- China

- /

- Communications

- /

- SHSE:600775

Nanjing Panda Electronics Company Limited (SHSE:600775) Looks Inexpensive After Falling 26% But Perhaps Not Attractive Enough

Nanjing Panda Electronics Company Limited (SHSE:600775) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 11% share price drop.

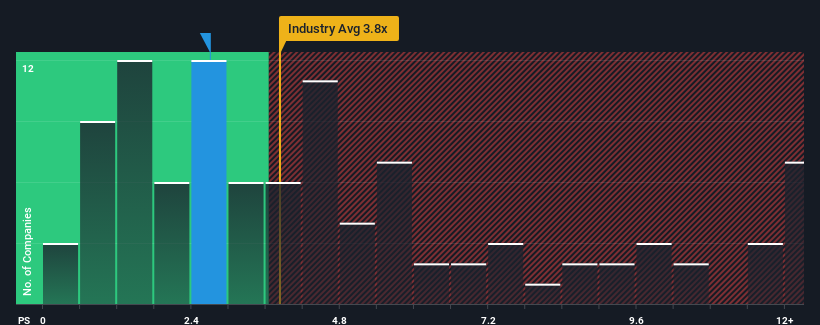

After such a large drop in price, Nanjing Panda Electronics' price-to-sales (or "P/S") ratio of 2.7x might make it look like a buy right now compared to the Communications industry in China, where around half of the companies have P/S ratios above 3.8x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Nanjing Panda Electronics

How Has Nanjing Panda Electronics Performed Recently?

Nanjing Panda Electronics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nanjing Panda Electronics.How Is Nanjing Panda Electronics' Revenue Growth Trending?

Nanjing Panda Electronics' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 26% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 34% over the next year. With the industry predicted to deliver 50% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Nanjing Panda Electronics is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The southerly movements of Nanjing Panda Electronics' shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Nanjing Panda Electronics' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 1 warning sign for Nanjing Panda Electronics that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Panda Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600775

Nanjing Panda Electronics

Engages in the smart transportation and safe city, industrial internet and intelligent manufacturing, and green and service-oriented electronic manufacturing businesses in China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives