- China

- /

- Communications

- /

- SHSE:603083

While shareholders of CIG ShangHai (SHSE:603083) are in the black over 3 years, those who bought a week ago aren't so fortunate

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. For instance the CIG ShangHai Co., Ltd. (SHSE:603083) share price is 221% higher than it was three years ago. That sort of return is as solid as granite. On top of that, the share price is up 62% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 26% in 90 days).

Since the long term performance has been good but there's been a recent pullback of 5.8%, let's check if the fundamentals match the share price.

View our latest analysis for CIG ShangHai

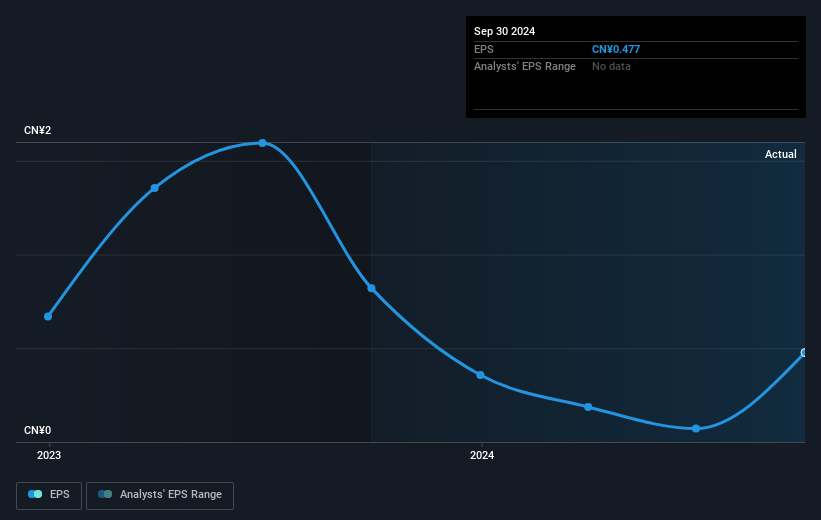

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

CIG ShangHai became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

CIG ShangHai shareholders gained a total return of 3.9% during the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 16% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with CIG ShangHai , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603083

CIG ShangHai

Engages in the research, development, manufacture, and sale of computing, optical module, and industrial interconnection products worldwide.

Excellent balance sheet and fair value.