- China

- /

- Electronic Equipment and Components

- /

- SHSE:688400

Exploring 3 High Growth Tech Stocks with Potential Expansion

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by rising inflation and fluctuating interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing value shares despite small-cap stocks lagging behind their larger counterparts. In this environment, identifying high-growth tech stocks that demonstrate robust potential for expansion can be particularly appealing to investors seeking opportunities in sectors poised for innovation and transformation.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 25.35% | 25.09% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1204 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

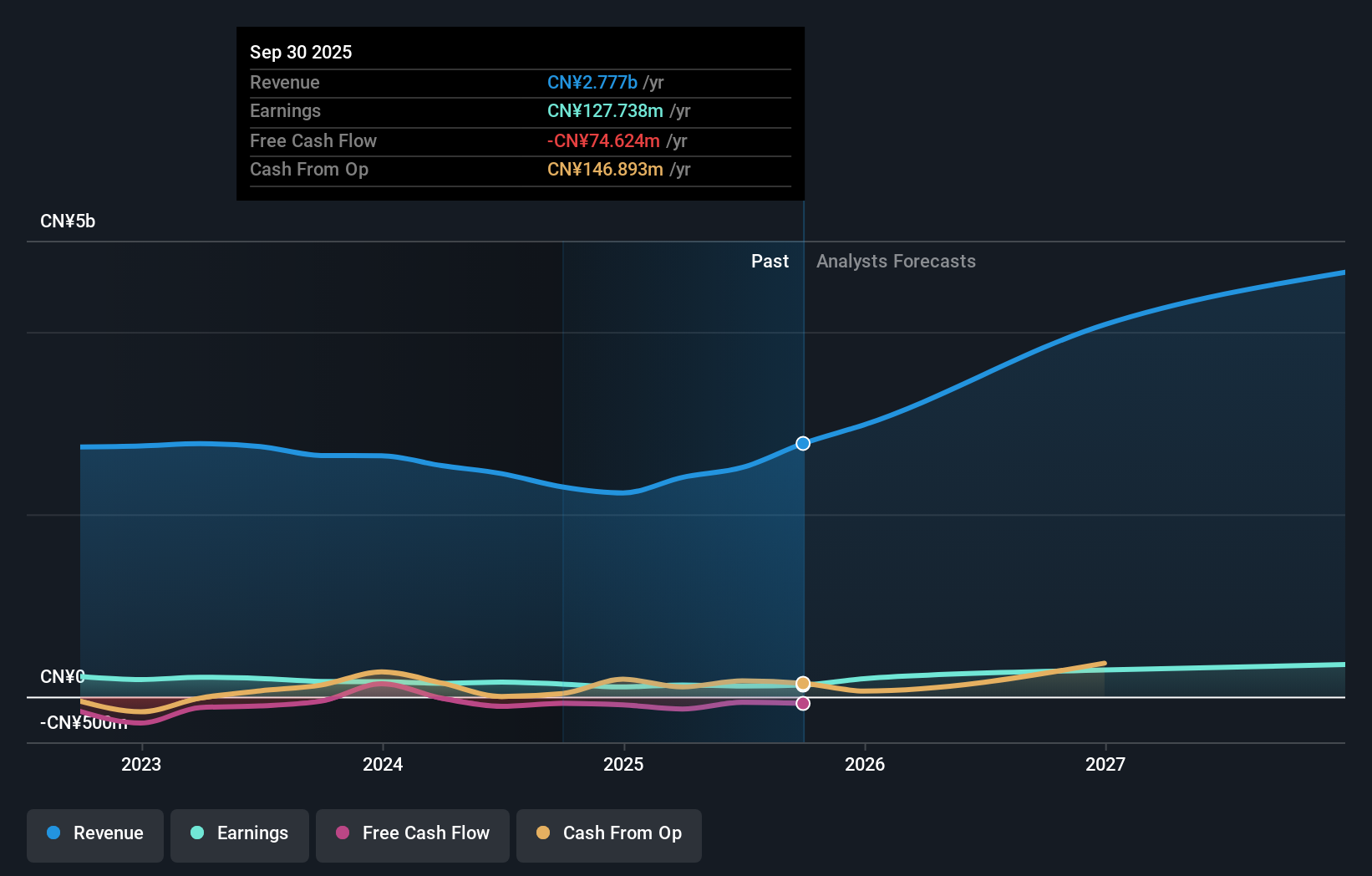

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company engaged in the research, development, manufacturing, and commercialization of antibody drugs with a market capitalization of HK$57.53 billion.

Operations: The company focuses on the research, development, production, and sale of biopharmaceutical products, generating CN¥1.87 billion in revenue from these activities.

Akeso's strategic focus on innovative cancer treatments is underscored by its recent advancements in clinical trials and regulatory successes. The company has demonstrated robust annualized revenue growth of 30.1% and earnings are projected to surge by 43.85% annually, signaling strong future prospects. Particularly noteworthy is Akeso's commitment to R&D, with substantial investments paving the way for groundbreaking therapies like ivonescimab and cadonilimab. These efforts are complemented by a series of Phase III trials that not only highlight the company's capability to lead in high-stakes environments but also position it well within the fiercely competitive biotech landscape.

- Get an in-depth perspective on Akeso's performance by reading our health report here.

Review our historical performance report to gain insights into Akeso's's past performance.

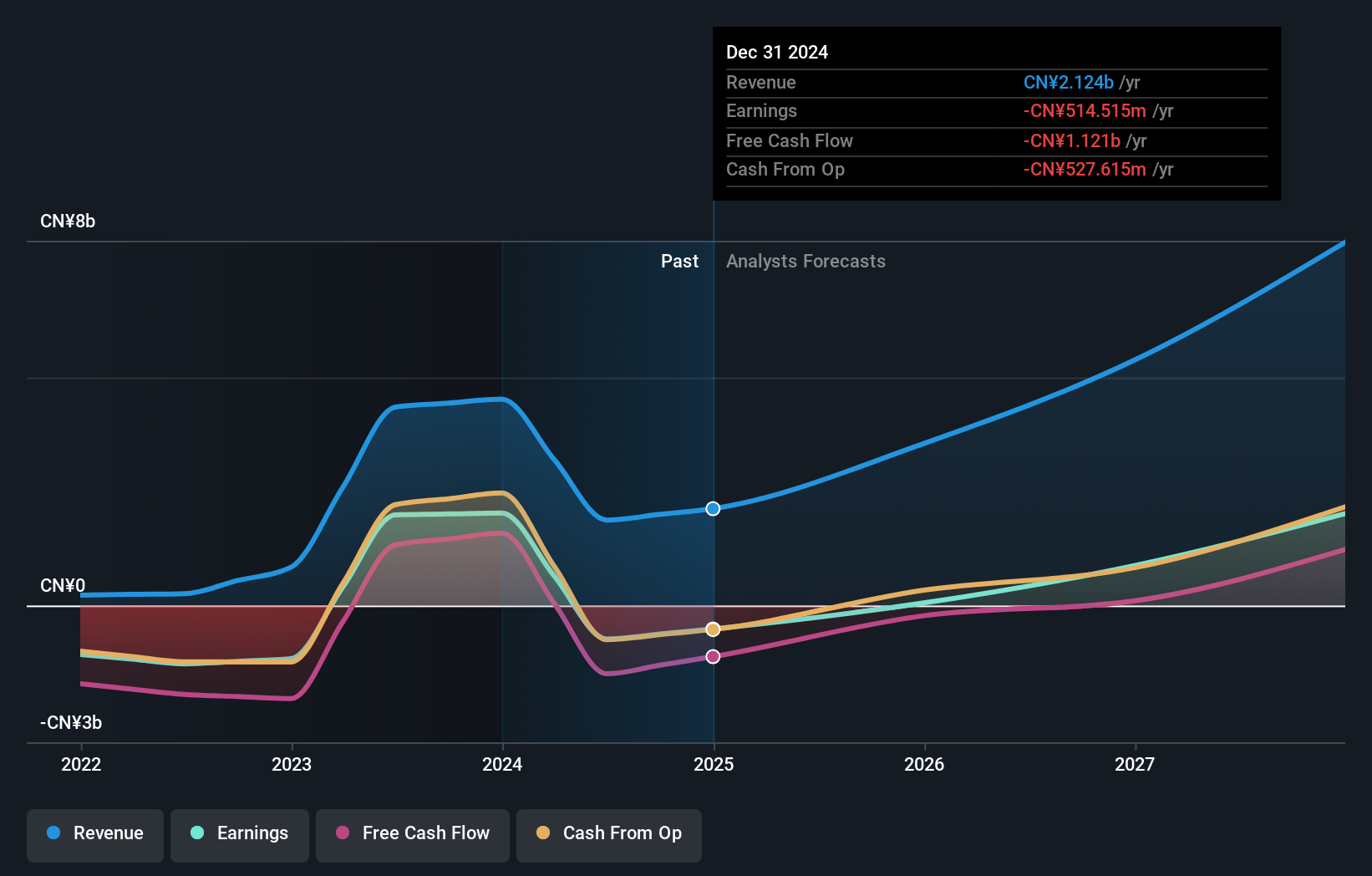

LUSTER LightTech (SHSE:688400)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LUSTER LightTech Co., LTD. focuses on the research and development of configurable visual systems, intelligent visual equipment, and core visual devices in China, with a market cap of CN¥18.94 billion.

Operations: LUSTER LightTech Co., LTD. specializes in developing advanced visual technology solutions, including configurable systems and intelligent equipment, within the Chinese market.

LUSTER LightTech's trajectory in the high-tech sector is marked by a robust annualized revenue growth of 22.3% and an even more impressive earnings growth forecast at 35.7% per year, outpacing the broader Chinese market's expectations. The company has also committed significantly to innovation, with R&D expenses reflecting this dedication; however, specific figures are not provided here. Recent strategic moves include a share repurchase program announced on December 5, 2024, aimed at enhancing shareholder value through a buyback of up to CNY 100 million worth of shares at CNY 35 each. Additionally, LUSTER has engaged in private placements raising up to CNY 785 million, signaling strong investor confidence and further financial fortification for future tech advancements.

- Click here and access our complete health analysis report to understand the dynamics of LUSTER LightTech.

Gain insights into LUSTER LightTech's past trends and performance with our Past report.

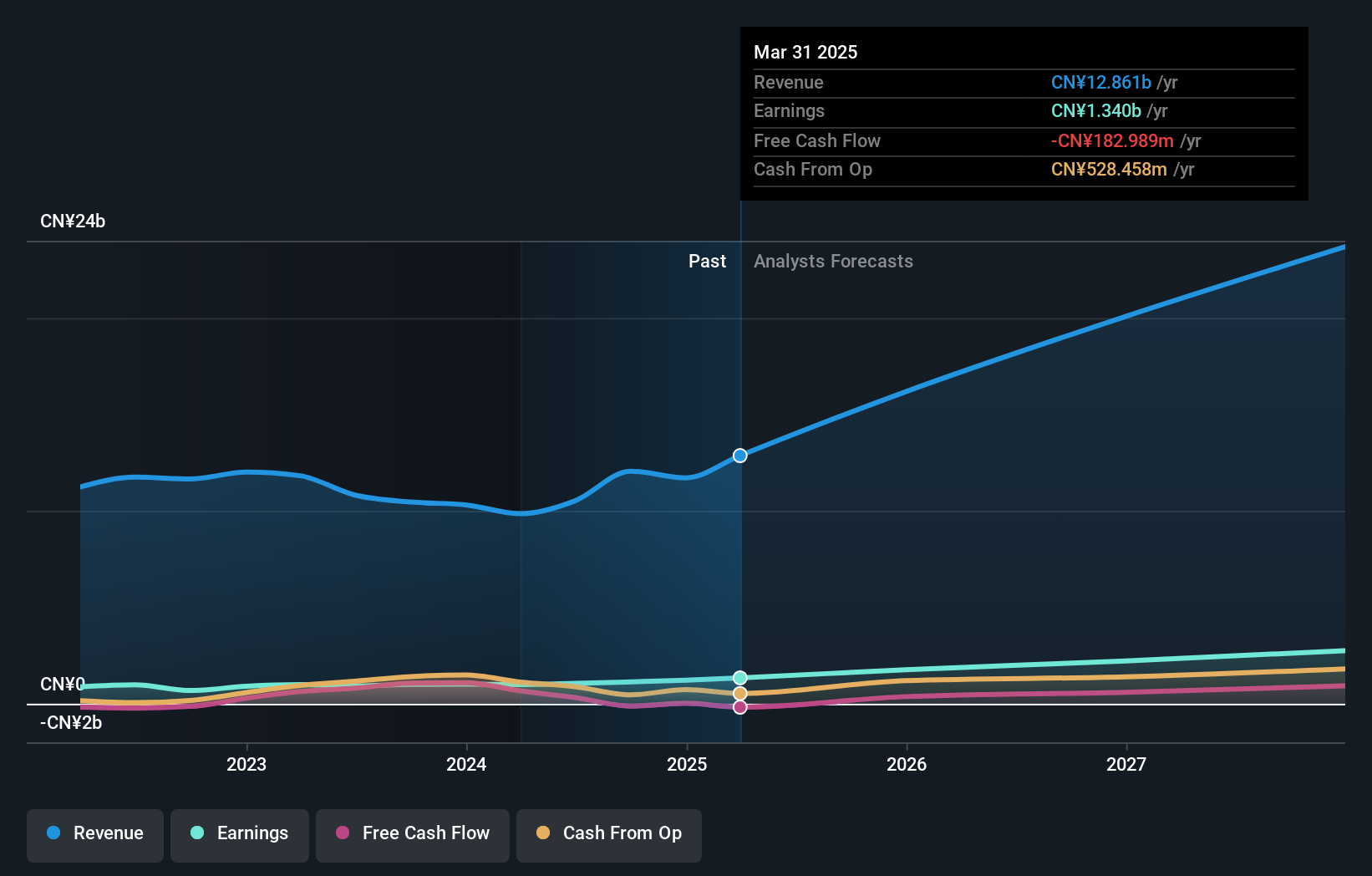

Huagong Tech (SZSE:000988)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Huagong Tech Company Limited is involved in the manufacturing and sale of laser equipment, hologram products, optical communication devices, and electronic components both in China and internationally, with a market capitalization of CN¥46.69 billion.

Operations: Huagong Tech generates revenue through its diverse product offerings, including laser equipment, hologram products, optical communication devices, and electronic components across domestic and international markets. The company's net profit margin shows a notable trend at 12.5%, reflecting its operational efficiency in managing costs relative to income generated from sales.

Huagong Tech is navigating an evolving landscape with a commendable revenue growth rate of 23.1% annually, outstripping the broader Chinese market's average of 13.3%. This performance is bolstered by earnings that have surged by 13.3% over the past year, surpassing its industry's growth rate of 1.9%. In light of a recent shareholders meeting to discuss significant changes to its business scope and amendments to its articles of association, Huagong Tech appears poised for strategic shifts that could further influence its trajectory in the tech sector. The company has also been impacted by a substantial one-off gain of CN¥304 million, which should be considered when evaluating its financial health and future prospects.

- Delve into the full analysis health report here for a deeper understanding of Huagong Tech.

Assess Huagong Tech's past performance with our detailed historical performance reports.

Taking Advantage

- Dive into all 1204 of the High Growth Tech and AI Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688400

LUSTER LightTech

Researches, develops, and sales of configurable visual systems, intelligent visual equipment, and optical communication products in China.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives