Stock Analysis

High Growth Tech Stocks to Consider in October 2024

Reviewed by Simply Wall St

As global markets navigate rising U.S. Treasury yields and a cautious Federal Reserve rate-cutting outlook, the tech-heavy Nasdaq Composite Index has shown resilience, slightly gaining amid broader market declines. In this environment, identifying high-growth tech stocks often involves looking for companies with robust innovation potential and adaptability to shifting economic conditions, making them intriguing considerations for investors seeking opportunities in a dynamic sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 29.19% | 70.82% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1279 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Vitrolife (OM:VITR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitrolife AB (publ) specializes in providing assisted reproduction products and has a market capitalization of approximately SEK32.74 billion.

Operations: Vitrolife AB (publ) generates revenue through three primary segments: Genetics (SEK1.23 billion), Consumables (SEK1.61 billion), and Technologies (SEK721 million).

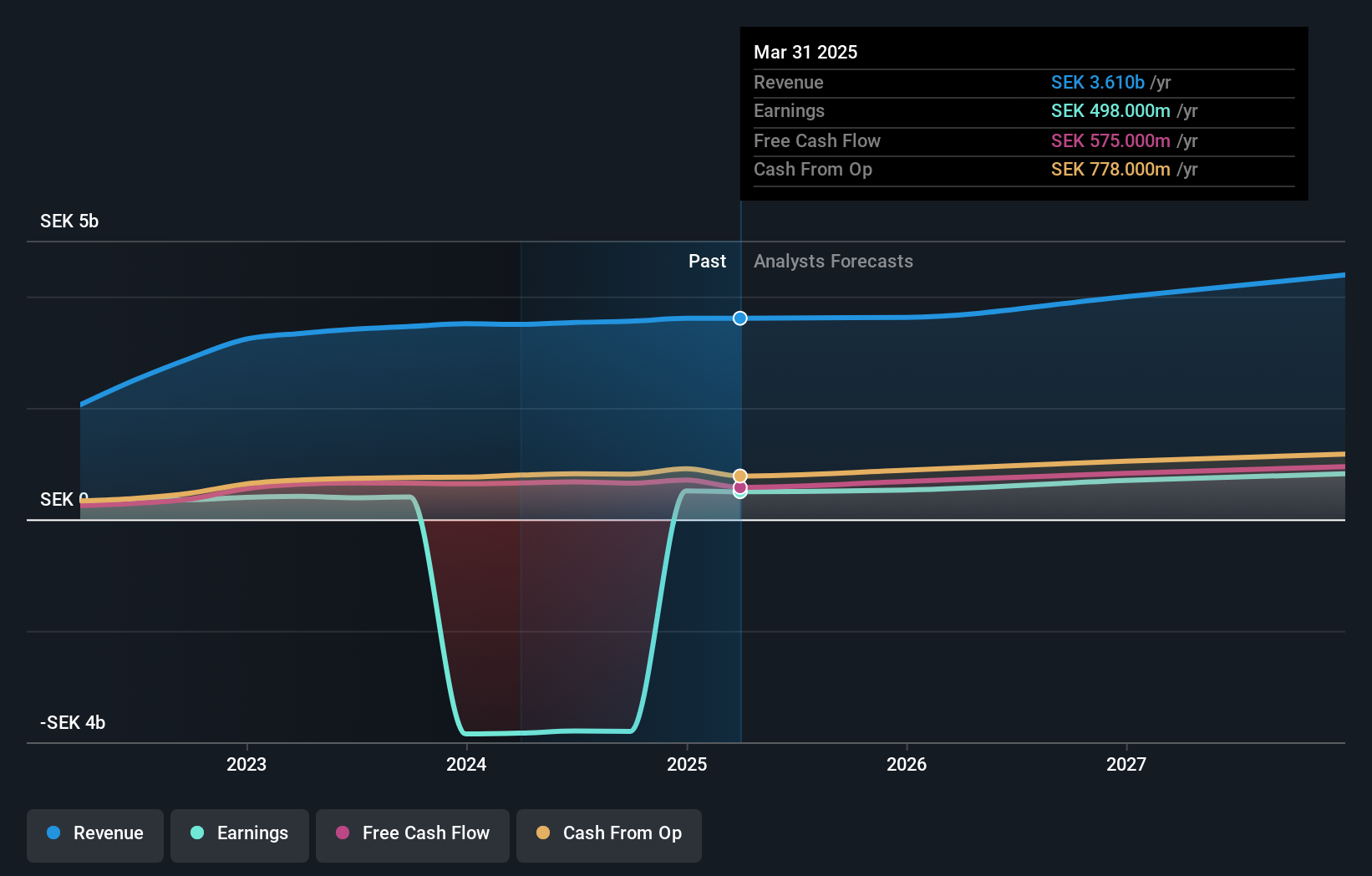

Vitrolife, navigating the challenging biotech landscape, is poised for significant growth with its revenue expected to increase by 8% annually, outpacing the Swedish market's modest 0.06% growth rate. Despite current unprofitability, the company's earnings are projected to surge by an impressive 116.5% per year. This growth trajectory is supported by a robust R&D commitment, crucial for fostering innovation in biotechnology—a sector where development cycles are long and capital-intensive. Recent financials reveal a stable upward trend with third-quarter sales rising to SEK 867 million from SEK 848 million year-over-year, underlining consistent performance amidst market fluctuations. With strategic investments in research and a clear focus on expanding its market footprint, Vitrolife demonstrates potential as a resilient player in high-growth tech sectors.

- Click here to discover the nuances of Vitrolife with our detailed analytical health report.

Review our historical performance report to gain insights into Vitrolife's's past performance.

Ningbo Yongxin OpticsLtd (SHSE:603297)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Yongxin Optics Co.,Ltd specializes in the manufacturing and sale of precision optical instruments and components in China, with a market capitalization of CN¥8.85 billion.

Operations: Ningbo Yongxin Optics Co.,Ltd generates revenue through the production and sale of precision optical instruments and components. The company's market capitalization is CN¥8.85 billion, reflecting its position in the optical manufacturing industry in China.

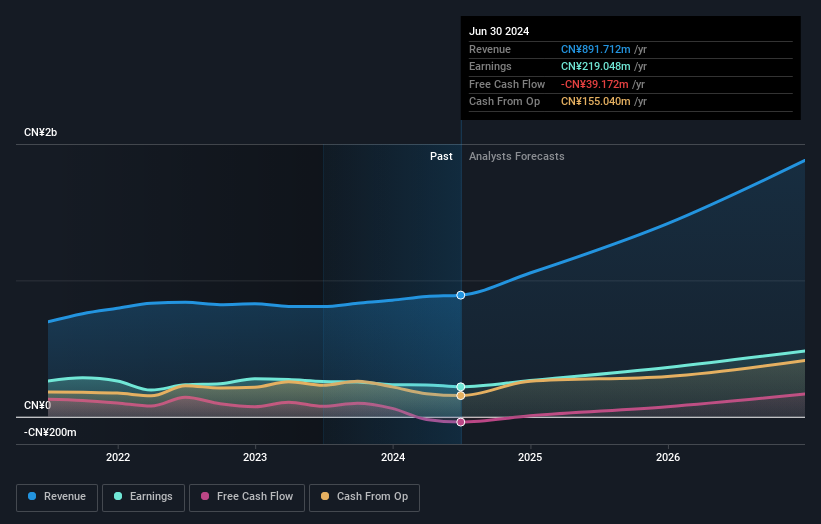

Ningbo Yongxin Optics Co., Ltd, despite a challenging year with a 20.5% dip in earnings, remains poised for recovery as its revenue is forecasted to grow at an impressive rate of 30.9% annually. This growth is significantly higher than the industry average of 13.7%, underscoring the company's potential resilience and adaptability in the optics sector. The firm's commitment to innovation is evident from its R&D spending trends, which are crucial for maintaining technological leadership in precision optics—a field demanding constant advancement. Moreover, recent earnings reports indicate a strategic emphasis on enhancing product offerings and market reach, with sales climbing from CNY 610.64 million to CNY 650.58 million over nine months despite fluctuating net income figures.

- Navigate through the intricacies of Ningbo Yongxin OpticsLtd with our comprehensive health report here.

Gain insights into Ningbo Yongxin OpticsLtd's past trends and performance with our Past report.

SDIC Intelligence Xiamen Information (SZSE:300188)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SDIC Intelligence Xiamen Information Co., Ltd. is a company with a market cap of CN¥13.66 billion, focusing on providing intelligent information solutions and services.

Operations: The company generates revenue through its intelligent information solutions and services, contributing significantly to its market presence.

SDIC Intelligence Xiamen Information, navigating through a transformative phase, reported a significant reduction in net loss from CNY 397.09 million to CNY 241.83 million year-over-year as of Q3 2024, underscoring effective cost management and operational improvements. This progress is mirrored in their revenue surge to CNY 897.38 million from CNY 750.49 million, marking a robust growth trajectory of approximately 19.6% annually, notably higher than the previous periods. The firm's commitment to innovation is palpable with R&D expenses aligning closely with industry demands; however, specific figures were not disclosed in the recent earnings call or reports. Looking ahead, SDIC Intelligence aims to leverage its enhanced product offerings and strategic market positioning to capitalize on emerging tech trends and client needs.

Make It Happen

- Click here to access our complete index of 1279 High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VITR

Vitrolife

Provides assisted reproduction products.