- United Arab Emirates

- /

- IT

- /

- ADX:PRESIGHT

High Growth Tech Stocks To Watch In November 2025

Reviewed by Simply Wall St

As global markets navigate the aftermath of the longest U.S. government shutdown in history, small-cap stocks have faced heightened sensitivity to interest rate movements, with the Russell 2000 Index dropping notably amid cautious Federal Reserve commentary and concerns over elevated valuations. In this environment, identifying high growth tech stocks requires a focus on companies that demonstrate resilience against macroeconomic pressures and possess innovative capabilities to adapt to evolving market dynamics.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Pharma Mar | 21.68% | 41.50% | ★★★★★★ |

| Gold Circuit Electronics | 25.79% | 31.13% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| eWeLLLtd | 25.07% | 25.13% | ★★★★★★ |

| CD Projekt | 35.69% | 50.71% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Presight AI Holding (ADX:PRESIGHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Presight AI Holding PLC is a big data analytics company leveraging generative artificial intelligence, operating in the United Arab Emirates and internationally, with a market capitalization of AED17.11 billion.

Operations: Presight AI Holding PLC generates revenue primarily from its artificial intelligence, machine learning, data analytics, and hosting services, amounting to AED2.78 billion.

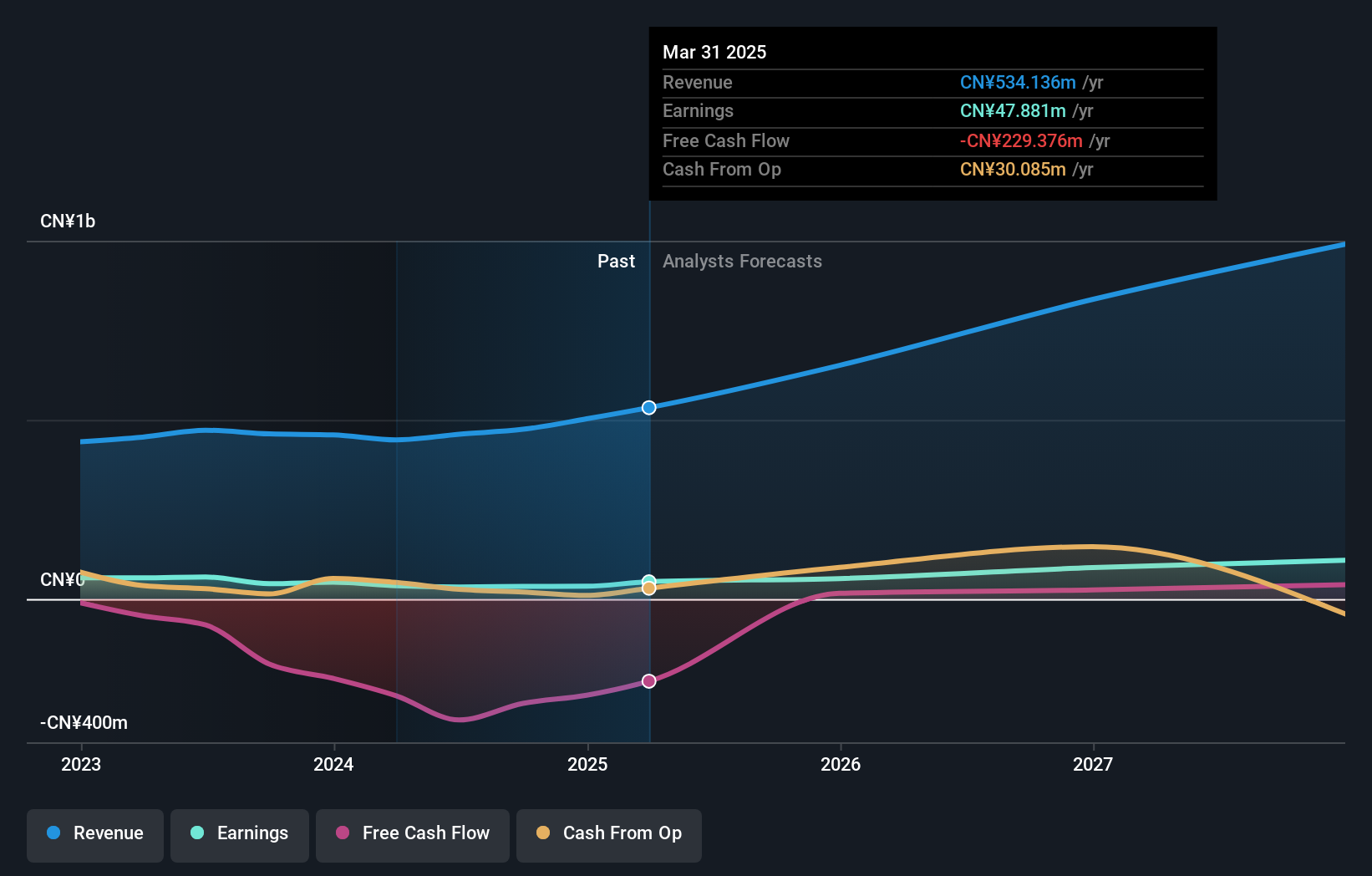

Presight AI Holding has demonstrated robust growth with a 21.7% annual increase in revenue, outpacing the AE market average of 7%. This growth is complemented by strategic alliances, such as those with ALPHA X and Dubai Taxi Company, aimed at enhancing digital transformation and smart city solutions. Despite a more modest earnings growth forecast of 17.3% annually, which remains above the market's 6%, challenges persist due to a decrease in profit margins from 30% to 19.8%. These figures underscore Presight's aggressive expansion efforts and innovation but highlight areas where efficiency gains are necessary to sustain profitability amidst rapid scaling activities.

- Take a closer look at Presight AI Holding's potential here in our health report.

Gain insights into Presight AI Holding's past trends and performance with our Past report.

MLOptic (SHSE:688502)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MLOptic Corp. is a precision optical solutions company serving both domestic and international markets, with a market cap of CN¥18.13 billion.

Operations: MLOptic Corp. generates revenue primarily from its Electronic Components & Parts segment, contributing CN¥630.65 million. The company's market presence spans both domestic and international regions, reflecting its strategic focus on precision optical solutions.

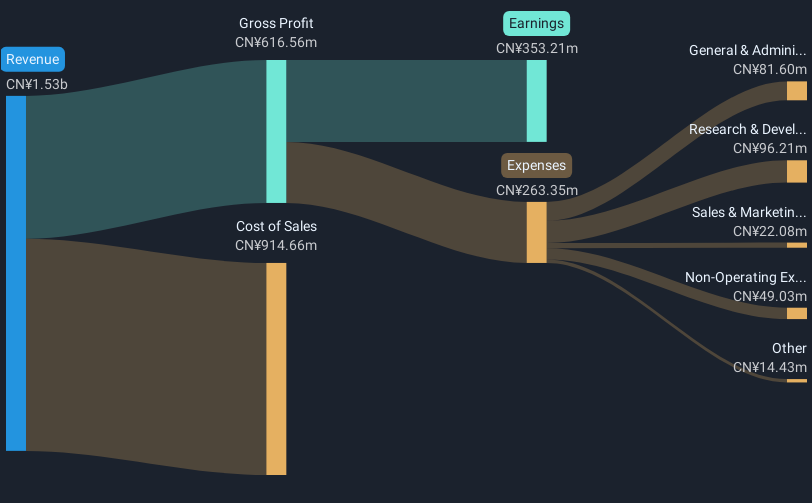

MLOptic's recent financial performance underscores its robust position in the tech sector, with a notable 34% increase in revenue to CNY 503.18 million and a surge in net income to CNY 45.69 million from last year's figures. This growth trajectory is bolstered by significant investments in R&D, reflecting a strategic focus on innovation—R&D expenses rose by 25%, aligning with its commitment to advancing optical technologies. The company also demonstrated confidence in its operations through share repurchases, enhancing shareholder value amidst market volatility. These developments suggest MLOptic is not only expanding its market footprint but also enhancing its technological capabilities, setting a strong foundation for future growth.

- Delve into the full analysis health report here for a deeper understanding of MLOptic.

Explore historical data to track MLOptic's performance over time in our Past section.

POCO Holding (SZSE:300811)

Simply Wall St Growth Rating: ★★★★★☆

Overview: POCO Holding Co., Ltd. specializes in the development, production, and sale of alloy soft magnetic powder and components for electronic equipment, with a market capitalization of CN¥20.48 billion.

Operations: The company focuses on producing alloy soft magnetic powder and cores, along with inductance components for electronic equipment. Its revenue streams are primarily derived from these products, targeting downstream users in the electronics sector.

POCO Holding has demonstrated a solid trajectory in the tech sector, with its recent earnings showing a rise in sales to CNY 1.3 billion, up from CNY 1.23 billion year-over-year, and net income increasing to CNY 293.58 million. This growth is underpinned by a strategic emphasis on innovation as seen in their R&D commitments—crucial for staying competitive in rapidly evolving tech landscapes. Moreover, the company's adjustments to corporate governance and capital structure suggest proactive management aligning with long-term operational goals, potentially enhancing future performance amidst dynamic market conditions.

- Get an in-depth perspective on POCO Holding's performance by reading our health report here.

Evaluate POCO Holding's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Take a closer look at our Global High Growth Tech and AI Stocks list of 248 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:PRESIGHT

Presight AI Holding

Operates as a big data analytics company powered by generative artificial intelligence (AI) in the United Arab Emirates and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives