- China

- /

- Electronic Equipment and Components

- /

- SHSE:688616

Hangzhou Xili Intelligent Technology Co.,Ltd (SHSE:688616) Surges 36% Yet Its Low P/E Is No Reason For Excitement

Hangzhou Xili Intelligent Technology Co.,Ltd (SHSE:688616) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.9% over the last year.

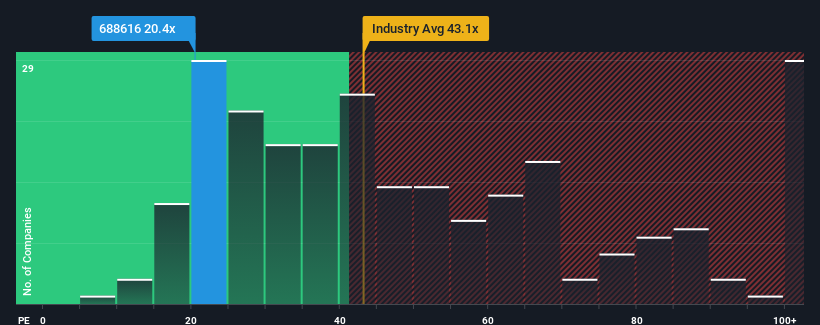

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may still consider Hangzhou Xili Intelligent TechnologyLtd as an attractive investment with its 20.4x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Hangzhou Xili Intelligent TechnologyLtd as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Hangzhou Xili Intelligent TechnologyLtd

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Hangzhou Xili Intelligent TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 57% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 37% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Hangzhou Xili Intelligent TechnologyLtd is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On Hangzhou Xili Intelligent TechnologyLtd's P/E

Despite Hangzhou Xili Intelligent TechnologyLtd's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Hangzhou Xili Intelligent TechnologyLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Hangzhou Xili Intelligent TechnologyLtd that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Xili Intelligent TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688616

Hangzhou Xili Intelligent TechnologyLtd

Hangzhou Xili Intelligent Technology Co.,Ltd.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success