Stock Analysis

- China

- /

- Electronic Equipment and Components

- /

- SHSE:603890

Suzhou Chunqiu Electronic Technology's (SHSE:603890) three-year decline in earnings translates into losses for shareholders

It's nice to see the Suzhou Chunqiu Electronic Technology Co., Ltd. (SHSE:603890) share price up 10% in a week. If you look at the last three years, the stock price is down. But on the bright side, its return of -27%, is better than the market, which is down 25%.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Suzhou Chunqiu Electronic Technology

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

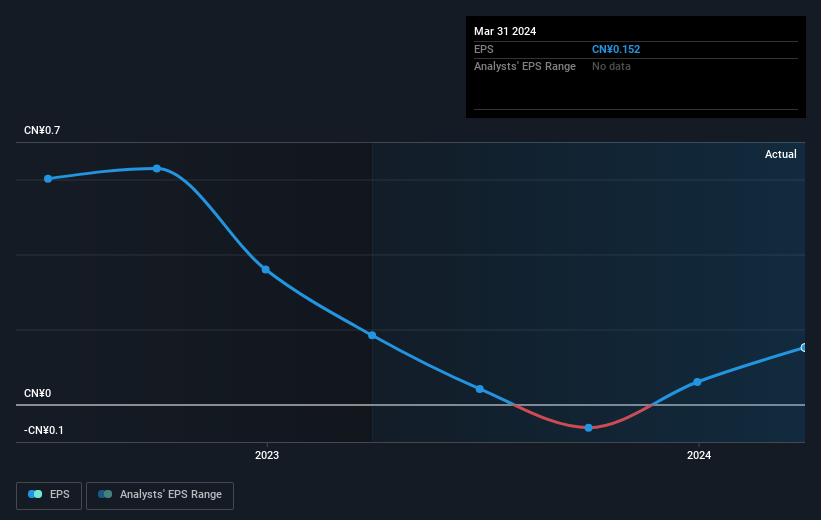

Suzhou Chunqiu Electronic Technology saw its EPS decline at a compound rate of 40% per year, over the last three years. In comparison the 10% compound annual share price decline isn't as bad as the EPS drop-off. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term. With a P/E ratio of 56.67, it's fair to say the market sees a brighter future for the business.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Suzhou Chunqiu Electronic Technology's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Suzhou Chunqiu Electronic Technology has rewarded shareholders with a total shareholder return of 7.9% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 5% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Suzhou Chunqiu Electronic Technology (of which 1 makes us a bit uncomfortable!) you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Suzhou Chunqiu Electronic Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Suzhou Chunqiu Electronic Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603890

Suzhou Chunqiu Electronic Technology

Suzhou Chunqiu Electronic Technology Co., Ltd.

Adequate balance sheet low.