- China

- /

- Tech Hardware

- /

- SHSE:688036

Shenzhen Transsion Holdings Co., Ltd.'s (SHSE:688036) Share Price Boosted 35% But Its Business Prospects Need A Lift Too

Despite an already strong run, Shenzhen Transsion Holdings Co., Ltd. (SHSE:688036) shares have been powering on, with a gain of 35% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 3.7% isn't as attractive.

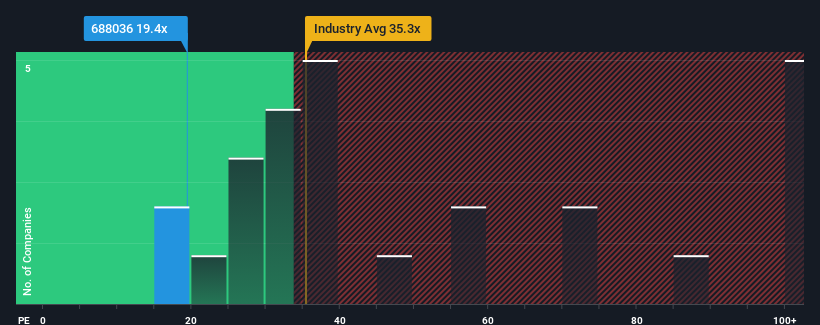

In spite of the firm bounce in price, Shenzhen Transsion Holdings may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 19.4x, since almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 58x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Shenzhen Transsion Holdings certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Shenzhen Transsion Holdings

How Is Shenzhen Transsion Holdings' Growth Trending?

In order to justify its P/E ratio, Shenzhen Transsion Holdings would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 115% gain to the company's bottom line. Pleasingly, EPS has also lifted 87% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 9.1% per annum over the next three years. With the market predicted to deliver 19% growth each year, the company is positioned for a weaker earnings result.

With this information, we can see why Shenzhen Transsion Holdings is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Despite Shenzhen Transsion Holdings' shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Shenzhen Transsion Holdings' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Shenzhen Transsion Holdings is showing 2 warning signs in our investment analysis, and 1 of those is potentially serious.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688036

Shenzhen Transsion Holdings

Provides smart devices and mobile services in Africa, South and Southeast Asia, the Middle East, Latin America, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives