- China

- /

- Communications

- /

- SHSE:600775

The Market Doesn't Like What It Sees From Nanjing Panda Electronics Company Limited's (SHSE:600775) Revenues Yet

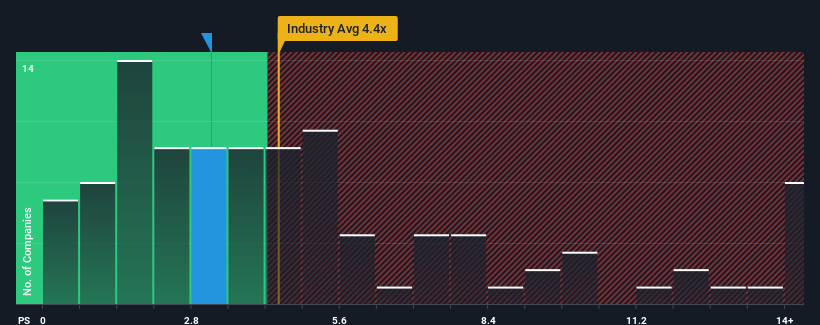

You may think that with a price-to-sales (or "P/S") ratio of 3.2x Nanjing Panda Electronics Company Limited (SHSE:600775) is a stock worth checking out, seeing as almost half of all the Communications companies in China have P/S ratios greater than 4.4x and even P/S higher than 8x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Nanjing Panda Electronics

What Does Nanjing Panda Electronics' P/S Mean For Shareholders?

Nanjing Panda Electronics hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Nanjing Panda Electronics will help you uncover what's on the horizon.How Is Nanjing Panda Electronics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Nanjing Panda Electronics' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. The last three years don't look nice either as the company has shrunk revenue by 25% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 20% during the coming year according to the one analyst following the company. That's shaping up to be materially lower than the 49% growth forecast for the broader industry.

In light of this, it's understandable that Nanjing Panda Electronics' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Nanjing Panda Electronics' P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Nanjing Panda Electronics' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Nanjing Panda Electronics (1 can't be ignored) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Panda Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600775

Nanjing Panda Electronics

Engages in the smart transportation and safe city, industrial internet and intelligent manufacturing, and green and service-oriented electronic manufacturing businesses in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives