Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:688020

Three Growth Companies With High Insider Ownership And Up To 172% Earnings Growth

Reviewed by Simply Wall St

As global markets show signs of stabilization with major indices like the Dow Jones and S&P 500 reaching new highs, investors are keenly observing trends that might suggest sustainable growth opportunities. In this context, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often align leadership interests with shareholder returns, fostering a culture of long-term value creation.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Modetour Network (KOSDAQ:A080160) | 12.3% | 45.6% |

| Cettire (ASX:CTT) | 28.7% | 29.9% |

| Gaming Innovation Group (OB:GIG) | 22.8% | 36.2% |

| Elliptic Laboratories (OB:ELABS) | 31.4% | 124.6% |

| KebNi (OM:KEBNI B) | 37.8% | 90.4% |

| UTI (KOSDAQ:A179900) | 34.2% | 111.6% |

| EHang Holdings (NasdaqGM:EH) | 33% | 98.2% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

| Adocia (ENXTPA:ADOC) | 12.8% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

Let's take a closer look at a couple of our picks from the screened companies.

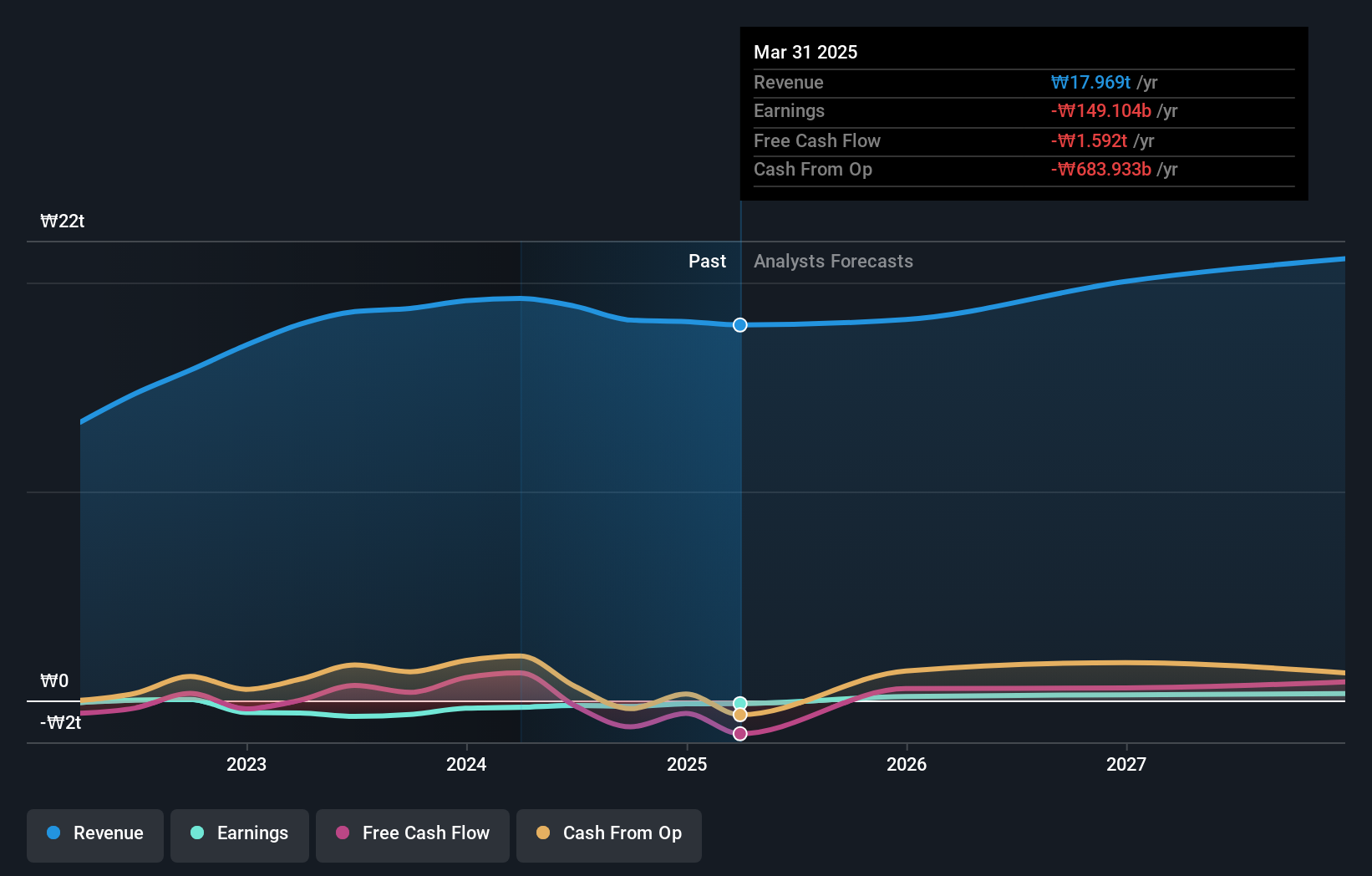

Doosan (KOSE:A000150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across South Korea, the U.S., Asia, the Middle East, and Europe with a market cap of approximately ₩2.66 trillion.

Operations: Doosan's revenue is primarily derived from its Bobcat and Energy segments, which generated ₩9.76 billion and ₩8.24 billion respectively, followed by contributions from the Electronic BG, Digital Innovation BU, and Fuel Cell divisions totaling ₩814.06 million, ₩278.33 million, and ₩260.89 million respectively.

Insider Ownership: 36%

Earnings Growth Forecast: 73.5% p.a.

Doosan, despite its high volatility in share price, shows promise with a forecasted annual earnings growth of 73.55% and an anticipated return to profitability within three years. The company's revenue growth, at 3.4% per year, is modest compared to the broader Korean market expectation of 10%. Recent financials reveal a significant reduction in net loss from KRW 696.39 billion to KRW 388.28 billion year-over-year and an improvement in basic loss per share. However, the sustainability of its dividend is questionable as it is not well covered by earnings.

- Get an in-depth perspective on Doosan's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Doosan's share price might be too pessimistic.

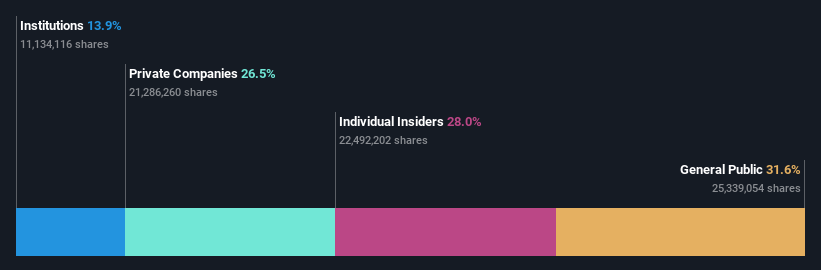

Guangzhou Fangbang ElectronicsLtd (SHSE:688020)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Fangbang Electronics Co., Ltd. specializes in the R&D, production, sale, and service of electronic materials in China, with a market capitalization of approximately CN¥2.87 billion.

Operations: The company generates its revenue primarily through the research, development, production, and sale of electronic materials.

Insider Ownership: 28.0%

Earnings Growth Forecast: 172.4% p.a.

Guangzhou Fangbang Electronics Co., Ltd, despite a highly volatile share price, is expected to become profitable within three years with earnings forecasted to grow significantly. The company's revenue growth rate of 53.5% per year surpasses the Chinese market average. Recent activities include substantial share buybacks totaling CNY 15.01 million, demonstrating insider confidence despite a net loss reduction in Q1 2024 compared to the previous year.

- Click here and access our complete growth analysis report to understand the dynamics of Guangzhou Fangbang ElectronicsLtd.

- Our valuation report here indicates Guangzhou Fangbang ElectronicsLtd may be overvalued.

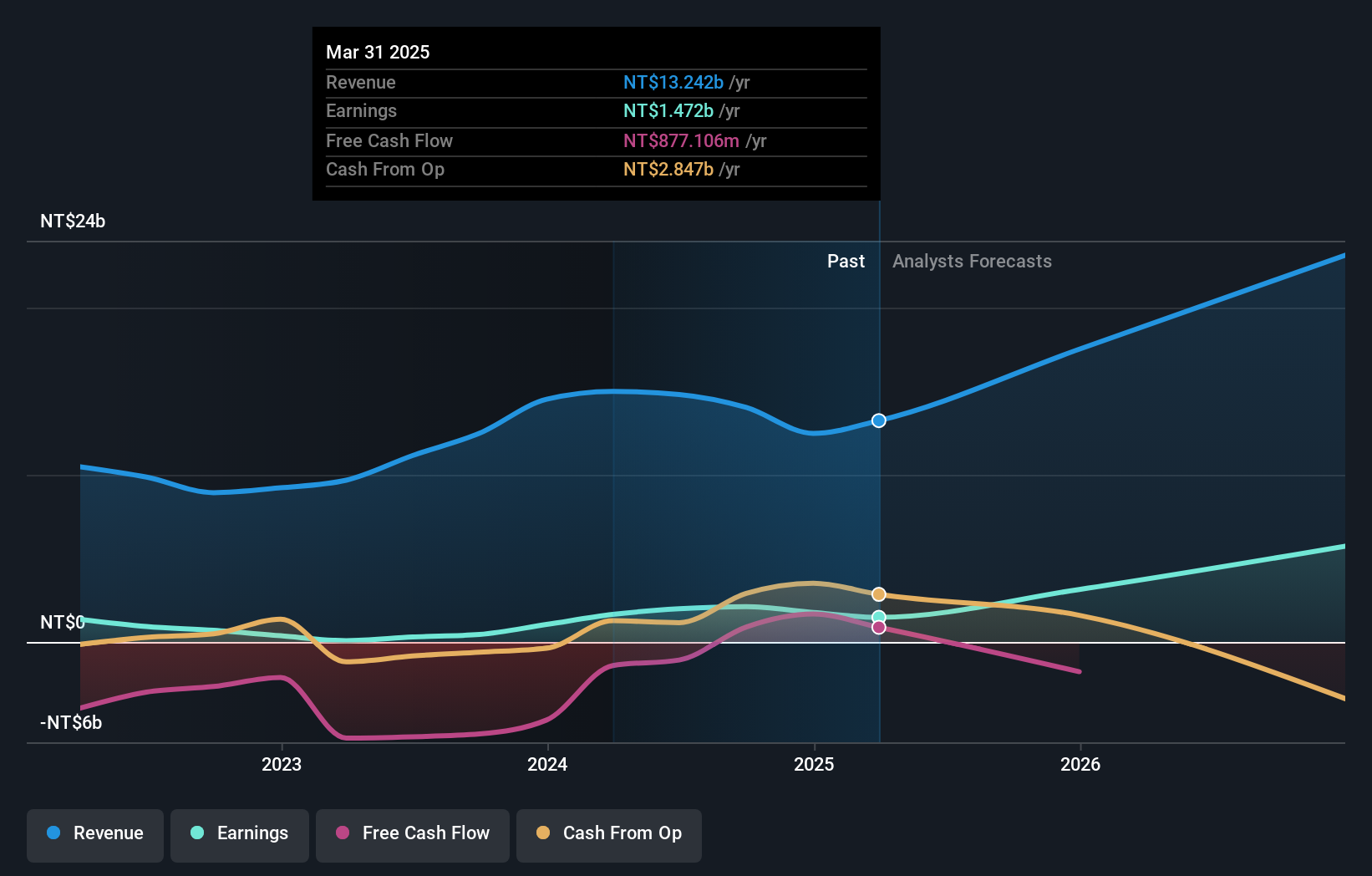

Century Iron and Steel IndustrialLtd (TWSE:9958)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Century Iron and Steel Industrial Co., Ltd. operates in the steel industry, with a market capitalization of approximately NT$70.19 billion.

Operations: The company generates its revenue primarily from the steel industry.

Insider Ownership: 10.5%

Earnings Growth Forecast: 30.3% p.a.

Century Iron and Steel Industrial Co., Ltd. has demonstrated strong performance with a very large increase in earnings over the past year. Recent financial results for Q1 2024 show a significant rise in sales to TWD 3.15 billion from TWD 2.68 billion, and net income surged to TWD 650.76 million from TWD 47.79 million year-over-year. Despite this, the company's debt is poorly covered by operating cash flow, and shareholder dilution occurred last year, adding complexity to its financial health amidst a volatile share price.

- Take a closer look at Century Iron and Steel IndustrialLtd's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Century Iron and Steel IndustrialLtd is priced higher than what may be justified by its financials.

Make It Happen

- Unlock our comprehensive list of 1506 Fast Growing Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Guangzhou Fangbang ElectronicsLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688020

Guangzhou Fangbang ElectronicsLtd

Guangzhou Fangbang Electronics Co., Ltd engages in the research and development, production, sale, and service of electronic materials in China.

High growth potential with mediocre balance sheet.