- China

- /

- Electronic Equipment and Components

- /

- SHSE:688322

Orbbec Inc. (SHSE:688322) Stocks Shoot Up 32% But Its P/S Still Looks Reasonable

Despite an already strong run, Orbbec Inc. (SHSE:688322) shares have been powering on, with a gain of 32% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 4.3% isn't as attractive.

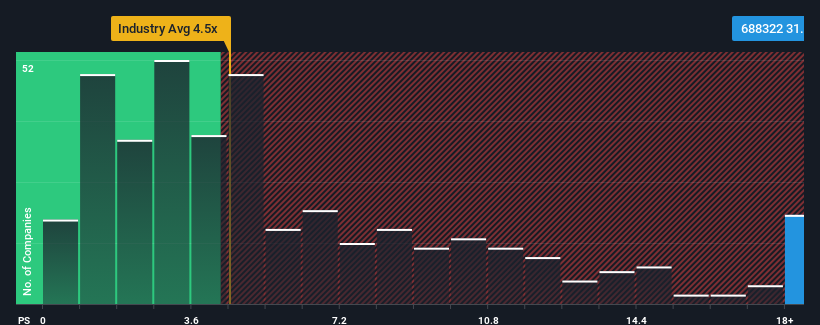

Following the firm bounce in price, Orbbec's price-to-sales (or "P/S") ratio of 31.6x might make it look like a strong sell right now compared to other companies in the Electronic industry in China, where around half of the companies have P/S ratios below 4.5x and even P/S below 2x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Orbbec

What Does Orbbec's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Orbbec has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Orbbec's future stacks up against the industry? In that case, our free report is a great place to start.How Is Orbbec's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Orbbec's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 4.8% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 66% over the next year. That's shaping up to be materially higher than the 27% growth forecast for the broader industry.

With this information, we can see why Orbbec is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in Orbbec have seen a strong upwards swing lately, which has really helped boost its P/S figure. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Orbbec shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Orbbec with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688322

High growth potential with excellent balance sheet.

Market Insights

Community Narratives