- China

- /

- Electronic Equipment and Components

- /

- SHSE:603025

Beijing Dahao Technology Corp.,Ltd's (SHSE:603025) Shares Climb 26% But Its Business Is Yet to Catch Up

Beijing Dahao Technology Corp.,Ltd (SHSE:603025) shares have continued their recent momentum with a 26% gain in the last month alone. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

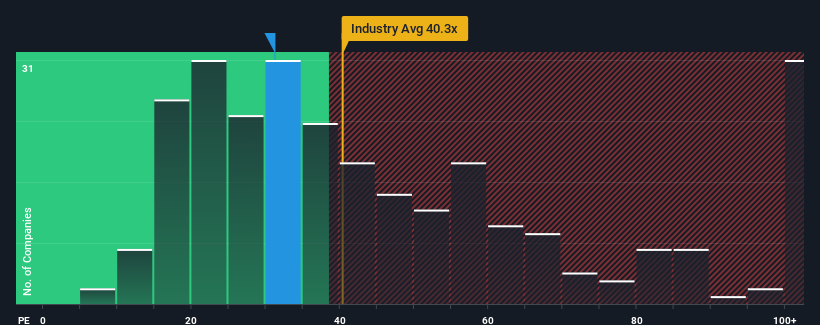

Even after such a large jump in price, it's still not a stretch to say that Beijing Dahao TechnologyLtd's price-to-earnings (or "P/E") ratio of 31.2x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 32x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Earnings have risen firmly for Beijing Dahao TechnologyLtd recently, which is pleasing to see. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Beijing Dahao TechnologyLtd

Is There Some Growth For Beijing Dahao TechnologyLtd?

In order to justify its P/E ratio, Beijing Dahao TechnologyLtd would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a worthy increase of 11%. Pleasingly, EPS has also lifted 93% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 39% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Beijing Dahao TechnologyLtd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Bottom Line On Beijing Dahao TechnologyLtd's P/E

Beijing Dahao TechnologyLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Beijing Dahao TechnologyLtd revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 1 warning sign for Beijing Dahao TechnologyLtd that you need to take into consideration.

You might be able to find a better investment than Beijing Dahao TechnologyLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Dahao TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603025

Beijing Dahao TechnologyLtd

Researches and develops, produces, and sells computerized control products for embroidery machine and related drivers in China and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives