As global markets navigate the complexities of rising U.S. Treasury yields and tepid economic growth, investors are increasingly seeking opportunities in growth stocks, which have recently outperformed value stocks despite broader market challenges. In such a climate, companies with strong insider ownership often stand out as they signal confidence from those closest to the business, potentially offering resilience and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.5% | 24.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's review some notable picks from our screened stocks.

Keda Industrial Group (SHSE:600499)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Keda Industrial Group Co., Ltd. manufactures and sells building material machinery in China and internationally, with a market cap of CN¥15.52 billion.

Operations: The company generates revenue from the manufacture and sale of building material machinery both domestically and internationally.

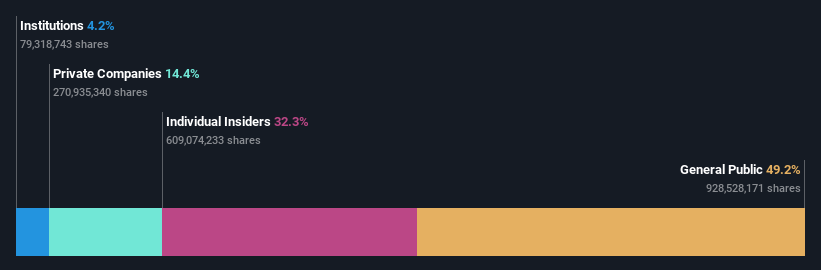

Insider Ownership: 32.3%

Revenue Growth Forecast: 14.3% p.a.

Keda Industrial Group is experiencing significant earnings growth, forecasted at 26.9% annually, outpacing the Chinese market average of 24.6%. Despite a decline in net profit margins from 27.7% to 6.9%, the company remains a good value with a price-to-earnings ratio of 20x, below the market average of 34.3x. Recent announcements include a share repurchase program aimed at employee incentives, indicating strong insider confidence despite no substantial recent insider buying or selling activity.

- Click to explore a detailed breakdown of our findings in Keda Industrial Group's earnings growth report.

- Our valuation report here indicates Keda Industrial Group may be undervalued.

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China with a market cap of CN¥9.21 billion.

Operations: Unfortunately, the provided text does not include specific revenue segments or figures for EmbedWay Technologies (Shanghai) Corporation.

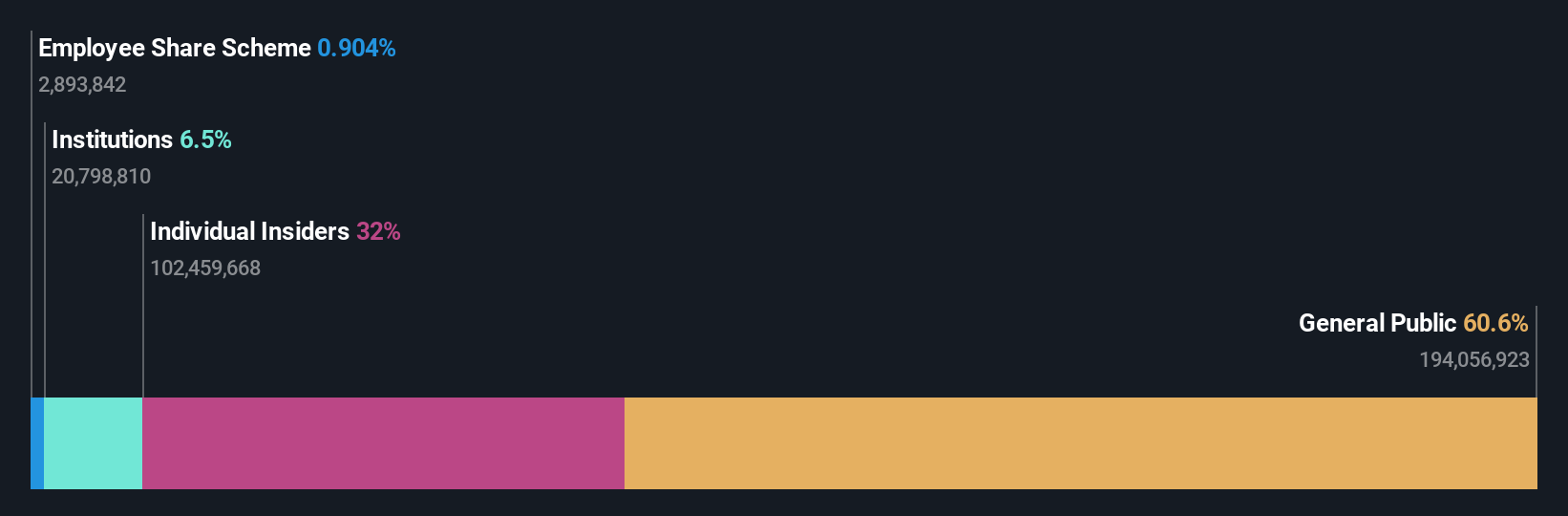

Insider Ownership: 32.1%

Revenue Growth Forecast: 18.3% p.a.

EmbedWay Technologies (Shanghai) has demonstrated strong financial performance, with net income nearly doubling in the past year to CNY 78.28 million. The company's earnings are expected to grow significantly at 33.65% annually, surpassing the Chinese market average of 24.6%. Despite a forecasted slower revenue growth rate of 18.3%, it remains above the market average of 13.7%. Recent inclusion in the S&P Global BMI Index reflects its growing prominence, although insider trading activity remains limited.

- Unlock comprehensive insights into our analysis of EmbedWay Technologies (Shanghai) stock in this growth report.

- Upon reviewing our latest valuation report, EmbedWay Technologies (Shanghai)'s share price might be too optimistic.

Hualan Biological Engineering (SZSE:002007)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hualan Biological Engineering Inc. is a biopharmaceutical company in China that focuses on the research, development, production, and commercialization of plasma products, viral and bacterial vaccines, recombinant proteins, and other biologics with a market cap of CN¥30.34 billion.

Operations: The company's revenue is derived from its activities in plasma products, viral vaccines, bacterial vaccines, and recombinant proteins and other biologics within the Chinese market.

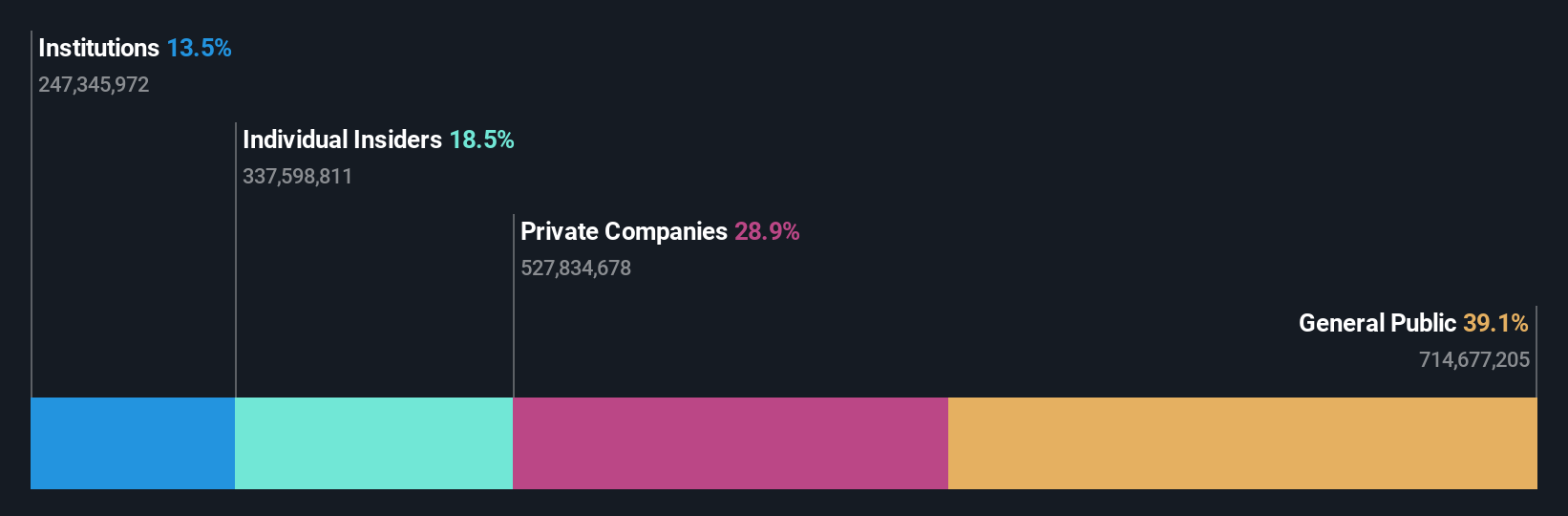

Insider Ownership: 18.5%

Revenue Growth Forecast: 20.1% p.a.

Hualan Biological Engineering is trading at a significant discount to its estimated fair value, suggesting potential upside. The company forecasts robust revenue growth of 20.1% annually, outpacing the Chinese market's average. However, recent earnings reports show declining sales and net income compared to last year, with basic earnings per share dropping from CNY 0.585 to CNY 0.5056 for the nine months ended September 2024. Insider trading activity remains unreported over the past three months.

- Navigate through the intricacies of Hualan Biological Engineering with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Hualan Biological Engineering's shares may be trading at a discount.

Turning Ideas Into Actions

- Access the full spectrum of 1522 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hualan Biological Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002007

Hualan Biological Engineering

A biopharmaceutical company, researches, develops, produces, and commercializes blood products, vaccines, and recombinant proteins in China and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives