- China

- /

- Communications

- /

- SZSE:301191

High Growth Tech Stocks to Watch in November 2025

Reviewed by Simply Wall St

In recent weeks, global markets have been grappling with concerns over high stock valuations and the uncertain profitability of artificial intelligence investments, leading to a decline in key indices such as the tech-heavy Nasdaq Composite. Despite these challenges, investors continue to seek out high growth opportunities within the technology sector, focusing on companies that demonstrate robust innovation potential and resilience amidst fluctuating market conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Pharma Mar | 21.68% | 41.50% | ★★★★★★ |

| Gold Circuit Electronics | 25.79% | 31.13% | ★★★★★★ |

| eWeLLLtd | 25.07% | 25.13% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 35.69% | 50.71% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

DREAMTECH (KOSE:A192650)

Simply Wall St Growth Rating: ★★★★☆☆

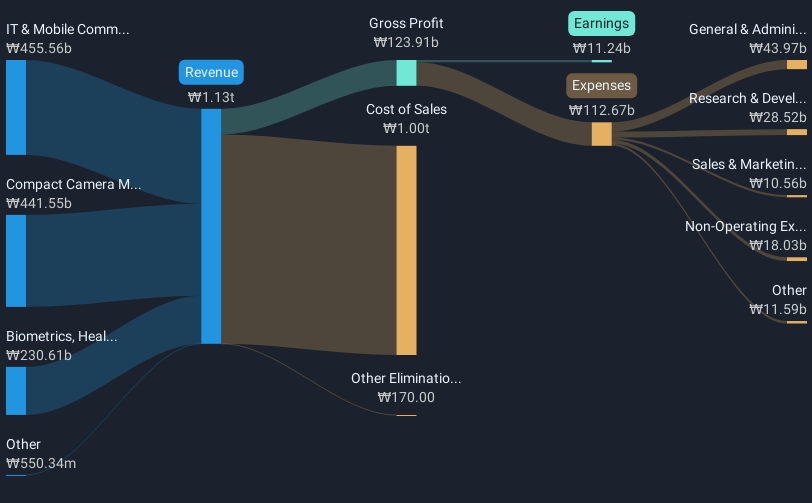

Overview: DREAMTECH Co., Ltd. is involved in the design, development, and manufacture of modules both in South Korea and internationally, with a market cap of ₩447.74 billion.

Operations: DREAMTECH Co., Ltd. focuses on creating and producing various modules for diverse markets globally. The company's operations encompass the entire lifecycle from design to manufacturing, serving both domestic and international clients.

DREAMTECH's strategic maneuvers, including a recent share buyback of 779,880 shares for KRW 4.99 billion and the affirmation of an annual dividend payout, underscore its commitment to shareholder value amidst challenging market conditions. The company's revenue growth at 13.8% annually outpaces the Korean market average of 10.4%, positioning it favorably against local competitors. Despite current unprofitability, DREAMTECH is poised for significant earnings growth with projections suggesting a surge by over 107% annually in the next three years. This anticipated profitability aligns with innovative R&D investments that not only reflect in heightened expenditures but also promise to catalyze future technological advancements within the sector.

- Navigate through the intricacies of DREAMTECH with our comprehensive health report here.

Explore historical data to track DREAMTECH's performance over time in our Past section.

Beijing InHand Networks Technology (SHSE:688080)

Simply Wall St Growth Rating: ★★★★☆☆

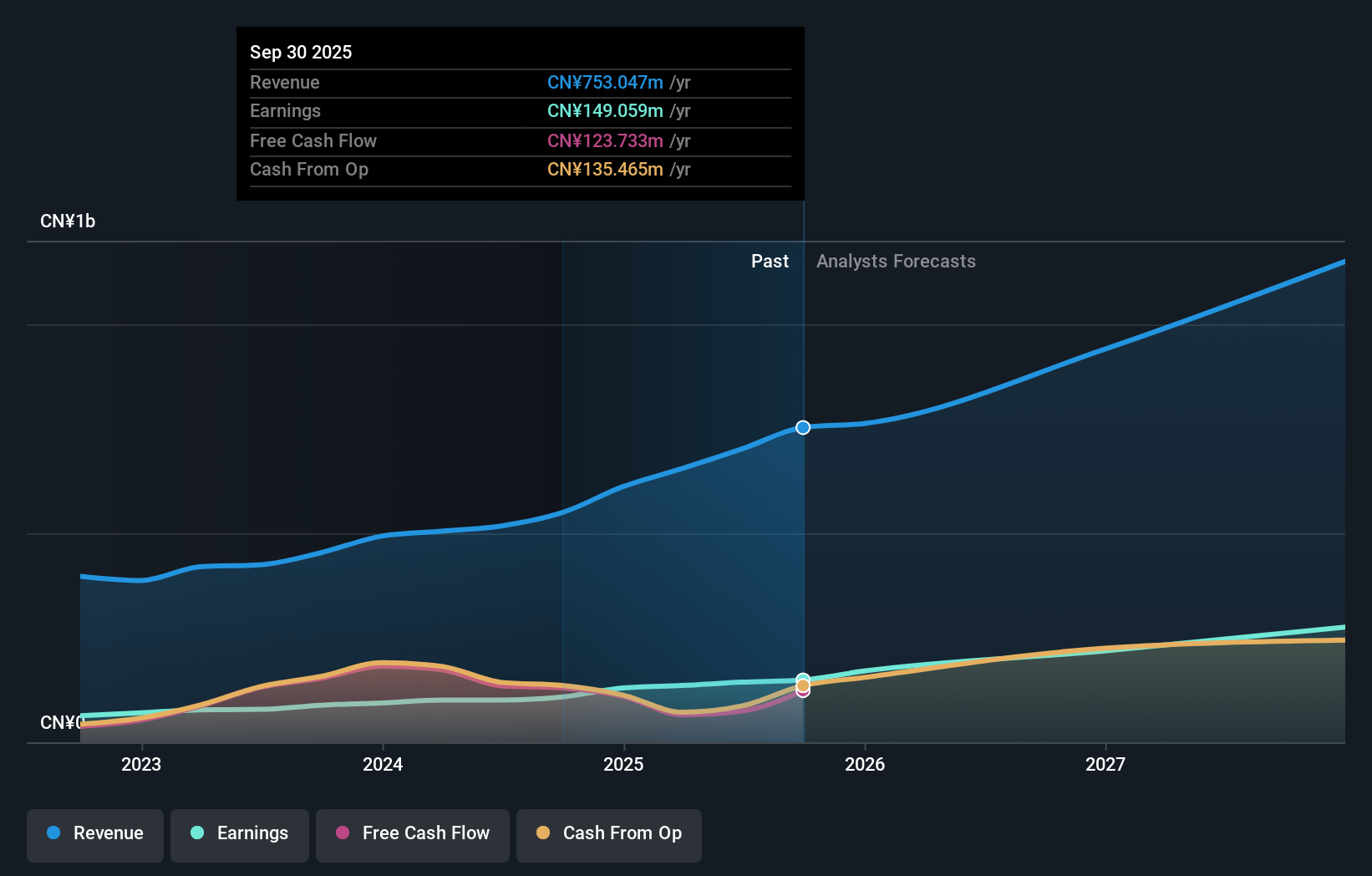

Overview: Beijing InHand Networks Technology Co., Ltd. specializes in computer network solutions and has a market cap of CN¥3.48 billion.

Operations: InHand Networks generates revenue primarily from its computer networks segment, totaling CN¥753.05 million.

Beijing InHand Networks Technology has demonstrated robust growth, with a notable 20.1% annual revenue increase and an earnings surge of 37.5% over the past year, outstripping its industry's average. This performance is underpinned by significant R&D investments, which not only fuel innovation but also enhance its competitive edge in the communications sector. Recent actions include repurchasing shares for CNY 20.09 million, underscoring confidence in its financial health and commitment to shareholder value. With earnings expected to grow by 26.9% annually, Beijing InHand is strategically positioned to capitalize on expanding market demands while continuing to innovate within its technological offerings.

Shenzhen Phoenix Telecom TechnologyLtd (SZSE:301191)

Simply Wall St Growth Rating: ★★★★★☆

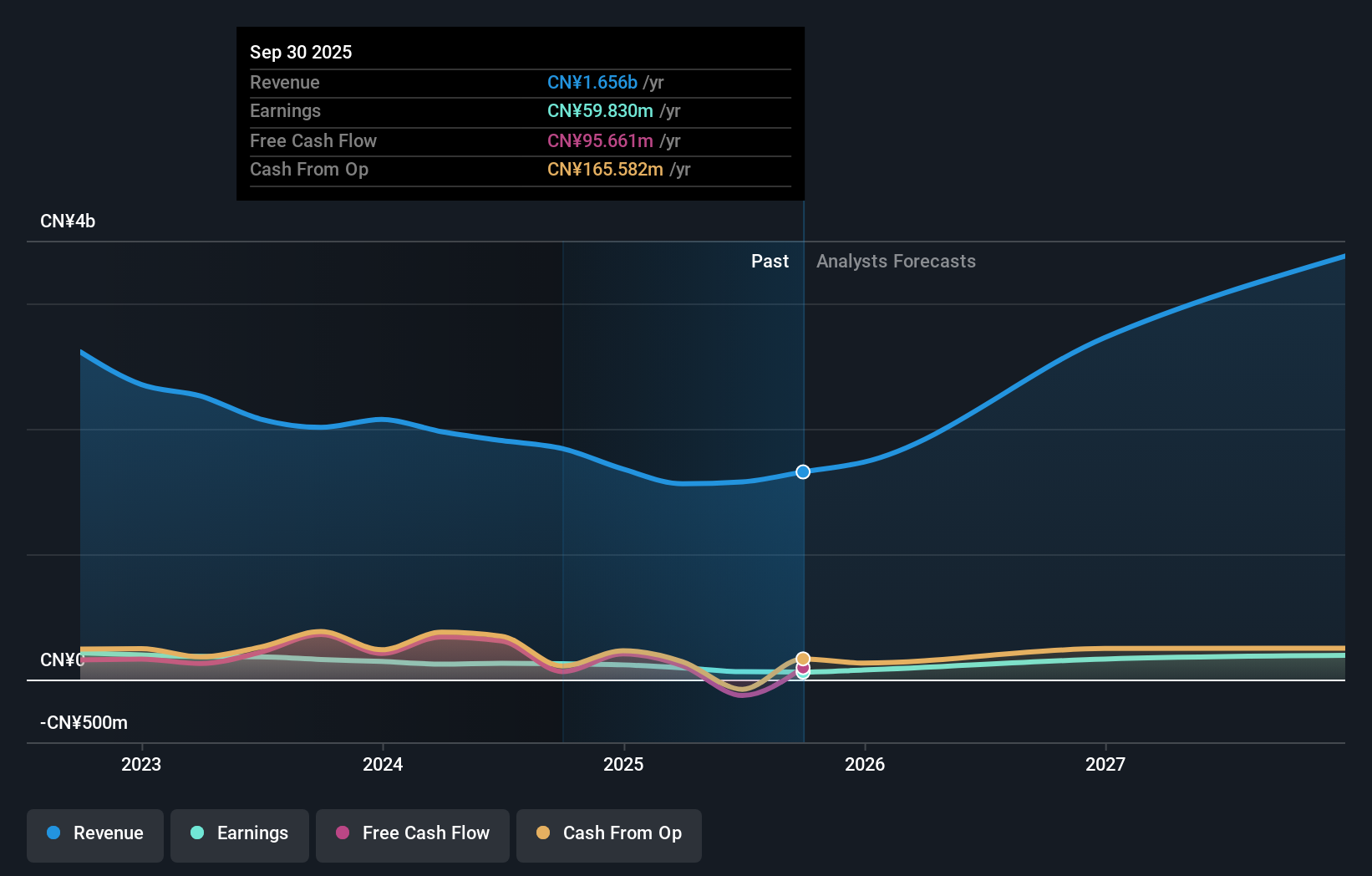

Overview: Shenzhen Phoenix Telecom Technology Co., Ltd. operates in the communication technology sector and has a market capitalization of CN¥5.89 billion.

Operations: The company generates revenue primarily from its Communication Terminal Equipment segment, totaling CN¥1.66 billion.

Shenzhen Phoenix Telecom TechnologyLtd. has shown a promising trajectory with a 34.2% annual revenue growth, significantly outpacing the CN market average of 14.4%. Despite facing challenges with earnings declining by 53% last year due to one-off gains of CN¥17.8M, the company is poised for a rebound with projected earnings growth of 51% annually over the next three years, far exceeding the market forecast of 27.6%. This resilience is underscored by its commitment to innovation as evidenced in its recent shareholder meeting discussing future incentive plans and management measures, ensuring alignment with long-term strategic goals.

Where To Now?

- Explore the 252 names from our Global High Growth Tech and AI Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301191

Shenzhen Phoenix Telecom TechnologyLtd

Shenzhen Phoenix Telecom Technology Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success