- China

- /

- Electronic Equipment and Components

- /

- SHSE:600366

Ningbo Yunsheng Co., Ltd.'s (SHSE:600366) Revenues Are Not Doing Enough For Some Investors

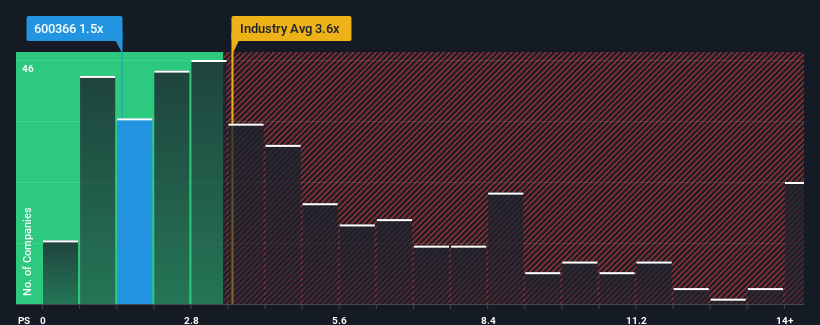

Ningbo Yunsheng Co., Ltd.'s (SHSE:600366) price-to-sales (or "P/S") ratio of 1.5x might make it look like a strong buy right now compared to the Electronic industry in China, where around half of the companies have P/S ratios above 3.6x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Ningbo Yunsheng

What Does Ningbo Yunsheng's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Ningbo Yunsheng's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Ningbo Yunsheng's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Ningbo Yunsheng would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. Still, the latest three year period has seen an excellent 66% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 15% as estimated by the sole analyst watching the company. With the industry predicted to deliver 26% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Ningbo Yunsheng's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Ningbo Yunsheng's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Ningbo Yunsheng's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Ningbo Yunsheng, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Yunsheng might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600366

Ningbo Yunsheng

Engages in the research and development, manufacture, and sale of rare earth permanent magnet materials in China.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives