- China

- /

- Electronic Equipment and Components

- /

- SHSE:603416

High Growth Tech Stocks In Asia Featuring WuXi Xinje ElectricLtd And Two Others

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets and economic uncertainty, the Asian tech sector continues to capture investor interest, driven by innovations in artificial intelligence and supportive government policies. As smaller-cap stocks show sensitivity to interest rate movements, identifying high-growth potential companies like WuXi Xinje Electric Ltd becomes crucial for investors seeking opportunities in this dynamic landscape.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| Giant Network Group | 31.77% | 35.00% | ★★★★★★ |

| Fositek | 33.63% | 43.83% | ★★★★★★ |

| Zhongji Innolight | 26.48% | 27.46% | ★★★★★★ |

| Eoptolink Technology | 33.00% | 33.05% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.00% | 27.48% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We'll examine a selection from our screener results.

WuXi Xinje ElectricLtd (SHSE:603416)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WuXi Xinje Electric Co., Ltd. focuses on developing, producing, and selling industrial automation products both in China and internationally, with a market capitalization of CN¥9.09 billion.

Operations: WuXi Xinje Electric Co., Ltd. specializes in industrial automation products, serving both domestic and international markets. The company's revenue model centers on the sale of these products, contributing to its market capitalization of CN¥9.09 billion.

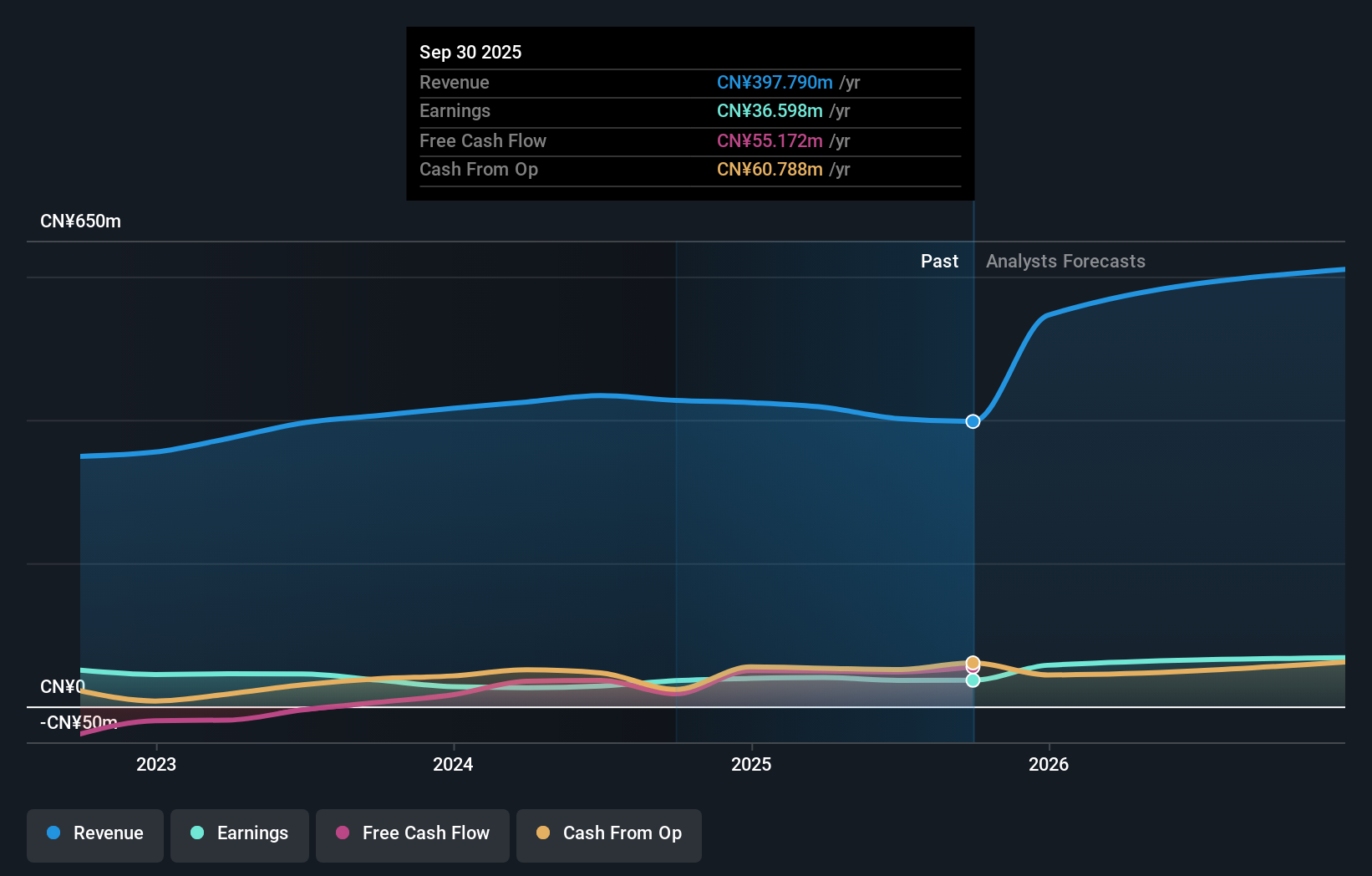

WuXi Xinje Electric Co., Ltd. has demonstrated robust growth metrics, with a revenue increase of 21.6% per year, outpacing the Chinese market average of 13.7%. Despite earnings growth projections slightly trailing the broader CN market at 24.9% compared to 26.2%, the company's commitment to innovation is evident from its recent financials; a significant one-off gain of CN¥73.1M boosted its last annual results, underscoring potential volatility in earnings quality. Moreover, with R&D expenses aligning closely with industry standards, WuXi Xinje is positioning itself as a competitive player in Asia's high-tech landscape by focusing on enhancing its technological capabilities and expanding market reach.

- Take a closer look at WuXi Xinje ElectricLtd's potential here in our health report.

Gain insights into WuXi Xinje ElectricLtd's past trends and performance with our Past report.

Beijing Labtech Instruments (SHSE:688056)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Labtech Instruments Co., Ltd. manufactures and supplies laboratory products and solutions globally, with a market capitalization of CN¥2.40 billion.

Operations: Labtech Instruments focuses on producing and distributing laboratory products and solutions to the global laboratory industry. The company operates with a market capitalization of approximately CN¥2.40 billion, emphasizing its significant presence in the sector.

Beijing Labtech Instruments has shown promising growth with a notable 20.5% annual increase in revenue, surpassing the Chinese market average of 13.7%. This performance is complemented by an impressive earnings growth of 28.3% per year, which also exceeds the broader market's 26.2%. Recently, strategic acquisitions have bolstered its market position, exemplified by a significant stake purchase for CN¥60 million at CN¥29.19 per share, enhancing shareholder value and expanding corporate influence in the high-tech sector in Asia.

Kohoku KogyoLTD (TSE:6524)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kohoku Kogyo Co., Ltd. is engaged in the manufacturing and sale of lead terminals for aluminum electrolytic capacitors, optical components and devices for optical fiber communication networks, and precision components using quartz glass materials across various international markets, with a market cap of ¥75.59 billion.

Operations: The company generates revenue through the sale of lead terminals, optical components, and precision quartz glass components across Japan, China, Asia, England, and the United States. It operates within diverse international markets.

Despite recent setbacks, including lowered earnings guidance and impairment losses totaling ¥310 million, Kohoku Kogyo CO., LTD. demonstrates resilience with an anticipated revenue growth of 11.5% per year, outpacing the Japanese market's 4.3%. This growth is bolstered by a robust earnings forecast, expected to surge by 28.4% annually, significantly above the market average of 8.3%. The firm's strategic focus on optical components and devices for emerging markets like undersea cables shows promise amid recovering orders and improving business conditions in Europe.

- Navigate through the intricacies of Kohoku KogyoLTD with our comprehensive health report here.

Review our historical performance report to gain insights into Kohoku KogyoLTD's's past performance.

Make It Happen

- Navigate through the entire inventory of 186 Asian High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WuXi Xinje ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603416

WuXi Xinje ElectricLtd

Engages in the research, development, production, and application of automation products in China and internationally.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026