- China

- /

- Electronic Equipment and Components

- /

- SHSE:603328

Guangdong Ellington Electronics Technology Co.,Ltd's (SHSE:603328) Price Is Right But Growth Is Lacking After Shares Rocket 29%

Guangdong Ellington Electronics Technology Co.,Ltd (SHSE:603328) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.0% in the last twelve months.

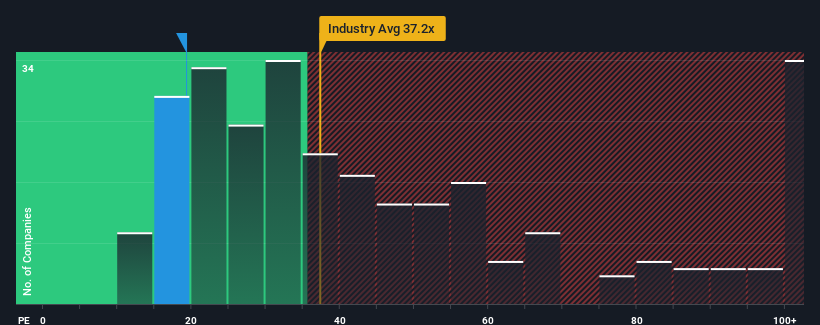

Although its price has surged higher, Guangdong Ellington Electronics TechnologyLtd's price-to-earnings (or "P/E") ratio of 19.3x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 55x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Guangdong Ellington Electronics TechnologyLtd has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Guangdong Ellington Electronics TechnologyLtd

Does Growth Match The Low P/E?

Guangdong Ellington Electronics TechnologyLtd's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 33% last year. Pleasingly, EPS has also lifted 63% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to deliver 41% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Guangdong Ellington Electronics TechnologyLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Guangdong Ellington Electronics TechnologyLtd's P/E?

The latest share price surge wasn't enough to lift Guangdong Ellington Electronics TechnologyLtd's P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Guangdong Ellington Electronics TechnologyLtd revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Guangdong Ellington Electronics TechnologyLtd (including 1 which is concerning).

You might be able to find a better investment than Guangdong Ellington Electronics TechnologyLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603328

Guangdong Ellington Electronics TechnologyLtd

Researches and develop, manufactures, and sells high-precision, high-density double-layer, and multi-layer printed circuit boards in China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives