- China

- /

- Entertainment

- /

- SHSE:600977

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

Amidst geopolitical tensions and consumer spending concerns, global markets have experienced fluctuations, with major U.S. indexes declining over the past week despite early gains. As the S&P 500 reached record highs before retreating, investor sentiment remains cautious due to factors like tariff uncertainties and weakening consumer confidence. In such an environment, high growth tech stocks can be appealing for their potential to offer innovative solutions and adaptability in rapidly changing market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.86% | 26.17% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.67% | 58.73% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1187 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

China Film (SHSE:600977)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Film Co., Ltd. operates in the production, distribution, projection, technology, service, and innovation of films and television dramas both in China and internationally with a market capitalization of CN¥20.33 billion.

Operations: China Film Co., Ltd. generates revenue through its diverse operations in film and television production, distribution, projection, and related technological services. The company serves both domestic and international markets.

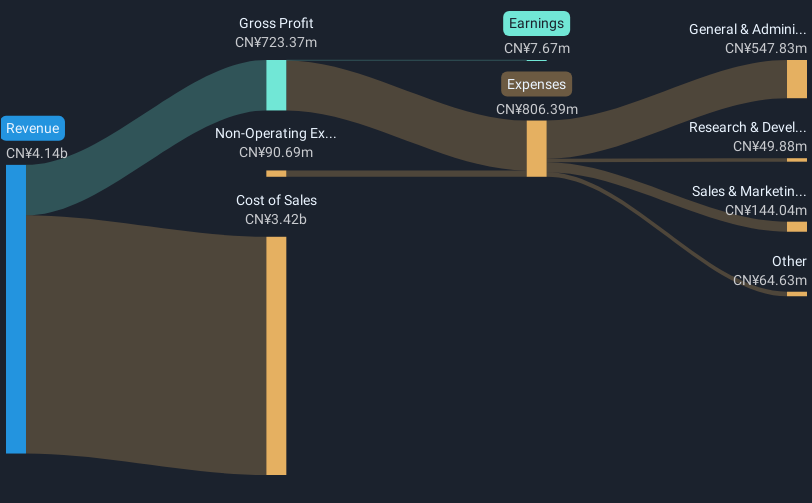

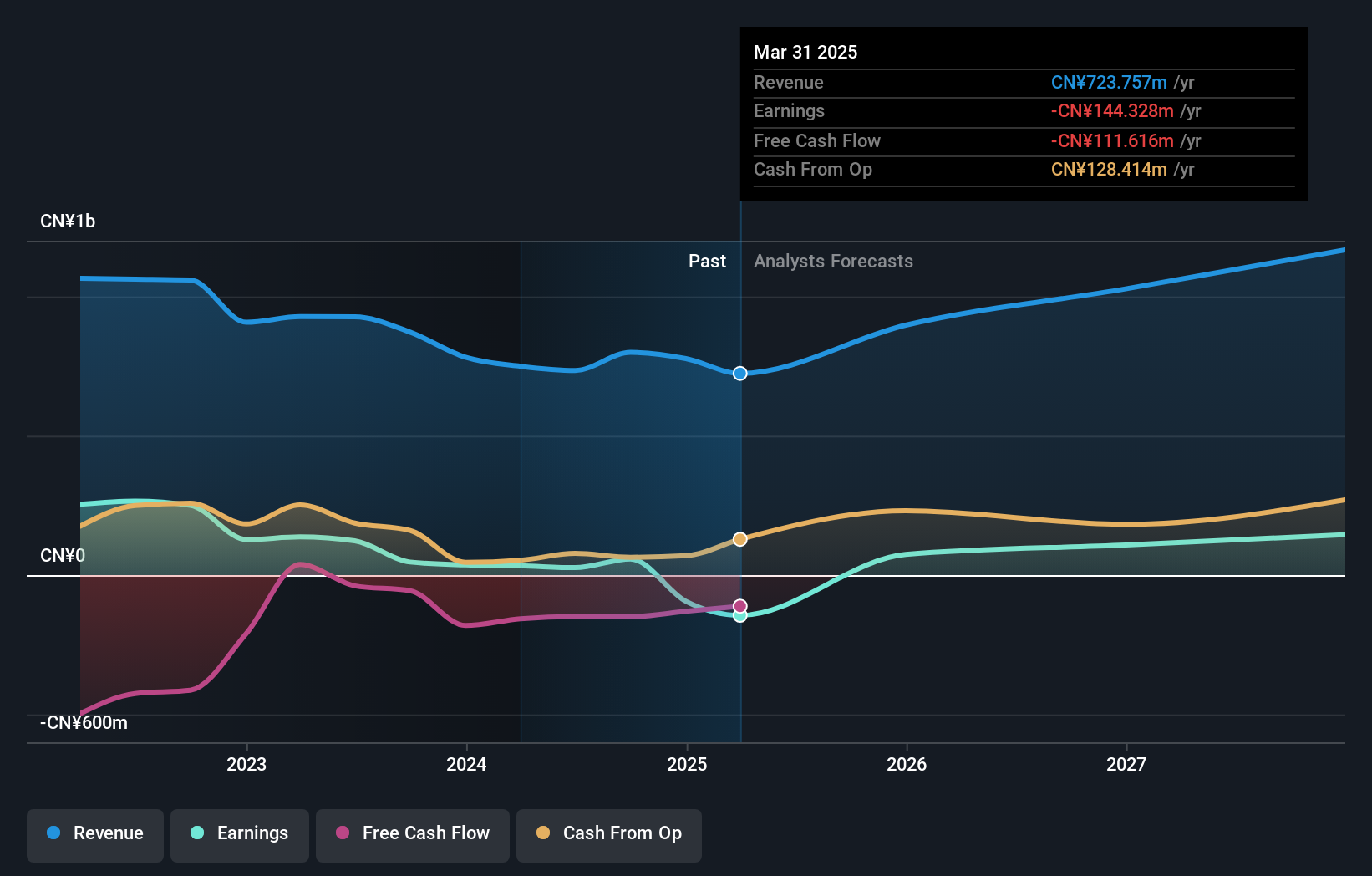

Despite a challenging year with earnings declining by 97%, China Film is poised for a significant rebound, forecasting an impressive annual earnings growth of 76.5%. This potential turnaround is underpinned by an anticipated revenue increase of 18.8% per year, outpacing the Chinese market's average of 13.4%. However, the company's profit margins have dipped to just 0.2%, a stark decrease from last year’s 5.2%. Looking ahead, while the return on equity is expected to remain low at around 6.2% in three years, the robust growth projections and positive free cash flow position China Film in an intriguing spot for future developments within the entertainment sector.

- Navigate through the intricacies of China Film with our comprehensive health report here.

Examine China Film's past performance report to understand how it has performed in the past.

Ningbo Yongxin OpticsLtd (SHSE:603297)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Yongxin Optics Co., Ltd specializes in the manufacturing and sale of precision optical instruments and components within China, with a market capitalization of approximately CN¥11.99 billion.

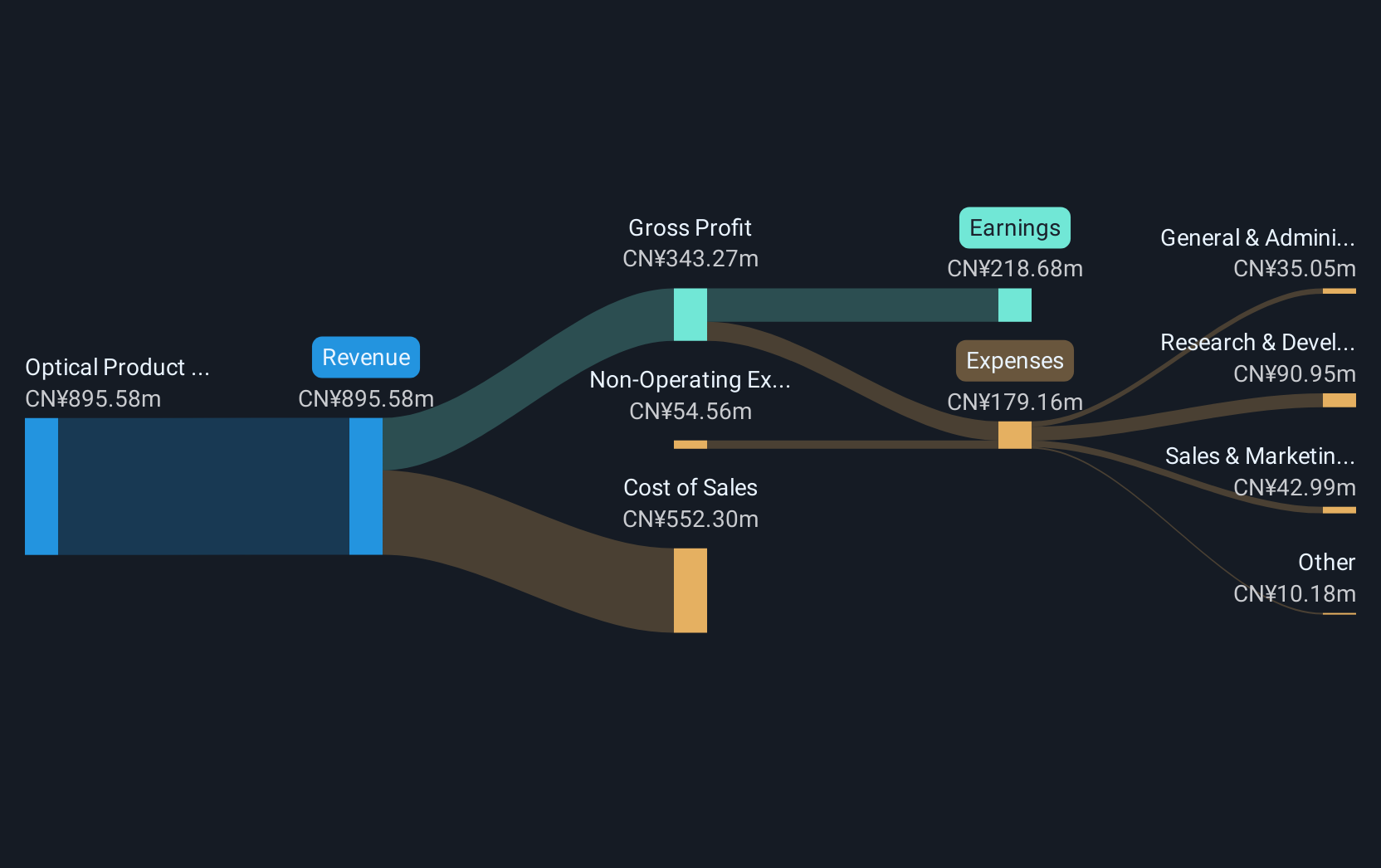

Operations: The primary revenue stream for Ningbo Yongxin Optics Co., Ltd comes from its optical product manufacturing segment, generating approximately CN¥894.06 million. The company focuses on precision optical instruments and components within the Chinese market.

Ningbo Yongxin OpticsLtd, with a robust forecast in annual revenue growth at 29.7%, outstrips the Chinese market's average of 13.4%. This growth is bolstered by an anticipated earnings increase of 36.5% per year, reflecting a dynamic response to evolving market demands. The company has strategically allocated significant resources to R&D, spending CN¥64.9M in the last fiscal year, which underscores its commitment to innovation and positions it well for sustained technological advancements in optics technology. Despite recent volatility in its share price, these financial indicators combined with positive free cash flow suggest that Ningbo Yongxin is navigating its challenges while laying down a strong foundation for future growth and industry leadership.

TRS Information Technology (SZSE:300229)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TRS Information Technology Co., Ltd. offers artificial intelligence, big data, and data security products and services in China with a market capitalization of CN¥22.87 billion.

Operations: TRS Information Technology Co., Ltd. specializes in artificial intelligence, big data, and data security solutions within China. The company operates with a market capitalization of CN¥22.87 billion.

TRS Information Technology has demonstrated a robust growth trajectory, with revenue and earnings expanding at annualized rates of 17.4% and 40.2%, respectively, outpacing the broader Chinese market norms. This performance is underpinned by strategic R&D investments, totaling CN¥64.9M last year, which fuel continuous innovation and technological advancement within its software solutions segment. Despite a volatile share price in recent months, TRS's aggressive growth strategy and substantial R&D focus position it strongly within the competitive tech landscape. The company's recent shareholder meeting also indicates proactive governance adjustments to further support its ambitious growth plans.

Make It Happen

- Reveal the 1187 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600977

China Film

Engages in the production, distribution, screening, technology, service, and innovation of films and television dramas in China and internationally.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives