- China

- /

- Electronic Equipment and Components

- /

- SHSE:603297

Earnings Not Telling The Story For Ningbo Yongxin Optics Co.,Ltd (SHSE:603297) After Shares Rise 25%

Those holding Ningbo Yongxin Optics Co.,Ltd (SHSE:603297) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

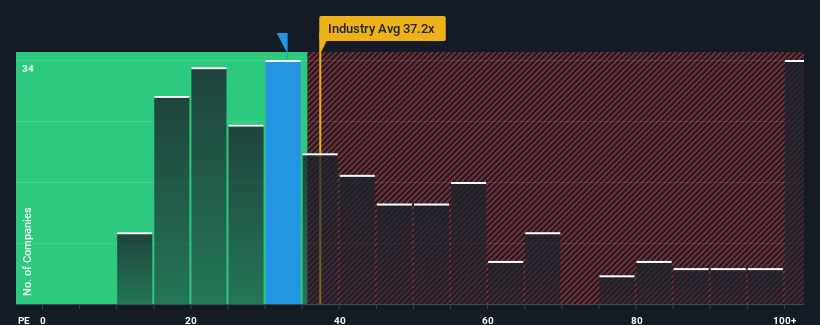

Although its price has surged higher, it's still not a stretch to say that Ningbo Yongxin OpticsLtd's price-to-earnings (or "P/E") ratio of 32.8x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Ningbo Yongxin OpticsLtd has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Ningbo Yongxin OpticsLtd

Is There Some Growth For Ningbo Yongxin OpticsLtd?

In order to justify its P/E ratio, Ningbo Yongxin OpticsLtd would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a decent 4.1% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 90% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 35% during the coming year according to the seven analysts following the company. That's shaping up to be materially lower than the 41% growth forecast for the broader market.

In light of this, it's curious that Ningbo Yongxin OpticsLtd's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Ningbo Yongxin OpticsLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Ningbo Yongxin OpticsLtd's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Ningbo Yongxin OpticsLtd you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Yongxin OpticsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603297

Ningbo Yongxin OpticsLtd

Manufactures and sells precision optical instruments and components in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success