- China

- /

- Electronic Equipment and Components

- /

- SHSE:688188

Getting In Cheap On Shanghai BOCHU Electronic Technology Corporation Limited. (SHSE:688188) Is Unlikely

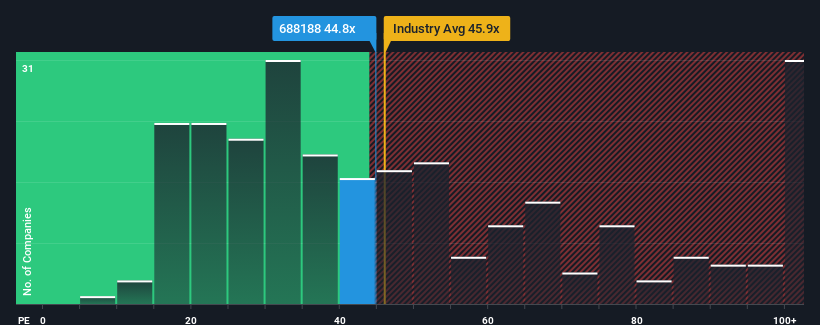

With a price-to-earnings (or "P/E") ratio of 44.8x Shanghai BOCHU Electronic Technology Corporation Limited. (SHSE:688188) may be sending bearish signals at the moment, given that almost half of all companies in China have P/E ratios under 34x and even P/E's lower than 19x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Shanghai BOCHU Electronic Technology has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Shanghai BOCHU Electronic Technology

Is There Enough Growth For Shanghai BOCHU Electronic Technology?

Shanghai BOCHU Electronic Technology's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered an exceptional 33% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 51% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 41% as estimated by the ten analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 38%, which is not materially different.

With this information, we find it interesting that Shanghai BOCHU Electronic Technology is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

What We Can Learn From Shanghai BOCHU Electronic Technology's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Shanghai BOCHU Electronic Technology's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Shanghai BOCHU Electronic Technology that you need to be mindful of.

You might be able to find a better investment than Shanghai BOCHU Electronic Technology. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688188

Shanghai BOCHU Electronic Technology

Shanghai BOCHU Electronic Technology Corporation Limited.

Undervalued with high growth potential.

Market Insights

Community Narratives