As global markets continue to navigate the evolving landscape shaped by recent U.S. policy changes and AI investment enthusiasm, major indices like the S&P 500 have reached new heights, reflecting a positive investor sentiment despite some economic uncertainties. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that effectively leverage emerging technologies such as artificial intelligence and data infrastructure to drive innovation and capture market opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Ningbo Yongxin OpticsLtd (SHSE:603297)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Yongxin Optics Co., Ltd specializes in the manufacturing and sale of precision optical instruments and components in China, with a market capitalization of approximately CN¥10.46 billion.

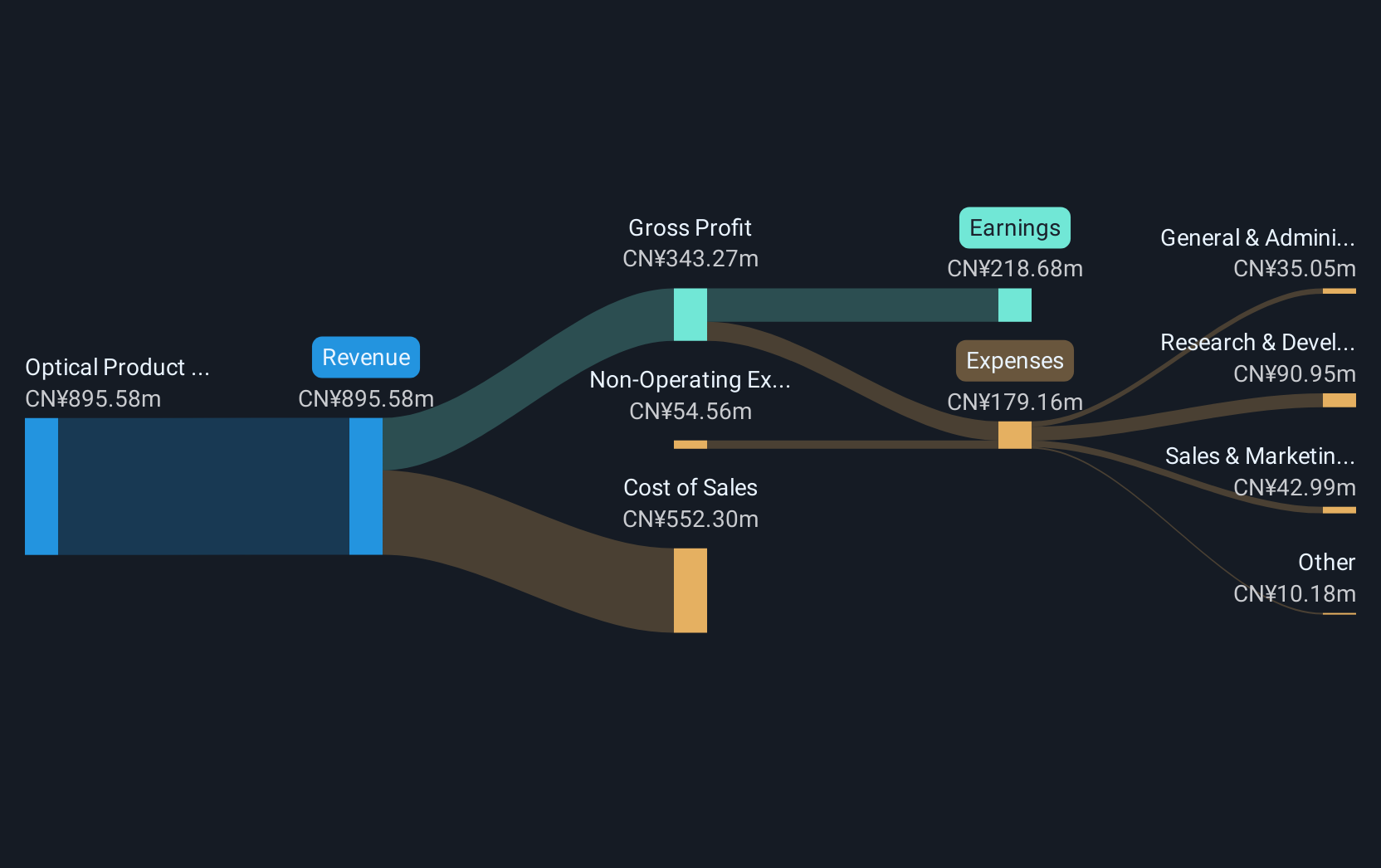

Operations: Yongxin Optics focuses on the production and distribution of precision optical instruments, generating revenue primarily from its Optical Product Manufacturing segment, which contributes CN¥894.06 million.

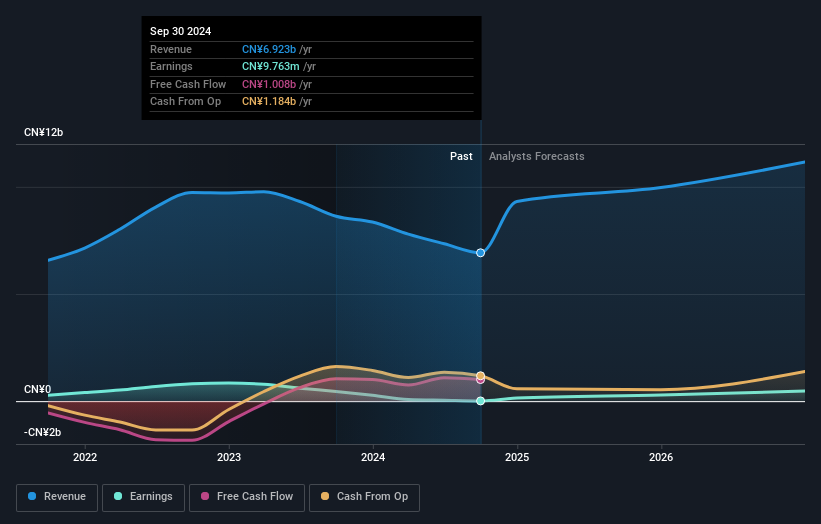

Ningbo Yongxin OpticsLtd has demonstrated a robust growth trajectory, with revenue increasing by 6.5% to CNY 650.58 million in the nine months ending September 2024, compared to the same period last year. This performance is underscored by an impressive annualized revenue growth rate of 29.7%, surpassing the Chinese market average of 13.4%. However, it's crucial to note a decline in net income from CNY 173.76 million to CNY 140.26 million over the same period, reflecting a decrease of around 19%. Despite this setback, earnings are expected to surge by approximately 33.5% annually over the next three years, indicating potential for substantial financial improvement and resilience in its operational model.

Beijing Zhong Ke San Huan High-Tech (SZSE:000970)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Zhong Ke San Huan High-Tech Co., Ltd. operates in the high-tech sector and has a market capitalization of CN¥12.84 billion.

Operations: Zhong Ke San Huan High-Tech specializes in the high-tech sector, focusing on innovative technologies and advanced materials. The company generates its revenue through various segments, with a significant emphasis on developing cutting-edge products. Its financial performance reflects strategic investments in research and development to enhance product offerings.

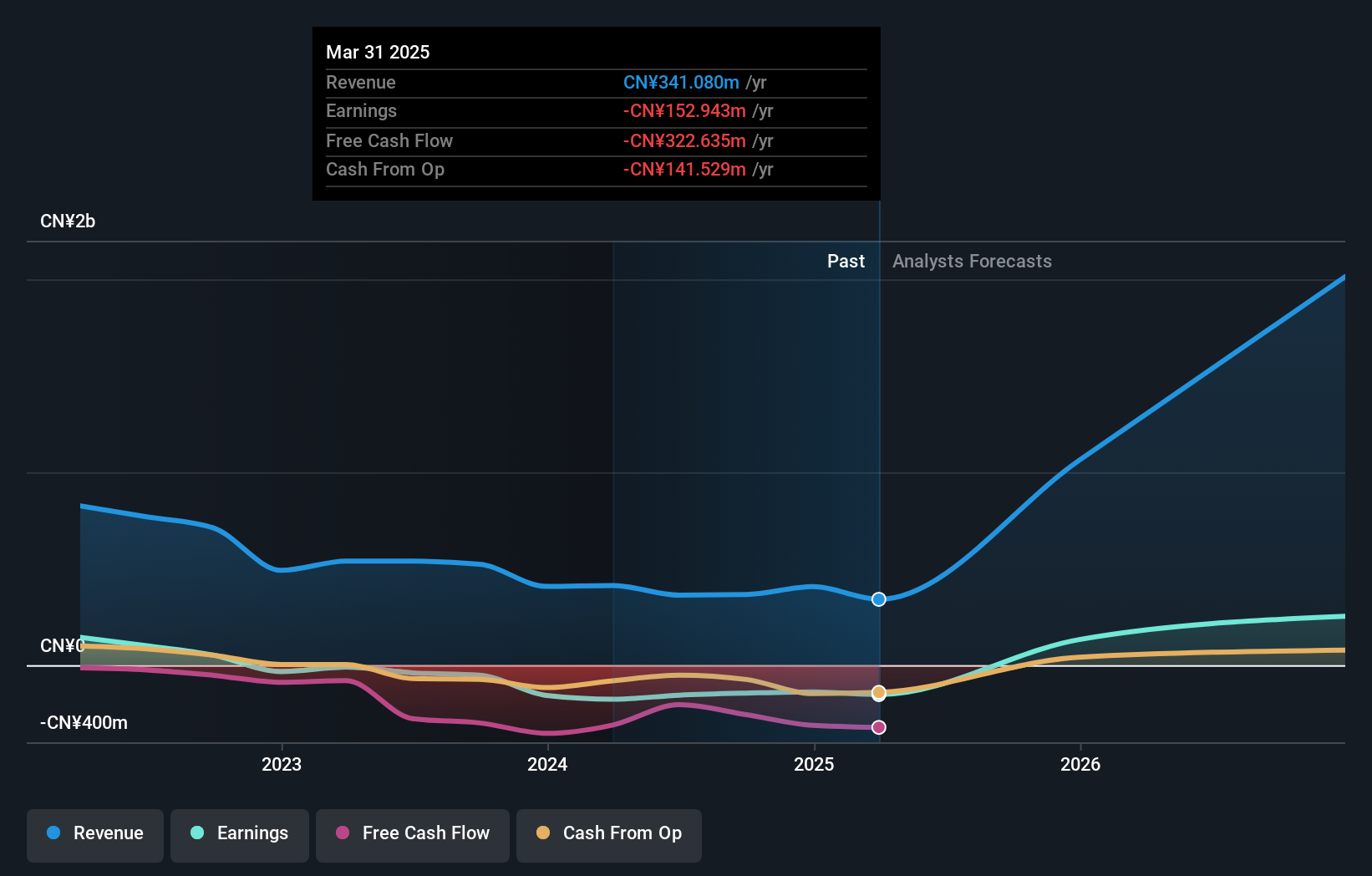

Beijing Zhong Ke San Huan High-Tech has navigated a challenging landscape with its recent revenue figures showing a decline to CNY 4.98 billion from last year's CNY 6.42 billion, reflecting broader market conditions. Despite this setback, the company's commitment to innovation is evident in its R&D investments and strategic decisions such as share repurchases totaling CNY 107.95 million, enhancing shareholder value. Moreover, the special shareholders meeting scheduled for December underscores a proactive approach in optimizing capital allocation and addressing project financing needs, positioning it for recovery and future growth within the tech sector.

Jilin University Zhengyuan Information Technologies (SZSE:003029)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jilin University Zhengyuan Information Technologies Co., Ltd. operates in the information technology sector with a market capitalization of CN¥3.95 billion.

Operations: The company generates revenue primarily through its information technology services, focusing on software development and systems integration. It operates within the IT sector, leveraging its expertise to deliver tailored solutions to clients.

Jilin University Zhengyuan Information Technologies is poised for significant growth, with a forecasted revenue increase of 72.9% annually. This surge is supported by an aggressive R&D strategy, where the firm invests heavily to fuel innovations, evident from its annualized earnings growth projection of 113.9%. Despite current unprofitability, these figures suggest a robust potential for profitability within three years. The company also actively enhances shareholder value through strategic share repurchases, having completed buybacks worth CNY 72.72 million recently. This approach not only secures financial agility but aligns with broader industry trends towards substantial revenue and profit trajectories in tech sectors driven by continuous technological advancements and market demand dynamics.

Taking Advantage

- Explore the 1225 names from our High Growth Tech and AI Stocks screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003029

Jilin University Zhengyuan Information Technologies

Jilin University Zhengyuan Information Technologies Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives