- China

- /

- Electronic Equipment and Components

- /

- SHSE:600563

High Growth Tech And 2 Other Promising Tech Stocks

Reviewed by Simply Wall St

With global markets buoyed by the Federal Reserve's announcement of upcoming rate cuts, both the Dow Jones Industrial Average and S&P 500 Index have moved back toward record highs, with small-cap stocks outperforming their larger counterparts. Amid this optimistic economic backdrop, we explore three promising tech stocks that stand out for their potential high growth and innovation. In a market environment where broad-based gains are being observed, identifying tech stocks with strong fundamentals and innovative capabilities can be crucial for capturing future growth opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Imeik Technology DevelopmentLtd | 25.24% | 23.27% | ★★★★★★ |

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| Seojin SystemLtd | 33.61% | 52.05% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Facilities by ADF | 32.33% | 94.46% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adveritas | 50.14% | 144.21% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

Click here to see the full list of 1326 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Xiamen Faratronic (SHSE:600563)

Simply Wall St Growth Rating: ★★★★☆☆

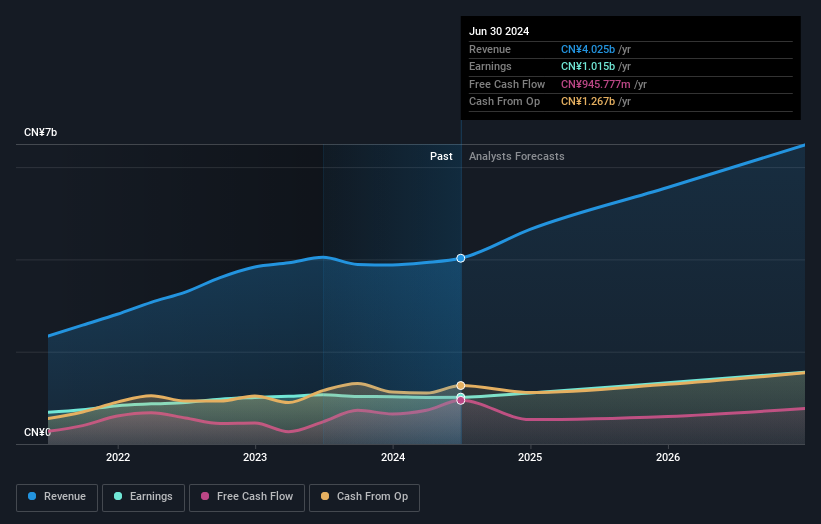

Overview: Xiamen Faratronic Co., Ltd. manufactures and sells film capacitors and metallized coating materials in China and internationally, with a market cap of CN¥17.66 billion.

Operations: The company generates significant revenue from its Electronic Primary Device Manufacturing segment, amounting to CN¥4.03 billion. The focus on film capacitors and metallized coating materials serves both domestic and international markets.

Xiamen Faratronic reported half-year sales of ¥2.07 billion, up from ¥1.93 billion the previous year, reflecting an 18.7% annual revenue growth forecast, outpacing the CN market's 10.4%. Despite a slight dip in net income to ¥481.94 million from ¥491.08 million, earnings are expected to grow at 17.3% per year, suggesting robust future prospects in the electronic components sector where they operate extensively with high-profile clients like TSMC and Apple. With R&D expenses critical for innovation in tech sectors, Xiamen Faratronic's commitment is evident as it consistently allocates substantial resources towards research and development initiatives to stay competitive and drive future growth. Their projected return on equity of 22.4% within three years underscores their strategic focus on enhancing shareholder value through sustained innovation and market expansion efforts.

- Click to explore a detailed breakdown of our findings in Xiamen Faratronic's health report.

Assess Xiamen Faratronic's past performance with our detailed historical performance reports.

Anker Innovations (SZSE:300866)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Anker Innovations Limited specializes in developing and selling mobile charging products, with a market cap of CN¥30.78 billion.

Operations: Anker Innovations Limited focuses on developing and selling mobile charging products. The company operates with a market cap of CN¥30.78 billion.

Anker Innovations, recognized for its consumer electronics and smart home devices, has shown impressive growth with earnings surging by 29.5% over the past year. Their R&D expenses are a key driver of innovation, with significant allocations ensuring they stay ahead in the competitive tech landscape. Revenue is projected to grow at 16.1% annually, outpacing the CN market's 10.4%, while earnings are forecasted to rise by 17.2% per year, reflecting robust future prospects in their industry segments.

- Take a closer look at Anker Innovations' potential here in our health report.

Gain insights into Anker Innovations' past trends and performance with our Past report.

Micro-Star International (TWSE:2377)

Simply Wall St Growth Rating: ★★★★☆☆

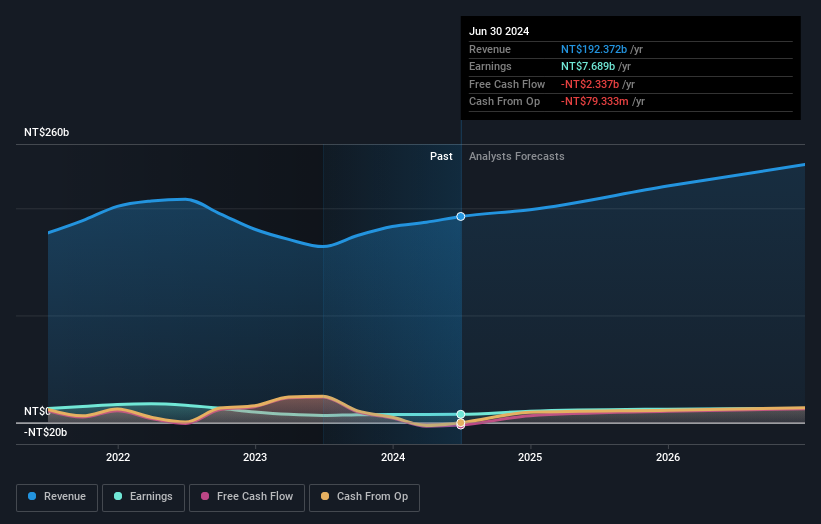

Overview: Micro-Star International Co., Ltd. manufactures and sells motherboards, interface cards, notebook computers, and other electronic products globally, with a market cap of NT$155.03 billion.

Operations: Micro-Star International Co., Ltd. generates revenue primarily from its computer information business, which accounts for NT$192.33 billion. The company operates in Asia, Europe, the United States, and other international markets.

Micro-Star International (MSI) has demonstrated robust performance with a 9.2% revenue growth forecast per year, although this trails the broader TW market's 11.9%. Their earnings are expected to rise by an impressive 21.6% annually, outpacing the tech industry's average of 12.7%. Notably, MSI's R&D expenses have been pivotal in driving innovation; they invested TWD 4.56 billion recently to enhance their competitive edge in high-performance computing and AI applications through advancements like CXL memory expansion servers powered by AMD EPYC processors.

Taking Advantage

- Reveal the 1326 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600563

Xiamen Faratronic

Manufactures and sells film capacitors and metallized coating materials in China and internationally.

Excellent balance sheet established dividend payer.