- China

- /

- Electronic Equipment and Components

- /

- SHSE:603375

There's No Escaping Wuxi Holyview Microelectronics Co.,Ltd.'s (SHSE:603375) Muted Earnings

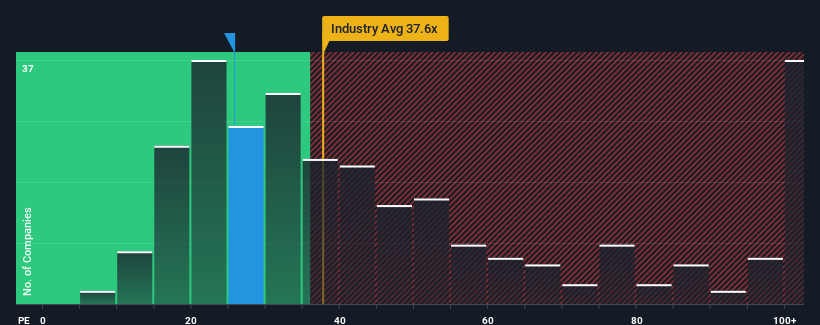

Wuxi Holyview Microelectronics Co.,Ltd.'s (SHSE:603375) price-to-earnings (or "P/E") ratio of 25.8x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 53x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen at a steady rate over the last year for Wuxi Holyview MicroelectronicsLtd, which is generally not a bad outcome. It might be that many expect the respectable earnings performance to degrade, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Wuxi Holyview MicroelectronicsLtd

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Wuxi Holyview MicroelectronicsLtd's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 5.3%. This was backed up an excellent period prior to see EPS up by 122% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 35% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Wuxi Holyview MicroelectronicsLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Wuxi Holyview MicroelectronicsLtd's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Wuxi Holyview MicroelectronicsLtd maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Wuxi Holyview MicroelectronicsLtd (1 is potentially serious) you should be aware of.

If you're unsure about the strength of Wuxi Holyview MicroelectronicsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Holyview MicroelectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603375

Wuxi Holyview MicroelectronicsLtd

Provides integrated electronic detonator solutions in China.

Excellent balance sheet unattractive dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026