- China

- /

- Electronic Equipment and Components

- /

- SHSE:688003

Investors Appear Satisfied With Suzhou TZTEK Technology Co., Ltd's (SHSE:688003) Prospects As Shares Rocket 29%

Suzhou TZTEK Technology Co., Ltd (SHSE:688003) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 82%.

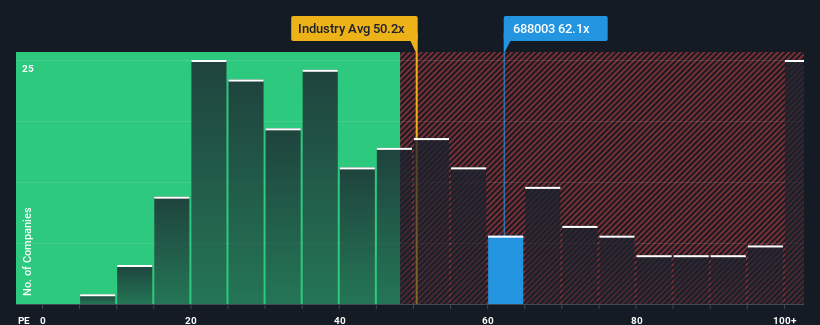

After such a large jump in price, Suzhou TZTEK Technology's price-to-earnings (or "P/E") ratio of 62.1x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 36x and even P/E's below 20x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Suzhou TZTEK Technology's negative earnings growth of late has neither been better nor worse than most other companies. It might be that many expect the company's earnings to strengthen positively despite the tough market conditions, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Suzhou TZTEK Technology

How Is Suzhou TZTEK Technology's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Suzhou TZTEK Technology's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 2.6%. Still, the latest three year period has seen an excellent 42% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 47% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 37%, which is noticeably less attractive.

In light of this, it's understandable that Suzhou TZTEK Technology's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Suzhou TZTEK Technology's P/E

The strong share price surge has got Suzhou TZTEK Technology's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Suzhou TZTEK Technology's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Suzhou TZTEK Technology that you need to take into consideration.

Of course, you might also be able to find a better stock than Suzhou TZTEK Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688003

Suzhou TZTEK Technology

Engages in the design, development, assembly, and debugging of the industrial vision equipment in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives