Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:688003

High Growth Tech Stocks To Watch For Potential Expansion

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data releases, global markets showed mixed performance, with small-cap stocks demonstrating resilience compared to their large-cap counterparts. Amidst cautious sentiment driven by subdued manufacturing activity and labor market uncertainties, investors are closely monitoring high-growth tech stocks for potential expansion opportunities. In such an environment, identifying strong candidates often involves looking at companies with robust fundamentals and innovative capabilities that can thrive despite broader market volatility.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Vaisala Oyj (HLSE:VAIAS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vaisala Oyj operates in the weather and environmental, and industrial measurement sectors, serving related markets with a market cap of €1.64 billion.

Operations: Vaisala Oyj generates revenue through its Industrial Measurements segment, contributing €219.40 million, and its Weather and Environment segment, which brings in €325 million. The company's focus on these sectors highlights its role in providing specialized measurement solutions tailored to weather-related and industrial markets.

Vaisala Oyj, amidst a vigorous technology landscape, demonstrates robust growth and strategic foresight. With a recent surge in earnings by 22.9% over the past year, surpassing the electronic industry's decline of 15.6%, Vaisala is carving out a strong position for itself. The company's commitment to innovation is evident in its R&D investments, crucial for maintaining its technological edge and supporting sustained growth—forecasted at an impressive 15.5% annually. Moreover, Vaisala's recent launch of the MGP241 product underscores its pivotal role in advancing CCUS technologies critical for industries aiming to reduce carbon footprints significantly. Recent strategic moves include a EUR 25 million project enhancing airport weather resilience across Indonesia, showcasing Vaisala’s capability to secure high-value contracts that align with global sustainability goals. This initiative not only expands their market presence but also solidifies their reputation as leaders in precision measurement solutions essential for safety and efficiency in critical sectors. As they continue to innovate and expand their influence within tech-intensive markets, Vaisala's forward-looking strategies are set to keep them relevant and competitive in evolving industrial landscapes.

- Click here and access our complete health analysis report to understand the dynamics of Vaisala Oyj.

Understand Vaisala Oyj's track record by examining our Past report.

Suzhou TZTEK Technology (SHSE:688003)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou TZTEK Technology Co., Ltd specializes in the design, development, assembly, and debugging of industrial vision equipment in China and has a market cap of CN¥7.31 billion.

Operations: Suzhou TZTEK Technology focuses on industrial vision equipment, generating revenue primarily through the design, development, assembly, and debugging processes. The company's operations are concentrated within China.

Suzhou TZTEK Technology, amidst a challenging fiscal year with a net loss of CNY 13.67 million from sales of CNY 851.09 million, continues to prioritize innovation and market expansion. The company's R&D expenditure aligns with its ambitious revenue growth projections of 40.3% annually, significantly outpacing the CN market average of 14%. Despite recent financial setbacks, TZTEK is poised for recovery with an impressive expected earnings growth rate of 47.5% per year, reflecting its potential resilience and adaptability in the high-tech sector. This strategic focus on research and development not only underscores their commitment to technological advancement but also positions them well for future competitiveness in the evolving tech landscape.

Insyde Software (TPEX:6231)

Simply Wall St Growth Rating: ★★★★★★

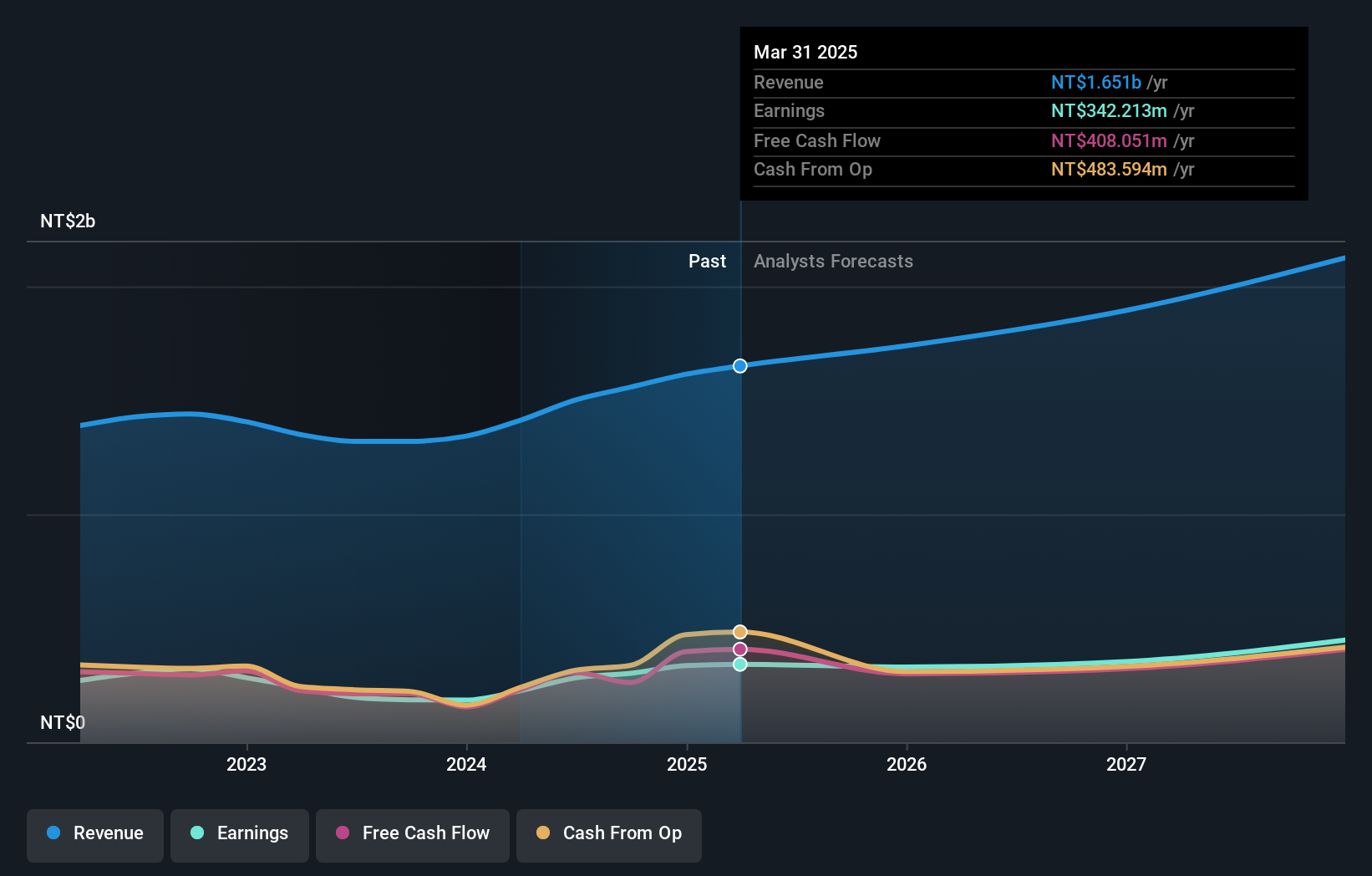

Overview: Insyde Software Corp. specializes in delivering system firmware and software engineering services to global clients across the mobile, desktop, server, and embedded systems sectors, with a market cap of NT$23.97 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to NT$1.50 billion. Its operations focus on providing specialized firmware and software solutions across various technology sectors globally.

Insyde Software has demonstrated robust financial performance, with a notable increase in sales to TWD 773.64 million from TWD 614.87 million year-over-year and an impressive surge in net income to TWD 156.17 million from TWD 58.66 million. This growth trajectory is underscored by a substantial investment in R&D, reflecting the company's commitment to innovation amid evolving tech landscapes. With earnings forecasted to grow by 56.4% annually and revenue expected to rise by 21.2% per year, Insyde is strategically positioned above many of its peers within the Taiwanese market which grows at a slower pace of 18.9%. This aggressive expansion in both product development and market reach suggests promising prospects for sustained growth, leveraging recent technological advances and operational enhancements discussed during their latest board meetings and special calls.

Taking Advantage

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1286 more companies for you to explore.Click here to unveil our expertly curated list of 1289 High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688003

Suzhou TZTEK Technology

Engages in the design, development, assembly, and debugging of the industrial vision equipment in China.