- China

- /

- Electronic Equipment and Components

- /

- SHSE:600366

Ningbo Yunsheng Co., Ltd.'s (SHSE:600366) Subdued P/S Might Signal An Opportunity

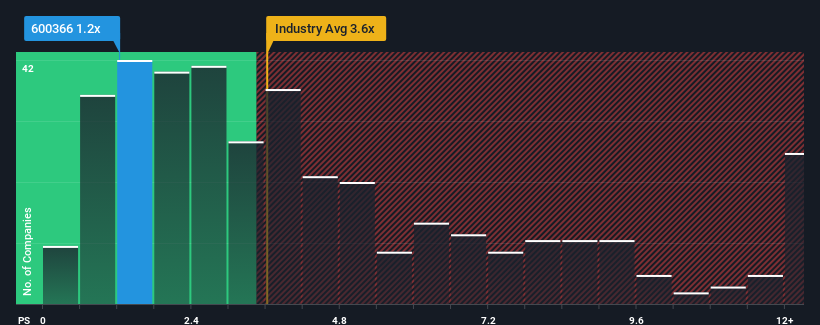

Ningbo Yunsheng Co., Ltd.'s (SHSE:600366) price-to-sales (or "P/S") ratio of 1.2x might make it look like a strong buy right now compared to the Electronic industry in China, where around half of the companies have P/S ratios above 3.6x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Ningbo Yunsheng

How Has Ningbo Yunsheng Performed Recently?

While the industry has experienced revenue growth lately, Ningbo Yunsheng's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Ningbo Yunsheng's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Ningbo Yunsheng's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 25%. Still, the latest three year period has seen an excellent 85% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 75% as estimated by the two analysts watching the company. With the industry only predicted to deliver 26%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Ningbo Yunsheng's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Ningbo Yunsheng's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Ningbo Yunsheng's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Ningbo Yunsheng you should know about.

If these risks are making you reconsider your opinion on Ningbo Yunsheng, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Yunsheng might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600366

Ningbo Yunsheng

Engages in the research and development, manufacture, and sale of rare earth permanent magnet materials in China.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives