Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:688312

Shenzhen Yanmade Technology Inc.'s (SHSE:688312) Stock Going Strong But Fundamentals Look Weak: What Implications Could This Have On The Stock?

Shenzhen Yanmade Technology (SHSE:688312) has had a great run on the share market with its stock up by a significant 21% over the last month. However, in this article, we decided to focus on its weak fundamentals, as long-term financial performance of a business is what ultimately dictates market outcomes. Specifically, we decided to study Shenzhen Yanmade Technology's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Shenzhen Yanmade Technology

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Shenzhen Yanmade Technology is:

5.5% = CN¥74m ÷ CN¥1.3b (Based on the trailing twelve months to March 2024).

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every CN¥1 worth of equity, the company was able to earn CN¥0.05 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Shenzhen Yanmade Technology's Earnings Growth And 5.5% ROE

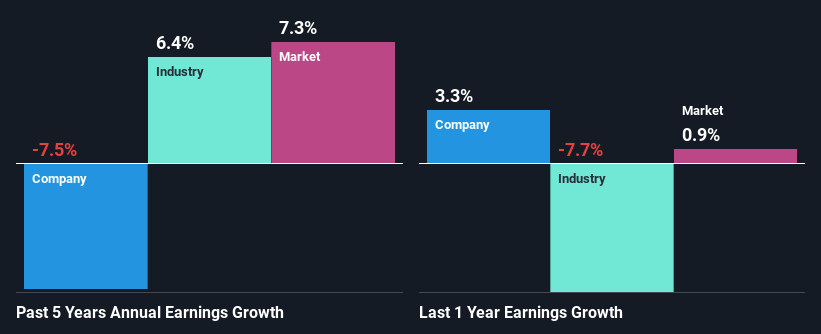

On the face of it, Shenzhen Yanmade Technology's ROE is not much to talk about. However, given that the company's ROE is similar to the average industry ROE of 6.3%, we may spare it some thought. But Shenzhen Yanmade Technology saw a five year net income decline of 7.5% over the past five years. Bear in mind, the company does have a slightly low ROE. So that's what might be causing earnings growth to shrink.

That being said, we compared Shenzhen Yanmade Technology's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 6.4% in the same 5-year period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Shenzhen Yanmade Technology's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Shenzhen Yanmade Technology Making Efficient Use Of Its Profits?

Shenzhen Yanmade Technology has a high three-year median payout ratio of 61% (that is, it is retaining 39% of its profits). This suggests that the company is paying most of its profits as dividends to its shareholders. This goes some way in explaining why its earnings have been shrinking. The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run. Our risks dashboard should have the 3 risks we have identified for Shenzhen Yanmade Technology.

Additionally, Shenzhen Yanmade Technology has paid dividends over a period of three years, which means that the company's management is rather focused on keeping up its dividend payments, regardless of the shrinking earnings.

Conclusion

On the whole, Shenzhen Yanmade Technology's performance is quite a big let-down. Because the company is not reinvesting much into the business, and given the low ROE, it's not surprising to see the lack or absence of growth in its earnings. So far, we've only made a quick discussion around the company's earnings growth. So it may be worth checking this free detailed graph of Shenzhen Yanmade Technology's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

Valuation is complex, but we're helping make it simple.

Find out whether Shenzhen Yanmade Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Shenzhen Yanmade Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688312

Shenzhen Yanmade Technology

Engages in the research and development, design, production, and sale of automated and intelligent test equipment primarily in China.

Adequate balance sheet with questionable track record.