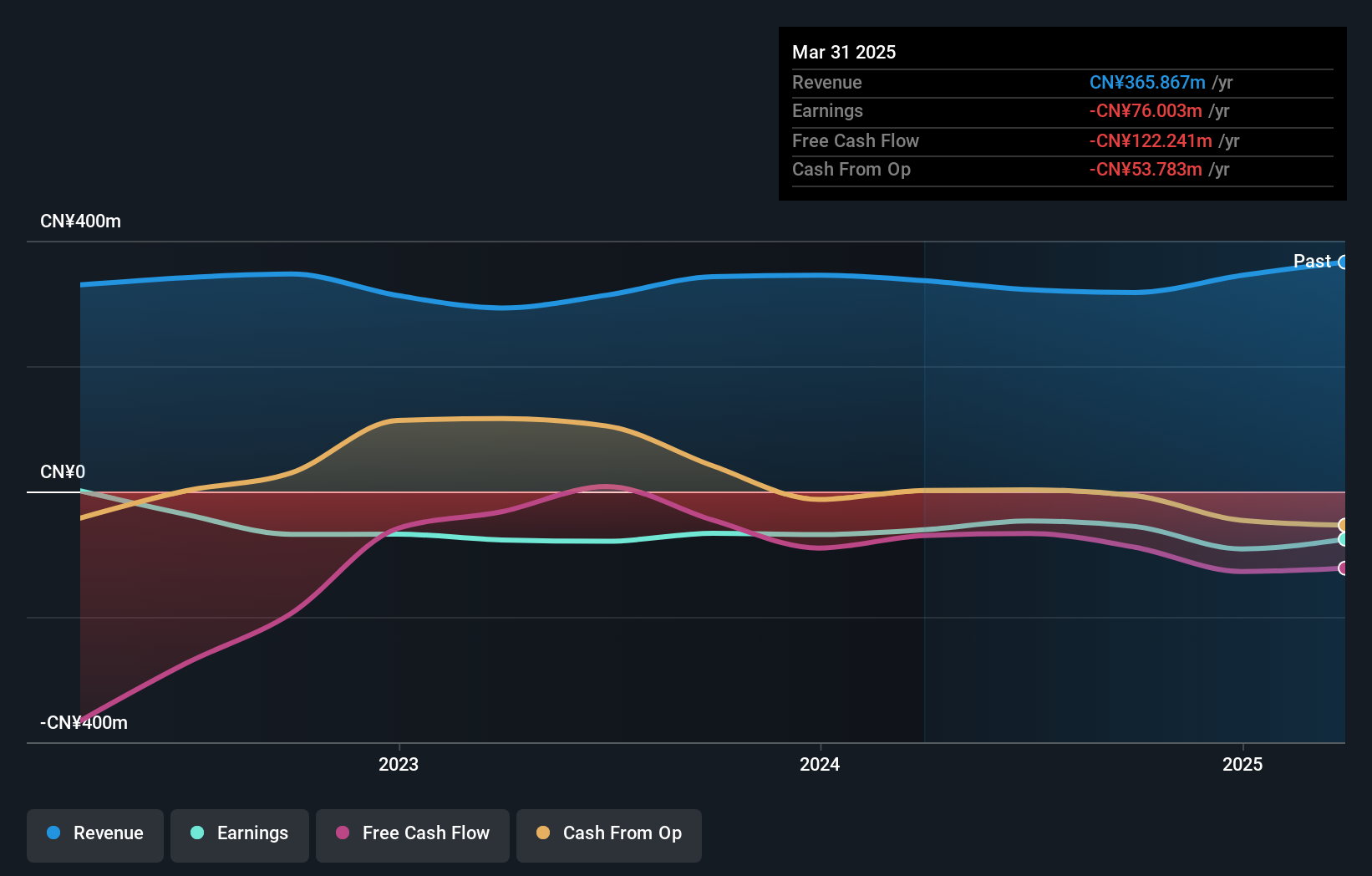

Guangzhou Fangbang ElectronicsLtd (SHSE:688020)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Fangbang Electronics Co., Ltd specializes in the R&D, production, sales, and service of electronic materials in China, with a market capitalization of approximately CN¥2.80 billion.

Operations: The company's revenue is primarily derived from the research, development, production, and sales of electronic materials.

Insider Ownership: 28.0%

Revenue Growth Forecast: 58.4% p.a.

Guangzhou Fangbang Electronics Co., Ltd is navigating a challenging phase with a net loss reduction in Q1 2024, reporting CNY 67.43 million in sales, down from the previous year. Despite recent revenue declines, the company's future looks promising with expected revenue growth outpacing the market at 58.4% annually and transitioning to profitability within three years. Recent share buybacks suggest confidence from management but be cautious of its highly volatile share price and current unprofitability.

- Delve into the full analysis future growth report here for a deeper understanding of Guangzhou Fangbang ElectronicsLtd.

- In light of our recent valuation report, it seems possible that Guangzhou Fangbang ElectronicsLtd is trading beyond its estimated value.

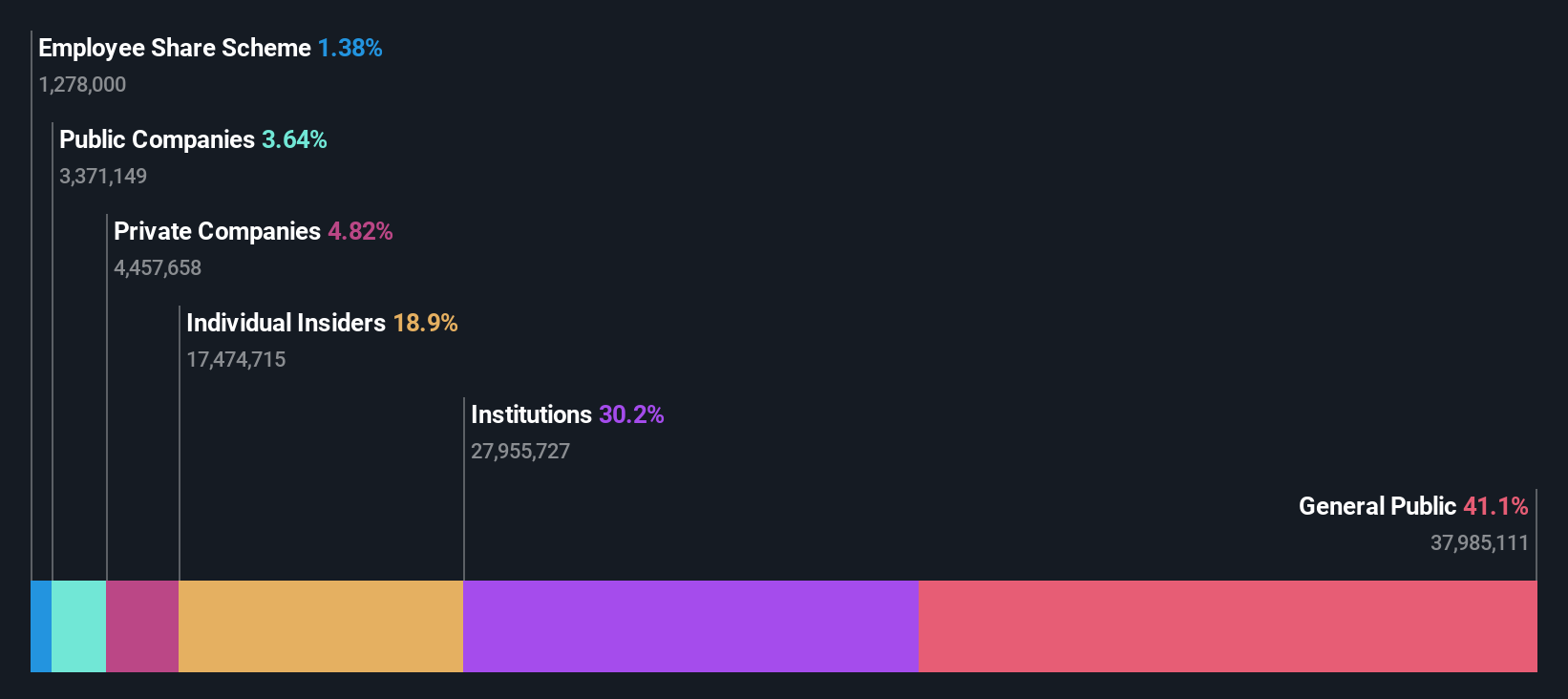

Shenzhen SEICHI Technologies (SHSE:688627)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen SEICHI Technologies Co., Ltd. specializes in the research, development, production, and sale of new display device testing equipment in China, with a market capitalization of approximately CN¥4.01 billion.

Operations: The company primarily generates revenue from the development, production, and sale of innovative display device testing equipment.

Insider Ownership: 18.6%

Revenue Growth Forecast: 29.2% p.a.

Shenzhen SEICHI Technologies has experienced substantial revenue growth, with a recent report showing a jump from CNY 51.18 million to CNY 83.05 million year-over-year. However, this growth is shadowed by an increased net loss of CNY 14.44 million. Despite the losses, earnings are expected to grow by 32.61% annually over the next three years, outpacing the Chinese market's forecast of 22.1%. The company's price-to-earnings ratio stands favorably at 38.4x compared to the industry average of 40.4x, indicating potential undervaluation amidst high volatility in its share price and a dividend yield that is currently not well covered by free cash flows.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen SEICHI Technologies.

- According our valuation report, there's an indication that Shenzhen SEICHI Technologies' share price might be on the expensive side.

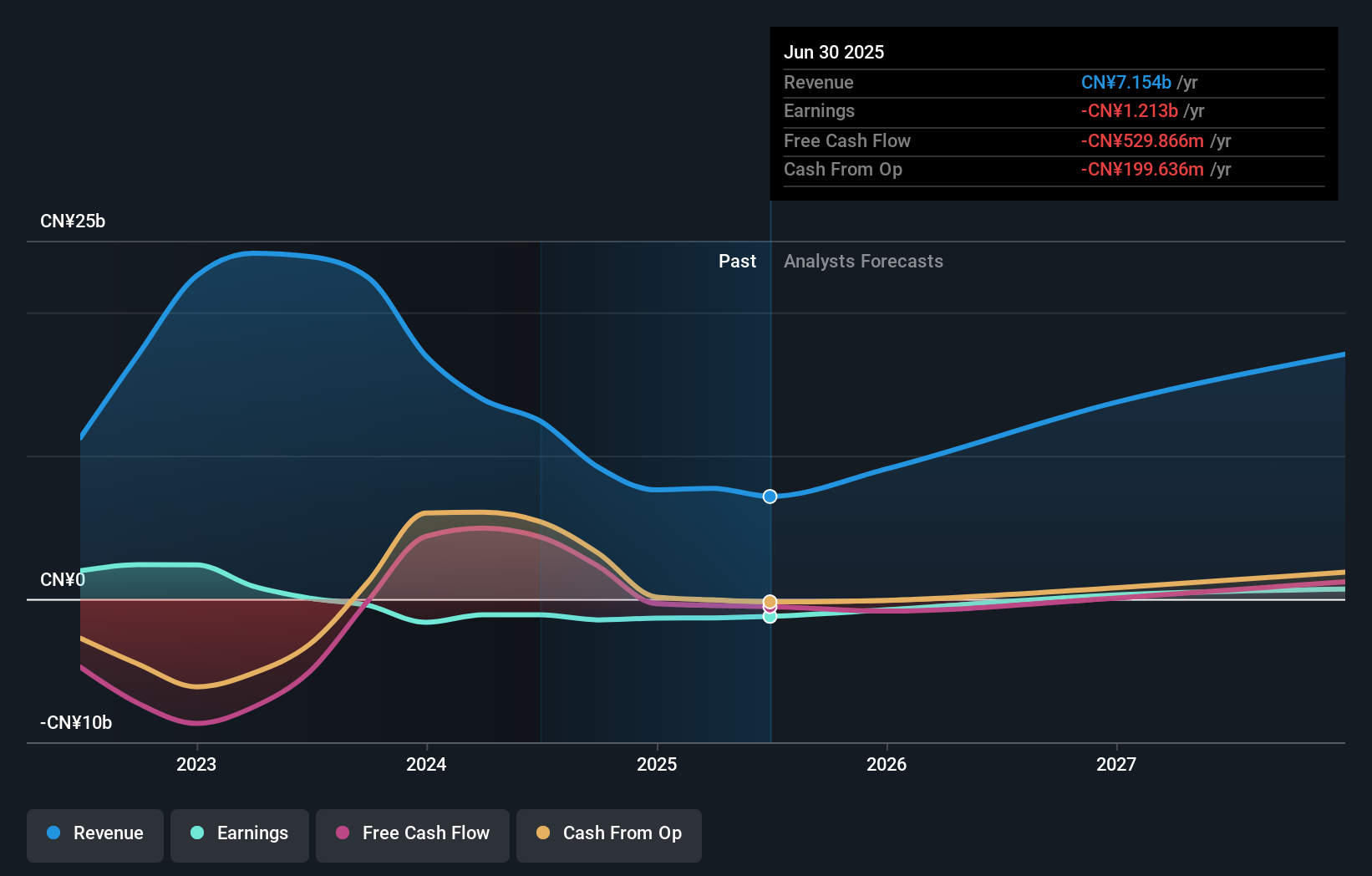

Shenzhen Dynanonic (SZSE:300769)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Dynanonic Co., Ltd. is a Chinese company involved in the R&D, production, and sale of nano-lithium iron phosphate and lithium-ion battery core materials, with a market capitalization of approximately CN¥7.76 billion.

Operations: The company generates revenue primarily from the research, development, production, and sales of nano-lithium iron phosphate, totaling CN¥3.05 billion.

Insider Ownership: 30.8%

Revenue Growth Forecast: 22.4% p.a.

Shenzhen Dynanonic is poised for significant growth, with earnings expected to increase by 90.22% annually. The company's revenue growth forecast at 22.4% per year surpasses the Chinese market average of 13.7%. Despite recent financial setbacks, including a substantial net loss reduction from CNY 717.33 million to CNY 184.68 million in Q1 2024, it is set to become profitable within three years. Moreover, its return on equity is projected to remain low at 13.9%. Recent share buybacks underline insider confidence despite these challenges.

- Dive into the specifics of Shenzhen Dynanonic here with our thorough growth forecast report.

- Our expertly prepared valuation report Shenzhen Dynanonic implies its share price may be lower than expected.

Where To Now?

- Delve into our full catalog of 366 Fast Growing Chinese Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300769

Shenzhen Dynanonic

Engages in the research and development, production, import, sale, and export of nano-lithium iron phosphate and lithium-ion battery core materials in China.

High growth potential with adequate balance sheet.