- China

- /

- Healthtech

- /

- SZSE:300451

November 2024's Top Insider-Owned Growth Companies

Reviewed by Simply Wall St

In the midst of a tumultuous week marked by cautious earnings reports and fluctuating indices, global markets have experienced mixed performances, with growth stocks generally lagging behind their value counterparts. As investors navigate these uncertain waters, insider ownership remains a critical factor to consider when evaluating potential growth companies, as it often signals confidence in the company's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 21.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here we highlight a subset of our preferred stocks from the screener.

Prosegur Compañía de Seguridad (BME:PSG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Prosegur Compañía de Seguridad, S.A. operates in the private security sector with a market cap of €992.46 million.

Operations: Prosegur Compañía de Seguridad, S.A. generates revenue from its operations in the private security sector.

Insider Ownership: 15%

Prosegur Compañía de Seguridad shows strong growth potential with earnings forecasted to increase significantly at 32.5% annually, outpacing the Spanish market. Despite trading at 59.2% below estimated fair value, challenges include slower revenue growth of 4.1% and a dividend yield of 8.17% that is not well covered by earnings or cash flows. Recent earnings reported sales of €3.58 billion for nine months ending September 2024, reflecting modest growth from the previous year.

- Unlock comprehensive insights into our analysis of Prosegur Compañía de Seguridad stock in this growth report.

- The valuation report we've compiled suggests that Prosegur Compañía de Seguridad's current price could be quite moderate.

B-SOFTLtd (SZSE:300451)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: B-SOFT Co., Ltd. operates in the medical and health industry in China with a market capitalization of CN¥8.45 billion.

Operations: The company generates revenue from its operations in the medical and health sector within China.

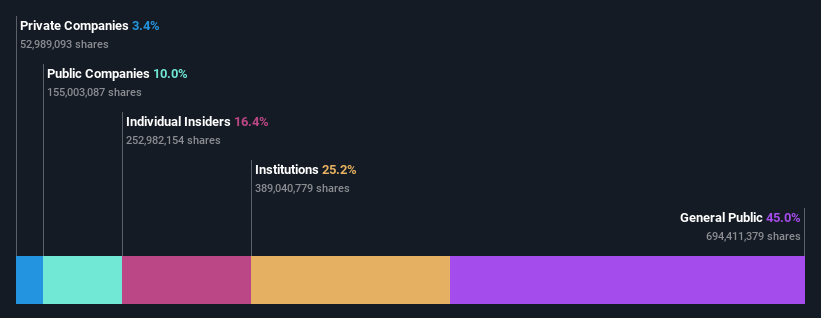

Insider Ownership: 16.4%

B-SOFT Ltd. demonstrates growth potential with forecasted earnings growth of 66.93% annually, surpassing the Chinese market average. Despite this, recent earnings for nine months ending September 2024 show a decline in net income to CNY 52.75 million from CNY 91.38 million a year ago, indicating challenges in profitability. Revenue is expected to grow at 18.1% per year, outpacing the market but remaining below high-growth benchmarks, while insider ownership remains stable without recent significant trading activity.

- Dive into the specifics of B-SOFTLtd here with our thorough growth forecast report.

- The valuation report we've compiled suggests that B-SOFTLtd's current price could be inflated.

Jiangsu Gian Technology (SZSE:300709)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Gian Technology Co., Ltd. manufactures and sells metal injection molding products in China and internationally, with a market cap of CN¥8.22 billion.

Operations: Unfortunately, the provided Business operations text does not include specific revenue segment details or amounts for Jiangsu Gian Technology Co., Ltd.

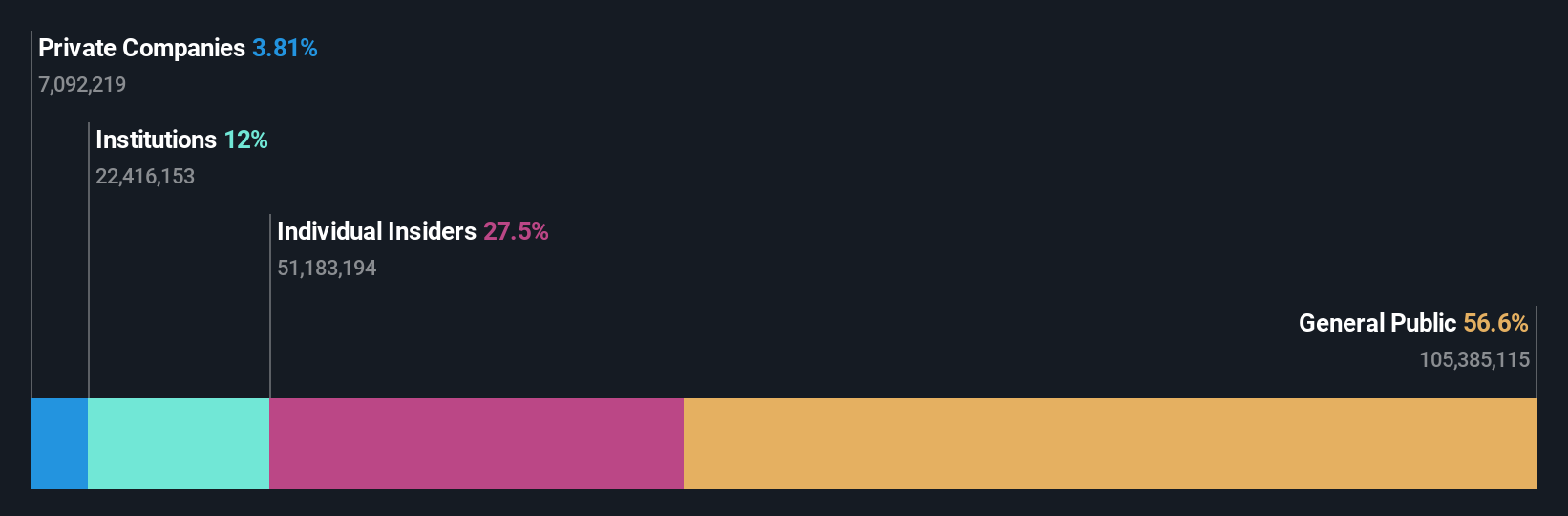

Insider Ownership: 27.5%

Jiangsu Gian Technology is set for robust growth, with revenue projected to increase by 30.2% annually, outpacing the Chinese market. Earnings are expected to grow significantly at 38.65% per year. However, recent earnings show a decline in sales and net income for the nine months ending September 2024 compared to last year. Despite becoming profitable this year, return on equity remains low at a forecasted 14.1%, and share price volatility has been high recently.

- Get an in-depth perspective on Jiangsu Gian Technology's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Jiangsu Gian Technology's share price might be on the expensive side.

Turning Ideas Into Actions

- Reveal the 1527 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if B-SOFTLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300451

Flawless balance sheet with reasonable growth potential.