As global markets continue to experience a surge, with the Russell 2000 Index reaching new heights alongside other major indices, investor sentiment is being shaped by geopolitical developments and domestic policy changes. In this environment of robust market activity and economic shifts, identifying high-growth tech stocks involves looking for companies that demonstrate resilience and adaptability in the face of tariff uncertainties and evolving consumer trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.23% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1286 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

SM Entertainment (KOSDAQ:A041510)

Simply Wall St Growth Rating: ★★★★☆☆

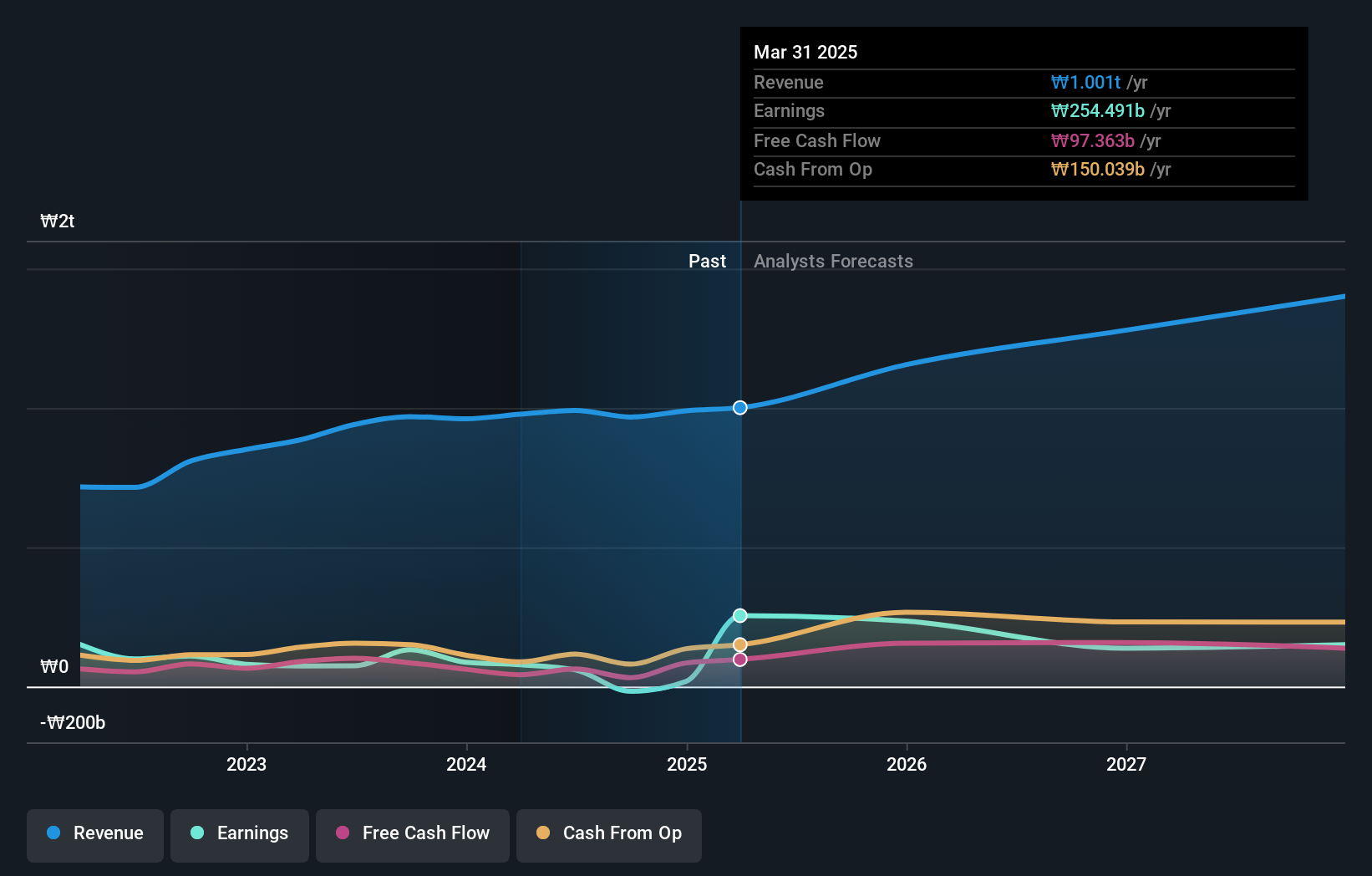

Overview: SM Entertainment Co., Ltd. operates in music and sound production, talent management, and music/audio content publication both in South Korea and internationally, with a market cap of ₩1.91 trillion.

Operations: SM Entertainment Co., Ltd. generates revenue primarily through its entertainment segment, excluding advertising agency activities, contributing ₩892.47 billion. The company also earns from its advertising agency segment, which accounts for ₩82.61 billion of the total revenue.

SM Entertainment, amidst a challenging industry landscape, is navigating with a strategic focus on innovation and market adaptation. With revenue growth projected at 10.1% annually, surpassing the Korean market's 9.2%, the company demonstrates resilience and potential for sustained expansion. However, it's crucial to note a significant one-off loss of ₩63.7 billion in the last fiscal year to June 2024, which has impacted financial results but is not expected to recur in future assessments. On a more positive note, earnings are anticipated to surge by 34.6% yearly over the next three years, outpacing the broader market forecast of 29.5%. This robust profit growth projection underscores SM Entertainment's strong recovery trajectory and its ability to capitalize on emerging opportunities within the entertainment sector.

- Get an in-depth perspective on SM Entertainment's performance by reading our health report here.

Explore historical data to track SM Entertainment's performance over time in our Past section.

SUNeVision Holdings (SEHK:1686)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SUNeVision Holdings Ltd. is an investment holding company that offers data centre and IT facility services in Hong Kong, with a market capitalization of approximately HK$17.70 billion.

Operations: SUNeVision Holdings Ltd. primarily generates revenue from its data centre and IT facility services, which contributed approximately HK$2.46 billion, alongside a smaller portion from Extra-Low Voltage (ELV) and IT systems at around HK$213 million.

SUNeVision Holdings, recently integrated into the S&P Global BMI Index, showcases robust growth with a forecasted revenue increase of 15.0% annually, outpacing the Hong Kong market's 7.8% growth rate. This tech entity has strategically focused on enhancing its R&D efforts, dedicating significant resources that resulted in an 11.8% annual earnings growth projection—higher than the local market's expectation of 11.3%. The recent adoption of new corporate bylaws underscores its commitment to governance and strategic agility, positioning it well within a competitive landscape where technological innovation is paramount.

- Navigate through the intricacies of SUNeVision Holdings with our comprehensive health report here.

Evaluate SUNeVision Holdings' historical performance by accessing our past performance report.

Optowide Technologies (SHSE:688195)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Optowide Technologies Co., Ltd. specializes in the research, development, production, and sale of precision optics and fiber components both in China and internationally, with a market cap of CN¥5.25 billion.

Operations: Optowide Technologies focuses on the precision optics and fiber components sector, generating revenue through both domestic and international sales channels. The company operates with a market cap of CN¥5.25 billion, emphasizing innovation in its product offerings to cater to diverse market needs.

Optowide Technologies has demonstrated a compelling growth trajectory, with revenue forecasted to increase by 31.1% annually, outstripping the CN market's average of 13.8%. This surge is supported by robust earnings growth of 47.3% over the past year, significantly ahead of the industry’s 1.8%, reflecting Optowide's effective strategy and operational efficiency. The company also actively manages its capital allocation, as evidenced by a recent CNY 20 million share repurchase program aimed at enhancing shareholder value through equity incentives and employee shareholding plans. These strategic moves underscore Optowide’s commitment to sustaining its competitive edge in a rapidly evolving tech landscape.

Key Takeaways

- Dive into all 1286 of the High Growth Tech and AI Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1686

SUNeVision Holdings

An investment holding company, provides data centre and information technology (IT) facility services in Hong Kong.

Reasonable growth potential with acceptable track record.