- China

- /

- Electronic Equipment and Components

- /

- SHSE:603416

Investors Could Be Concerned With WuXi Xinje ElectricLtd's (SHSE:603416) Returns On Capital

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Having said that, from a first glance at WuXi Xinje ElectricLtd (SHSE:603416) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for WuXi Xinje ElectricLtd, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.092 = CN¥209m ÷ (CN¥3.2b - CN¥885m) (Based on the trailing twelve months to September 2024).

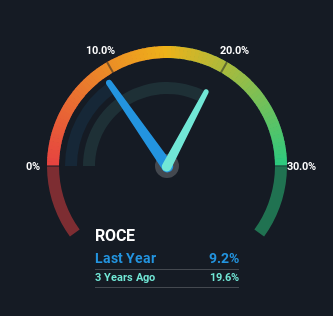

Thus, WuXi Xinje ElectricLtd has an ROCE of 9.2%. On its own that's a low return, but compared to the average of 5.5% generated by the Electronic industry, it's much better.

Check out our latest analysis for WuXi Xinje ElectricLtd

Above you can see how the current ROCE for WuXi Xinje ElectricLtd compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for WuXi Xinje ElectricLtd .

What The Trend Of ROCE Can Tell Us

Unfortunately, the trend isn't great with ROCE falling from 12% five years ago, while capital employed has grown 94%. Usually this isn't ideal, but given WuXi Xinje ElectricLtd conducted a capital raising before their most recent earnings announcement, that would've likely contributed, at least partially, to the increased capital employed figure. The funds raised likely haven't been put to work yet so it's worth watching what happens in the future with WuXi Xinje ElectricLtd's earnings and if they change as a result from the capital raise.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 28%, which has impacted the ROCE. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. Keep an eye on this ratio, because the business could encounter some new risks if this metric gets too high.

Our Take On WuXi Xinje ElectricLtd's ROCE

While returns have fallen for WuXi Xinje ElectricLtd in recent times, we're encouraged to see that sales are growing and that the business is reinvesting in its operations. In light of this, the stock has only gained 29% over the last five years. So this stock may still be an appealing investment opportunity, if other fundamentals prove to be sound.

WuXi Xinje ElectricLtd could be trading at an attractive price in other respects, so you might find our free intrinsic value estimation for 603416 on our platform quite valuable.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if WuXi Xinje ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603416

WuXi Xinje ElectricLtd

Engages in the research, development, production, and application of automation products in China and internationally.

Flawless balance sheet and fair value.

Market Insights

Community Narratives