- China

- /

- Communications

- /

- SHSE:688292

Some Beijing Haohan Data Technology Co.,Ltd (SHSE:688292) Shareholders Look For Exit As Shares Take 28% Pounding

Beijing Haohan Data Technology Co.,Ltd (SHSE:688292) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 66% share price decline.

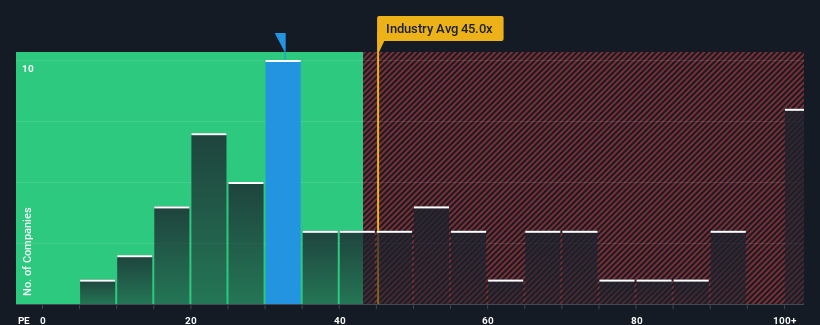

In spite of the heavy fall in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may still consider Beijing Haohan Data TechnologyLtd as a stock to potentially avoid with its 32.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Beijing Haohan Data TechnologyLtd has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Beijing Haohan Data TechnologyLtd

How Is Beijing Haohan Data TechnologyLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Beijing Haohan Data TechnologyLtd's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a worthy increase of 8.5%. EPS has also lifted 21% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Beijing Haohan Data TechnologyLtd's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

There's still some solid strength behind Beijing Haohan Data TechnologyLtd's P/E, if not its share price lately. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Beijing Haohan Data TechnologyLtd currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Beijing Haohan Data TechnologyLtd is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Haohan Data TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688292

Beijing Haohan Data TechnologyLtd

Provides network intelligence, information security protection, network security protection and big data application products in China.

Mediocre balance sheet unattractive dividend payer.

Market Insights

Community Narratives