- China

- /

- Communications

- /

- SHSE:688618

3onedata Co., Ltd. (SHSE:688618) Stock Rockets 31% But Many Are Still Ignoring The Company

3onedata Co., Ltd. (SHSE:688618) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 36% over that time.

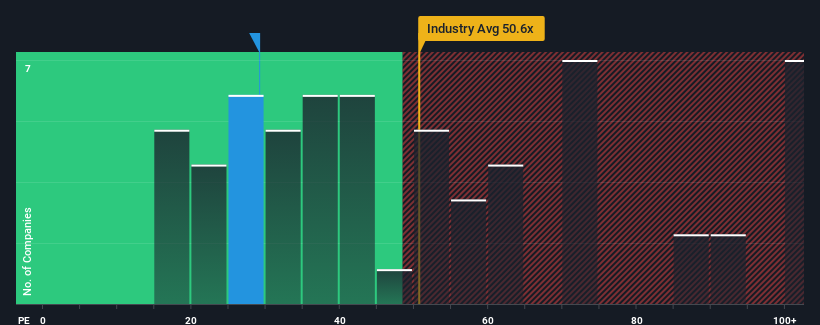

Even after such a large jump in price, there still wouldn't be many who think 3onedata's price-to-earnings (or "P/E") ratio of 29.1x is worth a mention when the median P/E in China is similar at about 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been pleasing for 3onedata as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for 3onedata

Is There Some Growth For 3onedata?

The only time you'd be comfortable seeing a P/E like 3onedata's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 15% gain to the company's bottom line. As a result, it also grew EPS by 29% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 61% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

In light of this, it's curious that 3onedata's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

3onedata's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that 3onedata currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for 3onedata you should be aware of.

If these risks are making you reconsider your opinion on 3onedata, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if 3onedata might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688618

3onedata

Provides industrial communication solution and services worldwide.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives