- China

- /

- Semiconductors

- /

- SHSE:688484

June 2024 Guide To Growth Companies With High Insider Ownership On Chinese Exchanges

Reviewed by Simply Wall St

As global markets navigate through varying degrees of economic challenges, China's equity market has shown resilience despite recent weak manufacturing data, suggesting underlying strength in some sectors. In this context, growth companies with high insider ownership on Chinese exchanges present a compelling focus, as such ownership structures can often align interests and foster long-term strategic planning essential in volatile environments.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 24.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.4% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| Fujian Wanchen Biotechnology Group (SZSE:300972) | 15.3% | 75.9% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

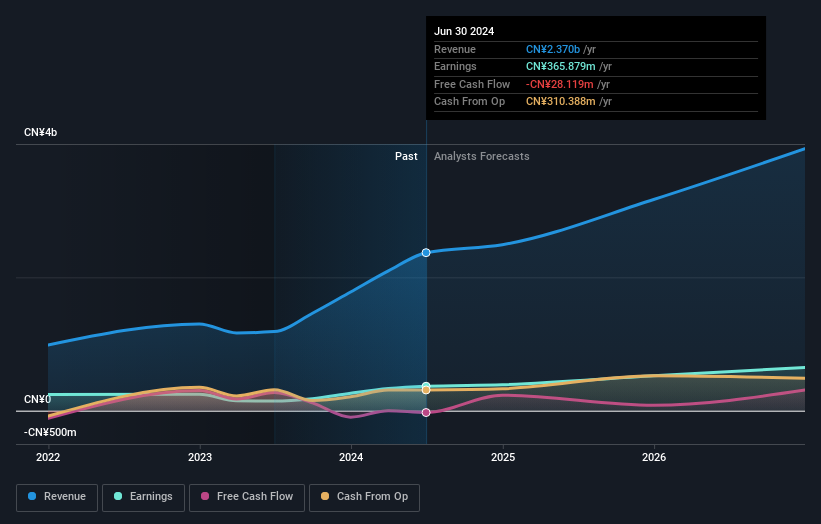

Appotronics (SHSE:688007)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Appotronics Corporation Limited, based in China, focuses on the research and development, production, sale, and leasing of laser display devices and machines with a market capitalization of approximately CN¥8.17 billion.

Operations: The company generates revenue primarily through the sale and leasing of laser display devices and machines.

Insider Ownership: 24.8%

Earnings Growth Forecast: 32.3% p.a.

Appotronics, a company based in China, is expected to see significant growth with earnings forecasted to increase by 32.34% annually and revenue by 23% per year, outpacing the broader Chinese market's growth rates. Despite this promising outlook, the company's return on equity is projected at a modest 9.6%. Recent activities include substantial share buybacks, indicating confidence from management but also highlighting reliance on one-off financial strategies that could impact long-term earnings quality.

- Dive into the specifics of Appotronics here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Appotronics is trading beyond its estimated value.

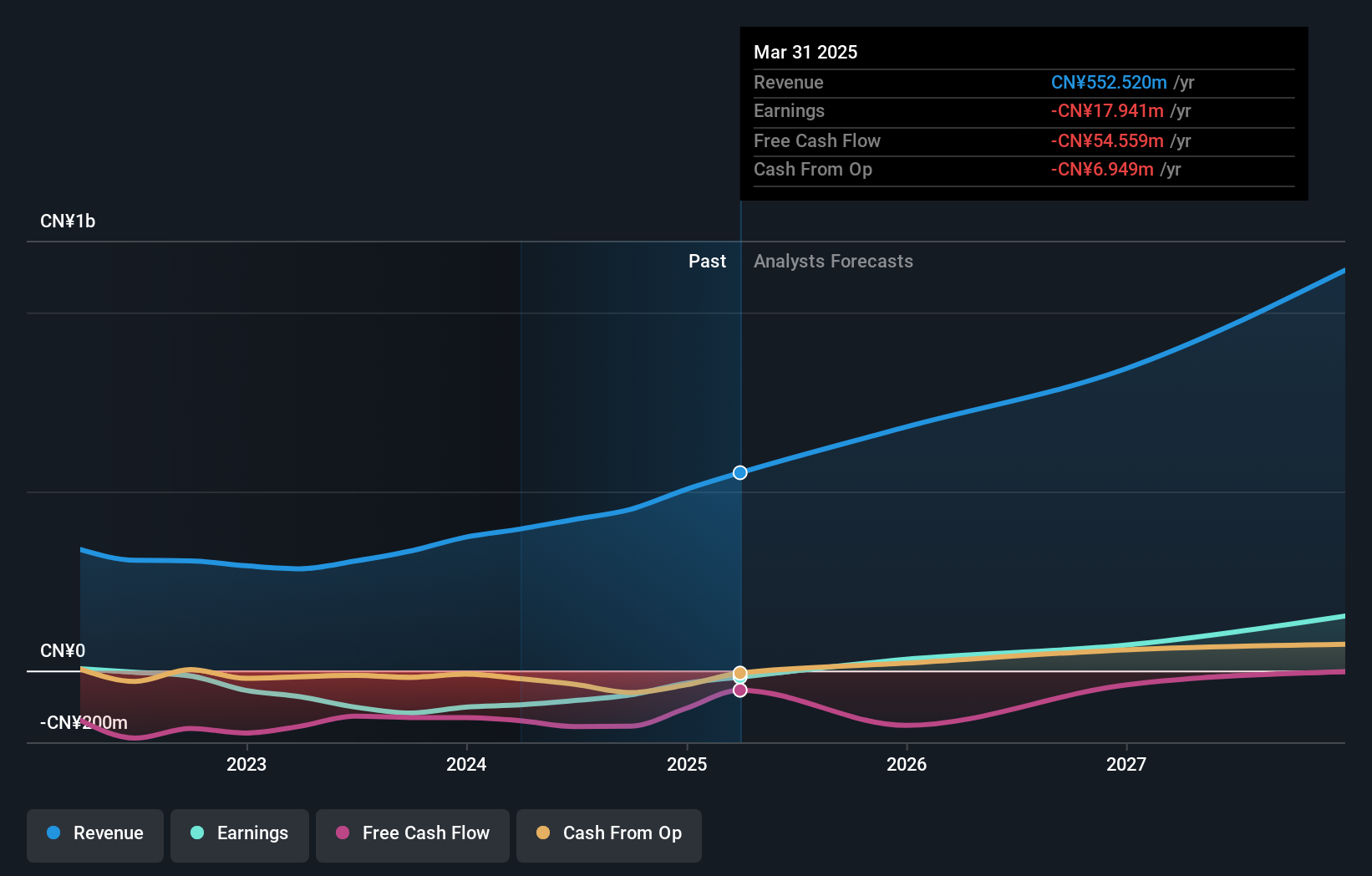

MEMSensing Microsystems (Suzhou China) (SHSE:688286)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MEMSensing Microsystems (Suzhou, China) Co., Ltd. is a company specializing in the development and manufacturing of micro-electromechanical systems, with a market capitalization of approximately CN¥2.62 billion.

Operations: The company generates revenue primarily from its Integrated Circuit segment, totaling CN¥395.25 million.

Insider Ownership: 25.9%

Earnings Growth Forecast: 97.5% p.a.

MEMSensing Microsystems, despite a highly volatile share price, shows promising growth prospects in China's high insider ownership sector. The company's revenue is expected to grow at 29.4% annually, significantly outpacing the Chinese market forecast of 14%. Although currently unprofitable with a recent net loss of CNY 14.45 million, forecasts suggest profitability within three years with substantial earnings growth. However, shareholder dilution over the past year and a low projected return on equity at 6% present challenges.

- Click to explore a detailed breakdown of our findings in MEMSensing Microsystems (Suzhou China)'s earnings growth report.

- Upon reviewing our latest valuation report, MEMSensing Microsystems (Suzhou China)'s share price might be too optimistic.

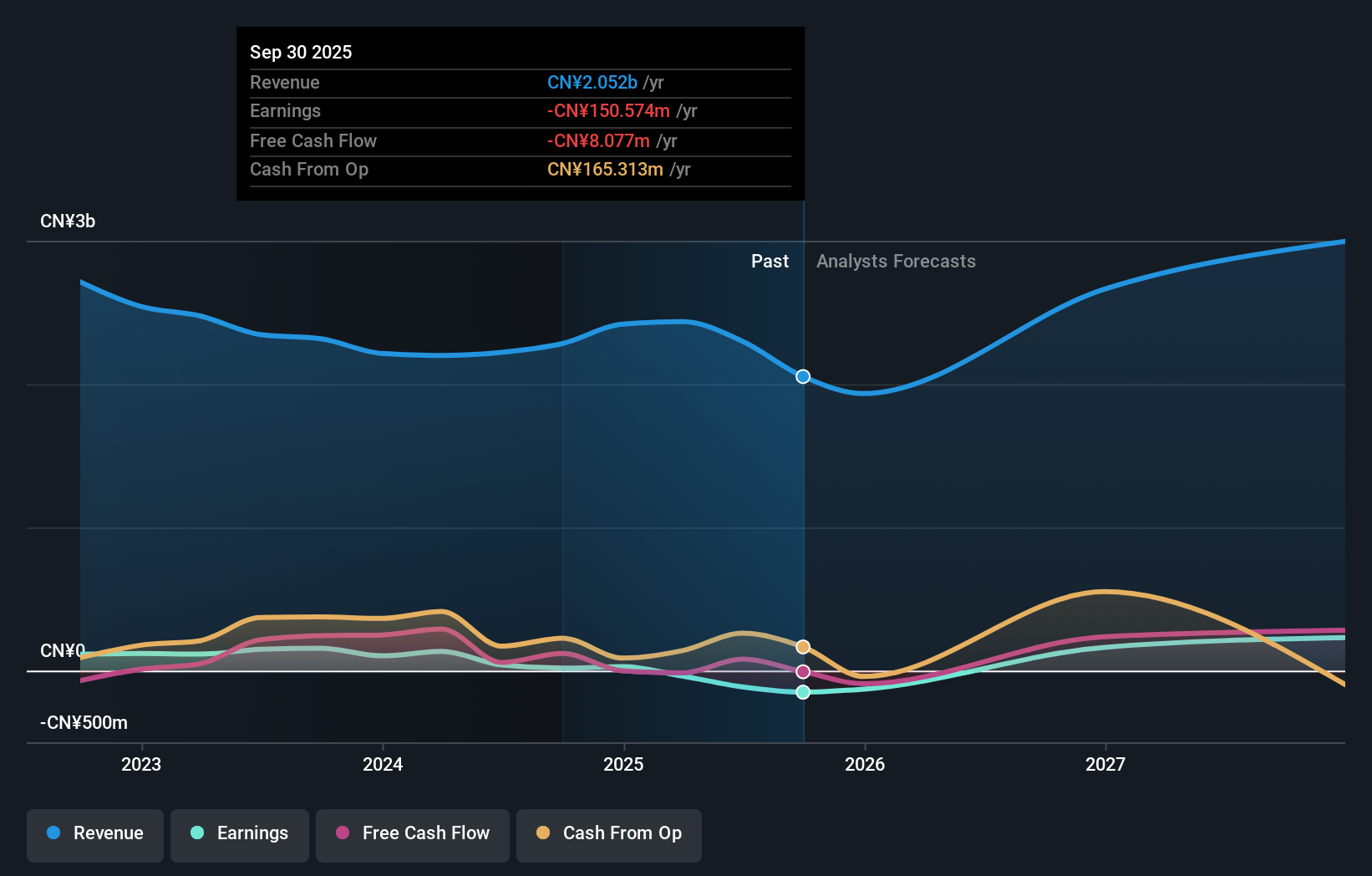

Southchip Semiconductor Technology(Shanghai) (SHSE:688484)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Southchip Semiconductor Technology (Shanghai) Co., Ltd. is a semiconductor design company specializing in power and battery management solutions in China, with a market capitalization of CN¥14.06 billion.

Operations: The company generates revenue primarily from its semiconductors segment, totaling CN¥2.10 billion.

Insider Ownership: 17.2%

Earnings Growth Forecast: 23.5% p.a.

Southchip Semiconductor Technology(Shanghai) has demonstrated robust financial performance with its Q1 2024 earnings more than tripling year-over-year to CNY 100.55 million. This growth is supported by a significant increase in sales, reflecting a strong market demand for their products. The company's inclusion in major Shanghai stock indices could enhance visibility and investor interest. Despite a high P/E ratio of 42.5x, below the industry average, forecasted annual earnings growth is substantial at 23.5%, slightly above the Chinese market average. However, the projected low return on equity of 12% in three years and an under-covered dividend raise concerns about future financial sustainability and shareholder returns.

- Get an in-depth perspective on Southchip Semiconductor Technology(Shanghai)'s performance by reading our analyst estimates report here.

- Our valuation report here indicates Southchip Semiconductor Technology(Shanghai) may be overvalued.

Next Steps

- Embark on your investment journey to our 401 Fast Growing Chinese Companies With High Insider Ownership selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688484

Southchip Semiconductor Technology(Shanghai)

A semiconductor design company, focuses on the provision of power and battery management solutions in China.

High growth potential with excellent balance sheet.