- Taiwan

- /

- Tech Hardware

- /

- TWSE:3017

High Growth Tech Stocks In Asia For August 2025

Reviewed by Simply Wall St

Amidst a backdrop of global economic shifts, the Asian markets have been experiencing notable developments, with China's robust export data and Japan's positive investor sentiment driving regional optimism. In this environment, high-growth tech stocks in Asia are gaining attention as investors seek opportunities that align with the current market dynamics and demonstrate resilience in adapting to evolving trade policies and economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 25.19% | 23.94% | ★★★★★★ |

| Zhejiang Lante Optics | 21.61% | 23.73% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 31.44% | 38.26% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| Gold Circuit Electronics | 26.46% | 31.77% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.08% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Rigol Technologies (SHSE:688337)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rigol Technologies Co., Ltd. is a global manufacturer and seller of test and measurement instruments, with a market capitalization of approximately CN¥6.96 billion.

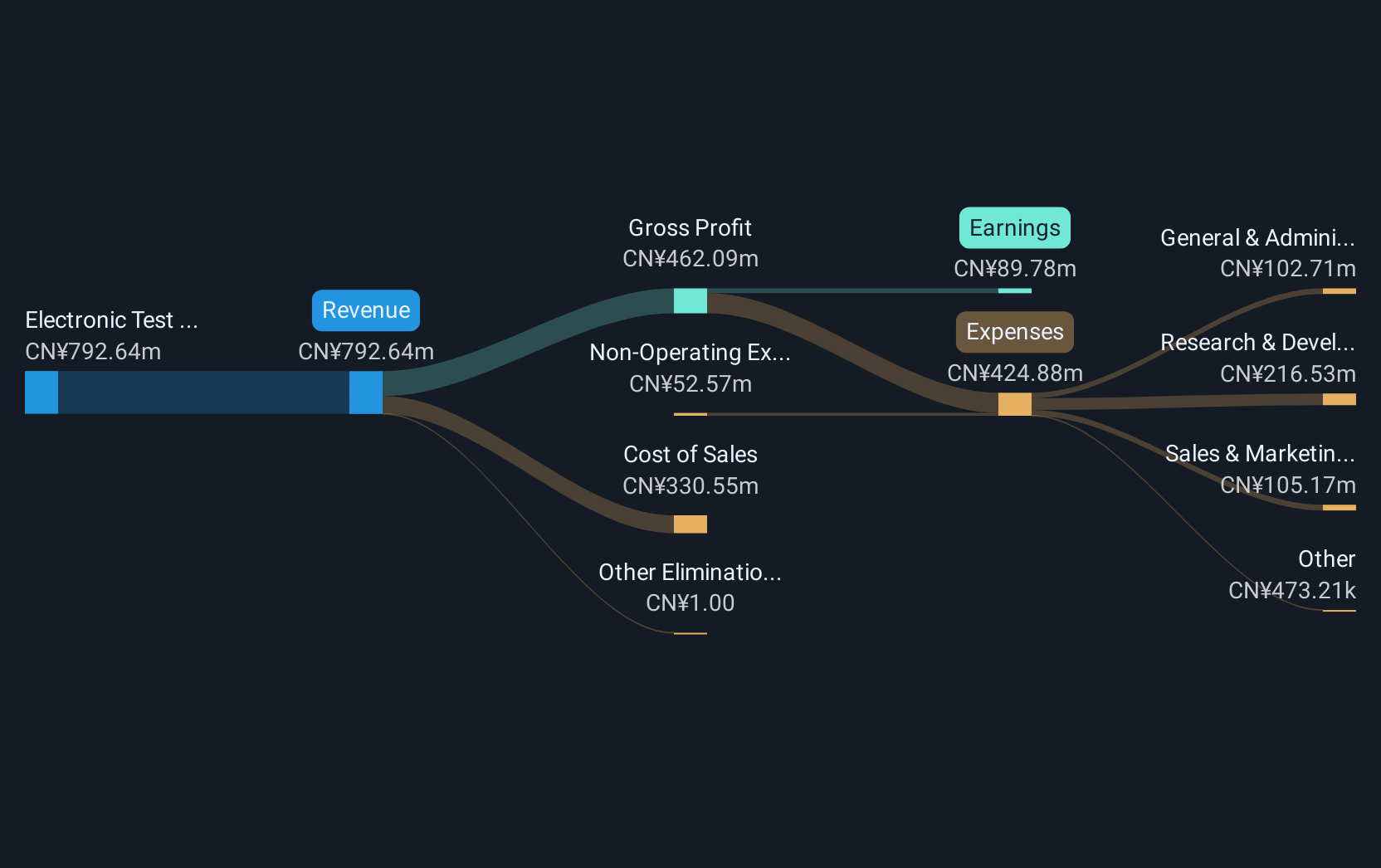

Operations: The company generates revenue primarily from its electronic test and measurement instruments segment, which accounts for CN¥792.64 million.

Rigol Technologies, amidst a dynamic tech landscape, demonstrates robust potential with its earnings projected to surge by 30.4% annually, outpacing the broader Chinese market's 23.6%. This growth is underpinned by significant R&D investments that reflect the company's commitment to innovation and maintaining a competitive edge in electronic technologies. However, it faces challenges as its revenue growth at 16.8% lags behind the high-growth threshold of 20%, coupled with a recent dip in earnings by -1.5% over the past year compared to the industry average of 2.8%. Looking ahead, while Rigol grapples with these mixed financial signals and one-off gains impacting earnings quality, its strategic focus on R&D could catalyze future advancements and market positioning in Asia’s tech sector.

- Dive into the specifics of Rigol Technologies here with our thorough health report.

Gain insights into Rigol Technologies' past trends and performance with our Past report.

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company focused on designing, developing, and producing mask products in China with a market capitalization of approximately CN¥7.13 billion.

Operations: Shenzhen Newway Photomask Making Co., Ltd derives its revenue primarily from the electronic components and parts segment, generating approximately CN¥958.81 million. The company operates within the lithography sector, focusing on mask product design and production in China.

Shenzhen Newway Photomask Making, a player in the high-growth tech sector in Asia, is making significant strides with its robust revenue growth of 27.1% annually, outperforming the broader Chinese market's average of 12.6%. This growth is bolstered by an impressive earnings increase projected at 33% per year, reflecting strong operational efficiency and market demand. The company has committed heavily to innovation with substantial R&D investments that represent a strategic move to solidify its competitive edge in the photomask industry—a critical component for semiconductor manufacturing. With recent earnings calls highlighting these advancements and a clear trajectory for future growth, Shenzhen Newway's focus on technological development positions it well amidst Asia’s dynamic tech landscape.

Asia Vital Components (TWSE:3017)

Simply Wall St Growth Rating: ★★★★★★

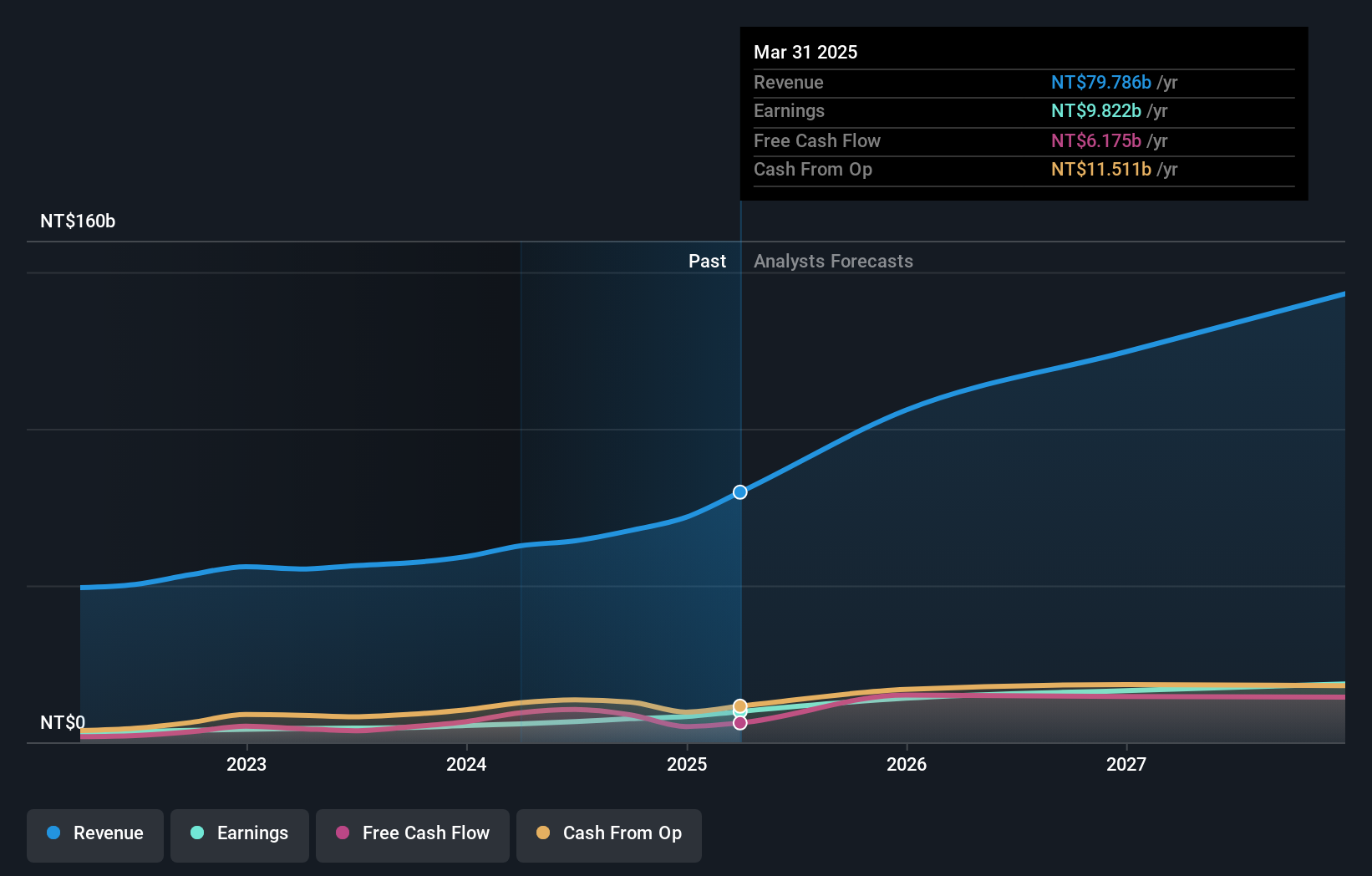

Overview: Asia Vital Components Co., Ltd. and its subsidiaries specialize in providing thermal solutions globally, with a market capitalization of approximately NT$423.10 billion.

Operations: The company generates revenue primarily through its Overseas Operating Department, contributing NT$93.10 billion, and the Integrated Management Division, adding NT$62.02 billion.

Asia Vital Components has demonstrated a robust trajectory in the tech sector, with its latest quarterly earnings surging to TWD 23.33 billion, a significant leap from TWD 15.31 billion year-over-year. This performance is anchored by a net income growth to TWD 3.51 billion from TWD 1.75 billion, reflecting an earnings increase of approximately 100%. The company's aggressive expansion into Vietnam through the establishment of AVC Development Co., Ltd., underlines its strategic intent to broaden its market reach and enhance operational capacities in Southeast Asia. These moves are complemented by active participation in major industry forums across Asia and the U.S., signaling AVC’s commitment to maintaining a prominent presence on the global tech stage.

- Get an in-depth perspective on Asia Vital Components' performance by reading our health report here.

Turning Ideas Into Actions

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 168 more companies for you to explore.Click here to unveil our expertly curated list of 171 Asian High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3017

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success