- China

- /

- Electronic Equipment and Components

- /

- SHSE:688475

Optimistic Investors Push Hangzhou EZVIZ Network Co., Ltd. (SHSE:688475) Shares Up 28% But Growth Is Lacking

Hangzhou EZVIZ Network Co., Ltd. (SHSE:688475) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

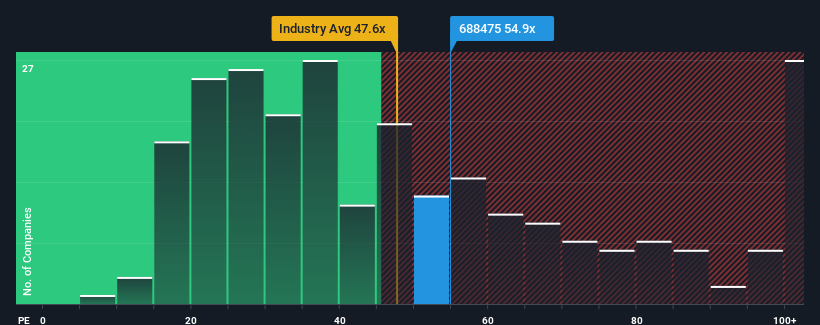

Following the firm bounce in price, Hangzhou EZVIZ Network may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 54.9x, since almost half of all companies in China have P/E ratios under 34x and even P/E's lower than 20x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

There hasn't been much to differentiate Hangzhou EZVIZ Network's and the market's retreating earnings lately. It might be that many expect the company's earnings to strengthen positively despite the tough market conditions, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Hangzhou EZVIZ Network

Is There Enough Growth For Hangzhou EZVIZ Network?

In order to justify its P/E ratio, Hangzhou EZVIZ Network would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with earnings down 4.7% overall from three years ago. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 32% during the coming year according to the ten analysts following the company. That's shaping up to be materially lower than the 38% growth forecast for the broader market.

With this information, we find it concerning that Hangzhou EZVIZ Network is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Hangzhou EZVIZ Network's P/E

The strong share price surge has got Hangzhou EZVIZ Network's P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Hangzhou EZVIZ Network currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Hangzhou EZVIZ Network (1 is concerning!) that you should be aware of before investing here.

Of course, you might also be able to find a better stock than Hangzhou EZVIZ Network. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou EZVIZ Network might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688475

Hangzhou EZVIZ Network

Engages in the manufacture and sale of smart home products in China and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives