- New Zealand

- /

- Software

- /

- NZSE:VGL

Exploring High Growth Tech Stocks with Strong Potential

Reviewed by Simply Wall St

In a week marked by major stock indexes hitting record highs, growth stocks have notably outperformed value stocks, with sectors like consumer discretionary and information technology leading the charge. This market environment highlights the potential appeal of high-growth tech stocks, which are often characterized by their innovative capabilities and ability to capitalize on emerging trends within rapidly evolving industries.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1286 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Vista Group International (NZSE:VGL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vista Group International Limited offers software and data analytics solutions to the global film industry, with a market capitalization of NZ$705.90 million.

Operations: Vista Group International Limited generates revenue primarily through its software and data analytics solutions tailored for the global film industry. The company's market capitalization stands at NZ$705.90 million.

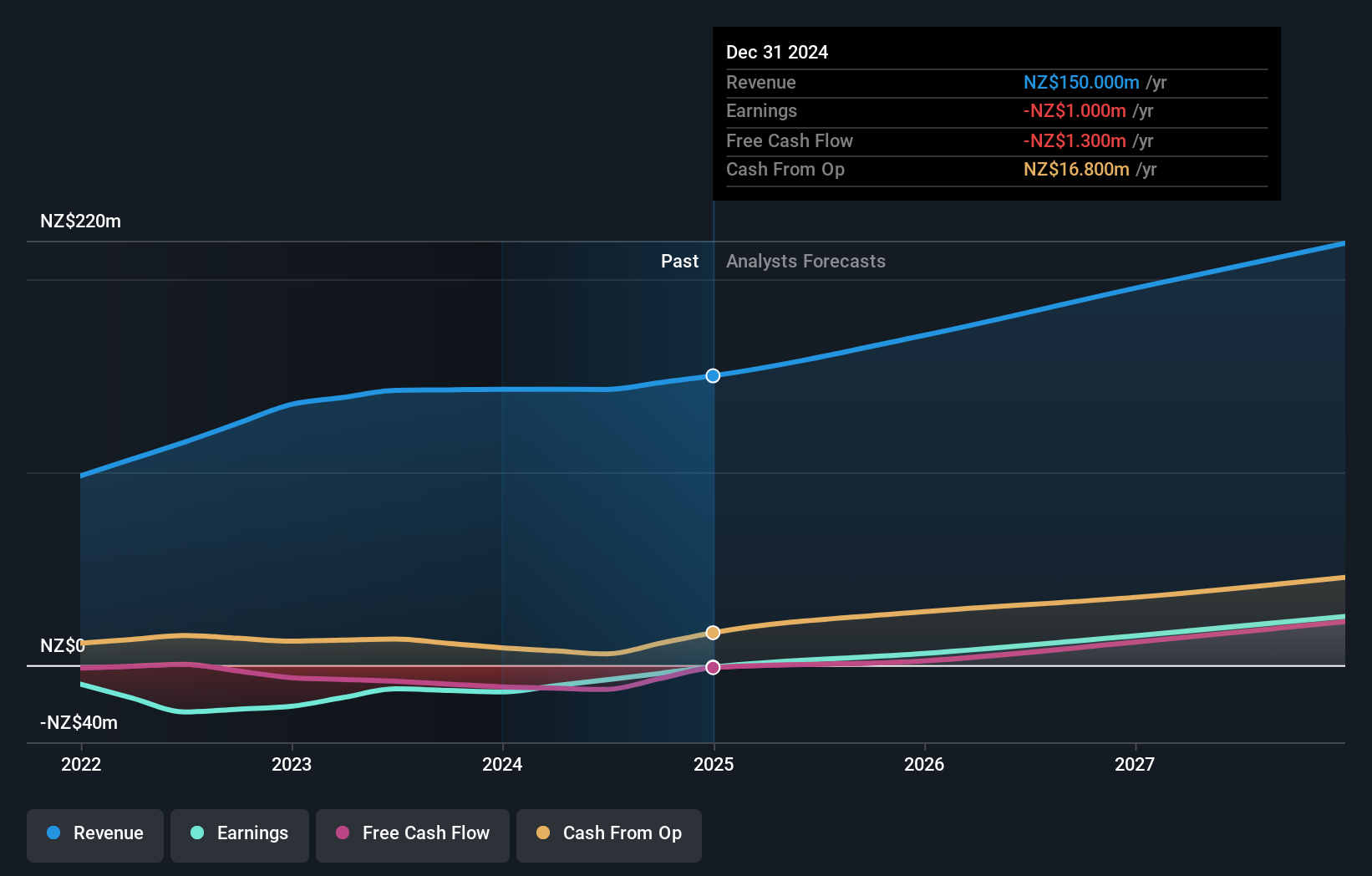

Vista Group International (VGL) is navigating a transformative phase with significant implications for its future in the tech industry. Despite currently being unprofitable, VGL's revenue growth is projected at 12.3% annually, outpacing the New Zealand market average of 4.4%. This growth trajectory is underpinned by an aggressive R&D investment strategy, which has seen expenses soar to fuel innovations and potentially profitable new products. Moreover, earnings are expected to surge by 61.1% per year as the company moves towards profitability within three years. Recent shareholder activism underscores a dynamic corporate governance landscape that could influence strategic directions and investor confidence moving forward.

3onedata (SHSE:688618)

Simply Wall St Growth Rating: ★★★★★☆

Overview: 3onedata Co., Ltd. offers industrial communication solutions and services globally, with a market cap of CN¥2.60 billion.

Operations: The company specializes in providing industrial communication solutions and services on a global scale. It operates with a market capitalization of approximately CN¥2.60 billion, focusing on delivering advanced communication technologies to various industries worldwide.

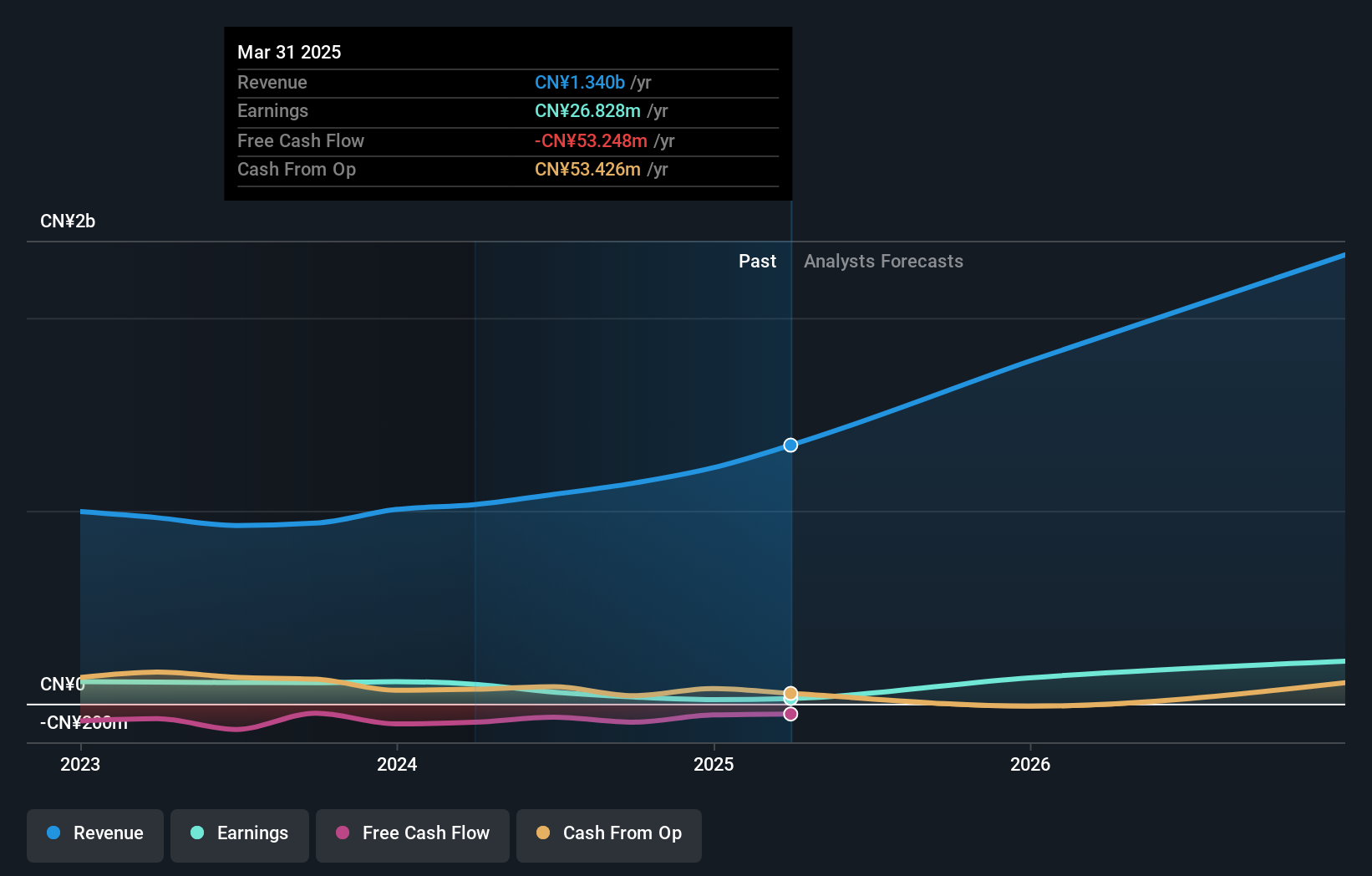

3onedata is demonstrating robust growth dynamics, with revenue projected to increase by 28.5% annually, outstripping the CN market's average of 13.7%. This surge is supported by a significant commitment to R&D, where expenses are strategically allocated to foster innovation and secure competitive advantages in the tech sector. Despite a recent dip in net income from CNY 76.81 million to CNY 33.28 million over nine months, the company's earnings are expected to climb by an impressive 38.2% each year, suggesting potential for substantial financial recovery and market position strengthening. Recent corporate activities include a special shareholders meeting and quarterly earnings calls that could hint at strategic shifts or reinforce investor confidence. The company's aggressive investment in R&D not only underscores its pursuit of technological advancement but also aligns with industry trends towards enhanced data solutions and connectivity—a critical move as industries worldwide increasingly depend on sophisticated tech infrastructure.

- Dive into the specifics of 3onedata here with our thorough health report.

Gain insights into 3onedata's historical performance by reviewing our past performance report.

Shenzhen Bromake New Material (SZSE:301387)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Bromake New Material Co., Ltd. focuses on the research, development, production, and sale of consumer electronics protective and functional products with a market capitalization of CN¥3.65 billion.

Operations: The company generates revenue primarily from the sale of electronic components and parts, totaling CN¥1.14 billion.

Shenzhen Bromake New Material Co., Ltd. has demonstrated a significant revenue growth rate of 40.5% this year, outpacing the Chinese market average of 13.7%. This growth is supported by an aggressive R&D strategy, with expenses amounting to a substantial portion of their revenue, reflecting a deep commitment to innovation in new materials technology. Despite facing challenges with net income dropping to CNY 7.41 million from CNY 87.35 million last year, the company's future prospects appear robust with earnings expected to surge by an impressive 92.7% annually, indicating potential for recovery and expansion in its market presence.

- Take a closer look at Shenzhen Bromake New Material's potential here in our health report.

Learn about Shenzhen Bromake New Material's historical performance.

Taking Advantage

- Click here to access our complete index of 1286 High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:VGL

Vista Group International

Provides software and data analytics solutions to the film industry.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives