- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3526

Spotlight On High Growth Tech Stocks For December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, with the small-cap Russell 2000 Index hitting a notable intraday peak, investor sentiment appears buoyed by recent domestic policy developments and geopolitical events. In this context of robust market performance and economic shifts, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and resilience amid changing trade dynamics and economic indicators.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.34% | ★★★★★★ |

Click here to see the full list of 1284 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

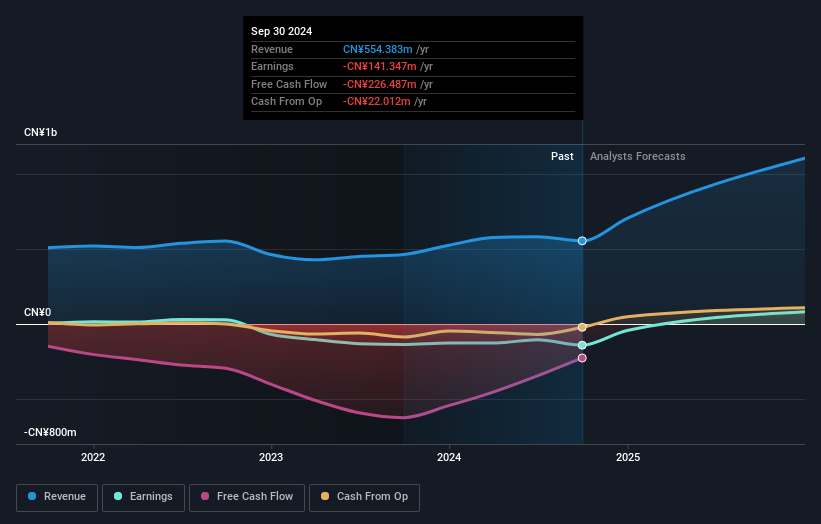

Suzhou Gyz Electronic TechnologyLtd (SHSE:688260)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Gyz Electronic Technology Co., Ltd specializes in the research, development, design, and production of components for optical, automotive electronics, and optoelectronic semiconductors in China with a market cap of CN¥2.09 billion.

Operations: The company focuses on producing components for optical, automotive electronics, and optoelectronic semiconductors. Its operations are centered in China, contributing to a market cap of CN¥2.09 billion.

Suzhou Gyz Electronic TechnologyLtd, despite its current unprofitability and a net loss increase to CNY 79.72 million from CNY 64.51 million year-over-year, is positioned for significant future growth with an expected annual earnings increase of 184%. The company's commitment to innovation is evident in its R&D spending trends, crucial for staying competitive in the fast-evolving tech landscape. With revenue growth projected at an impressive rate of 54.5% annually, surpassing the Chinese market average of 13.9%, Suzhou Gyz is strategically expanding its market presence. This robust revenue forecast coupled with substantial planned profitability improvements underscores potential shifts in both its financial health and industry standing over the next three years.

Universal Microwave Technology (TPEX:3491)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Universal Microwave Technology, Inc. specializes in designing, developing, and manufacturing custom microwave and millimeter-wave devices and antennas for broadband wireless communications with a market capitalization of NT$19.50 billion.

Operations: The company generates revenue primarily through its Microwave/Millimeter Wave Products and Radio Frequency Products segments, contributing NT$1.26 billion and NT$1.06 billion, respectively. Additionally, it offers Communications Network Engineering Services, which add NT$214.58 million to its revenue stream.

Universal Microwave Technology has demonstrated a robust financial performance, with a significant increase in sales to TWD 639.64 million and net income soaring to TWD 132.43 million in the third quarter of 2024, up from TWD 375.53 million and TWD 45.94 million respectively in the previous year. This growth trajectory is underscored by an earnings forecast that outpaces the Taiwanese market's average, projecting an annual increase of 53.7%. The company’s commitment to innovation is reflected in its R&D investments aligning with revenue growth at a remarkable rate of 33.8% annually, which exceeds the market norm by over twenty percentage points (20%). These figures highlight not only Universal Microwave Technology's strong current performance but also its potential for sustained advancement within the tech sector.

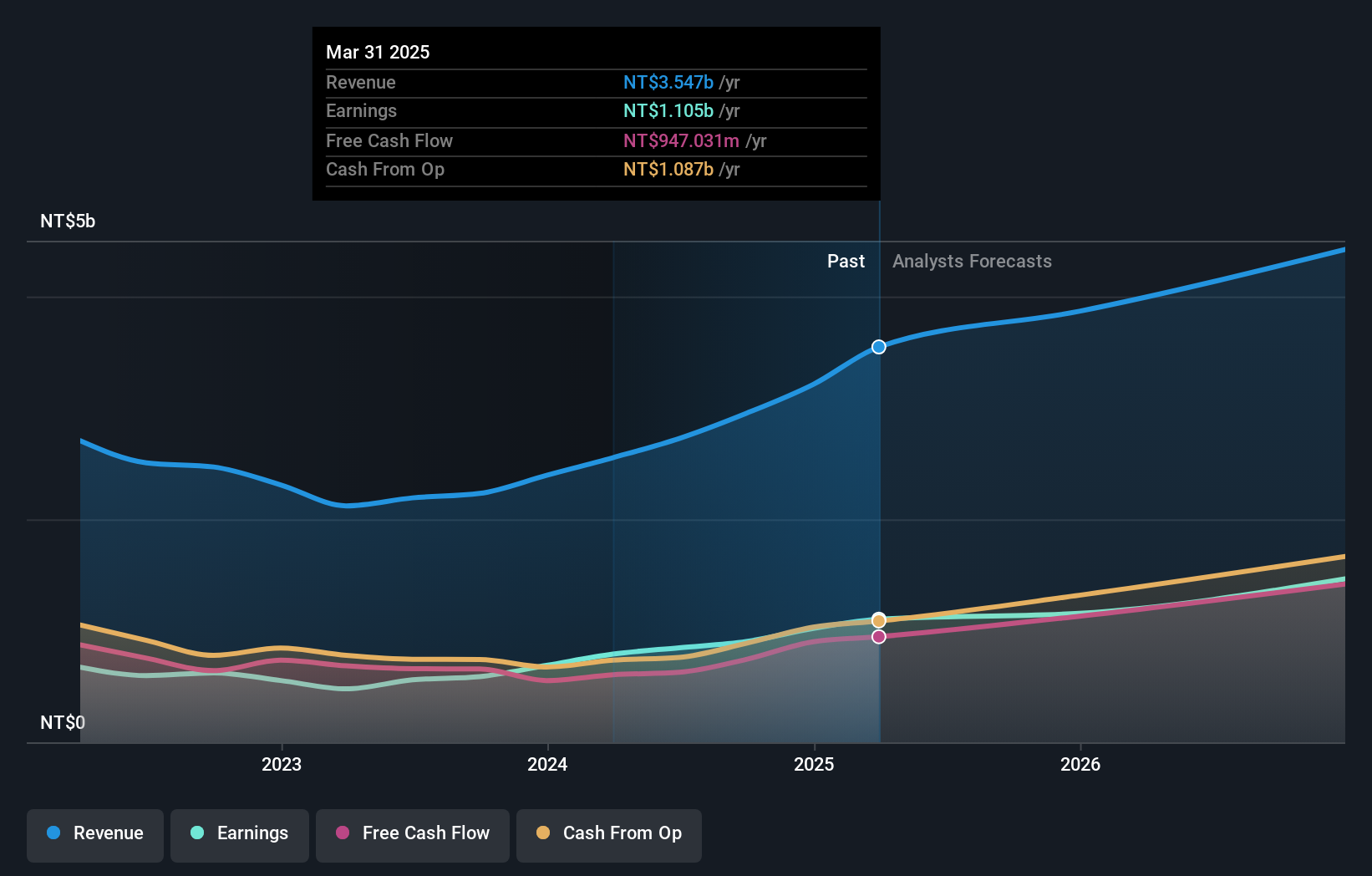

Alltop Technology (TPEX:3526)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alltop Technology Co., Ltd. specializes in the design, manufacture, and sale of electrical connectors globally, with a market capitalization of NT$16.59 billion.

Operations: The company generates revenue primarily from its electronic coupling segment, which reported NT$2.95 billion. With a market capitalization of NT$16.59 billion, it focuses on the global distribution of electrical connectors.

Alltop Technology has shown a strong upward trajectory, with third-quarter sales rising to TWD 907.73 million from TWD 682.38 million in the previous year, and net income increasing to TWD 264.94 million from TWD 209.49 million. This performance is complemented by a robust R&D commitment, as evidenced by the company's R&D expenses aligning closely with its revenue growth rates of 23.7% annually, significantly outpacing the industry norm. The recent appointment of a chief sustainability officer highlights Alltop's strategic focus on long-term operational sustainability within the tech sector, potentially enhancing its market position further as it continues to innovate and expand its technological offerings.

- Click here to discover the nuances of Alltop Technology with our detailed analytical health report.

Evaluate Alltop Technology's historical performance by accessing our past performance report.

Summing It All Up

- Gain an insight into the universe of 1284 High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3526

Alltop Technology

Engages in the design, manufacture, and sale of electrical connectors worldwide.

Outstanding track record with flawless balance sheet.