As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical tensions, small-cap stocks face unique challenges and opportunities. The S&P 600, representing smaller companies, has been influenced by broader market sentiment and economic indicators such as consumer spending and inflation rates. In this context, identifying promising stocks involves looking for companies with strong fundamentals that can withstand volatility while capitalizing on niche market opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| Co-Tech Development | 26.81% | 3.29% | 6.53% | ★★★★★☆ |

| Feedback Technology | 23.09% | 11.19% | 19.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Anhui Tongfeng Electronics (SHSE:600237)

Simply Wall St Value Rating: ★★★★★★

Overview: Anhui Tongfeng Electronics Company Limited focuses on the R&D, production, and sales of thin films, film capacitors, and related electronic components in China with a market cap of CN¥4.29 billion.

Operations: The company generates revenue primarily from the sale of thin films, film capacitors, and electronic components within China. It has a market capitalization of CN¥4.29 billion.

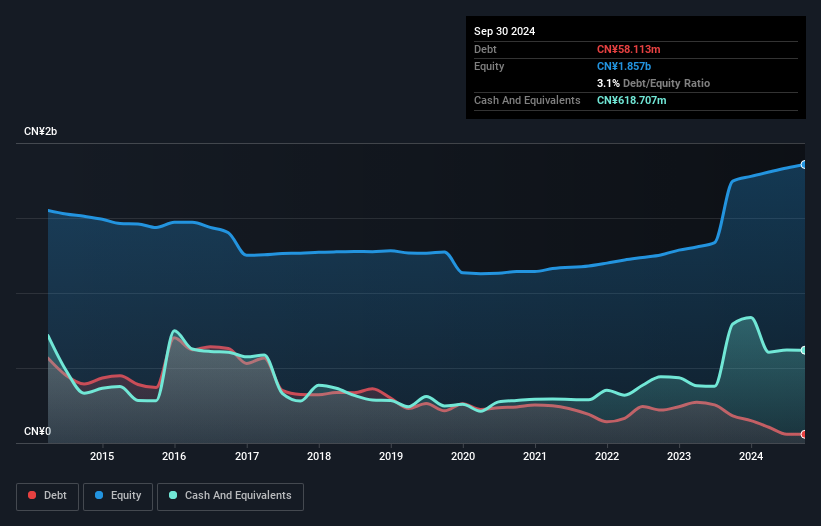

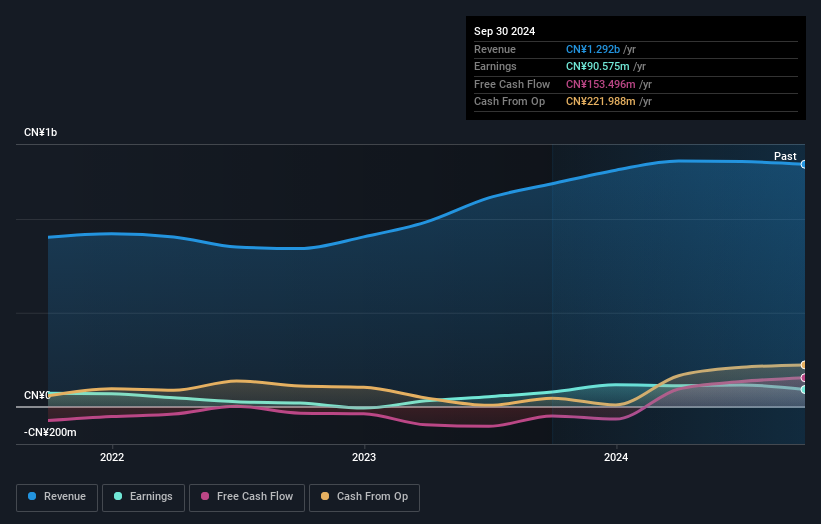

Anhui Tongfeng Electronics, a small player in the electronics sector, showcases a price-to-earnings ratio of 48.5x, slightly under the industry average of 49.9x, suggesting relative value. The company's earnings growth over the past year hit 18.1%, surpassing the industry's modest 3% rise, indicating robust performance. Additionally, its debt-to-equity ratio has impressively decreased from 16.9% to just 3.1% over five years, reflecting improved financial health and reduced leverage concerns. While not currently free cash flow positive, its profitability ensures that cash runway isn't an immediate issue for this promising contender in the market landscape.

Shanghai Sinotec (SHSE:603121)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Sinotec Co., Ltd. is engaged in the development, production, and sale of auto parts in China, with a market capitalization of CN¥4.56 billion.

Operations: Shanghai Sinotec generates revenue primarily from the sale of auto parts in China. The company's cost structure is influenced by production expenses, which impact its profitability. Notably, its net profit margin has shown variability over recent periods.

Sinotec, a smaller player in the auto components sector, has shown impressive earnings growth of 17.4% over the last year, outpacing the industry average of 10.5%. Despite its highly volatile share price recently, it trades at 6.3% below its estimated fair value, suggesting potential undervaluation. The company's debt to equity ratio has risen from 11.4% to 38.5% over five years; however, with a net debt to equity ratio of 11.5%, it's considered satisfactory by industry standards and benefits from high-quality past earnings and positive free cash flow outlooks for future operations.

Boai NKY Medical Holdings (SZSE:300109)

Simply Wall St Value Rating: ★★★★★★

Overview: Boai NKY Medical Holdings Ltd. operates in the fine chemical and medical care sectors both within China and globally, with a market capitalization of CN¥6.99 billion.

Operations: Boai NKY Medical Holdings generates revenue from its fine chemical and medical care businesses. The company's financial performance includes a notable net profit margin trend, which requires further analysis for comprehensive insights.

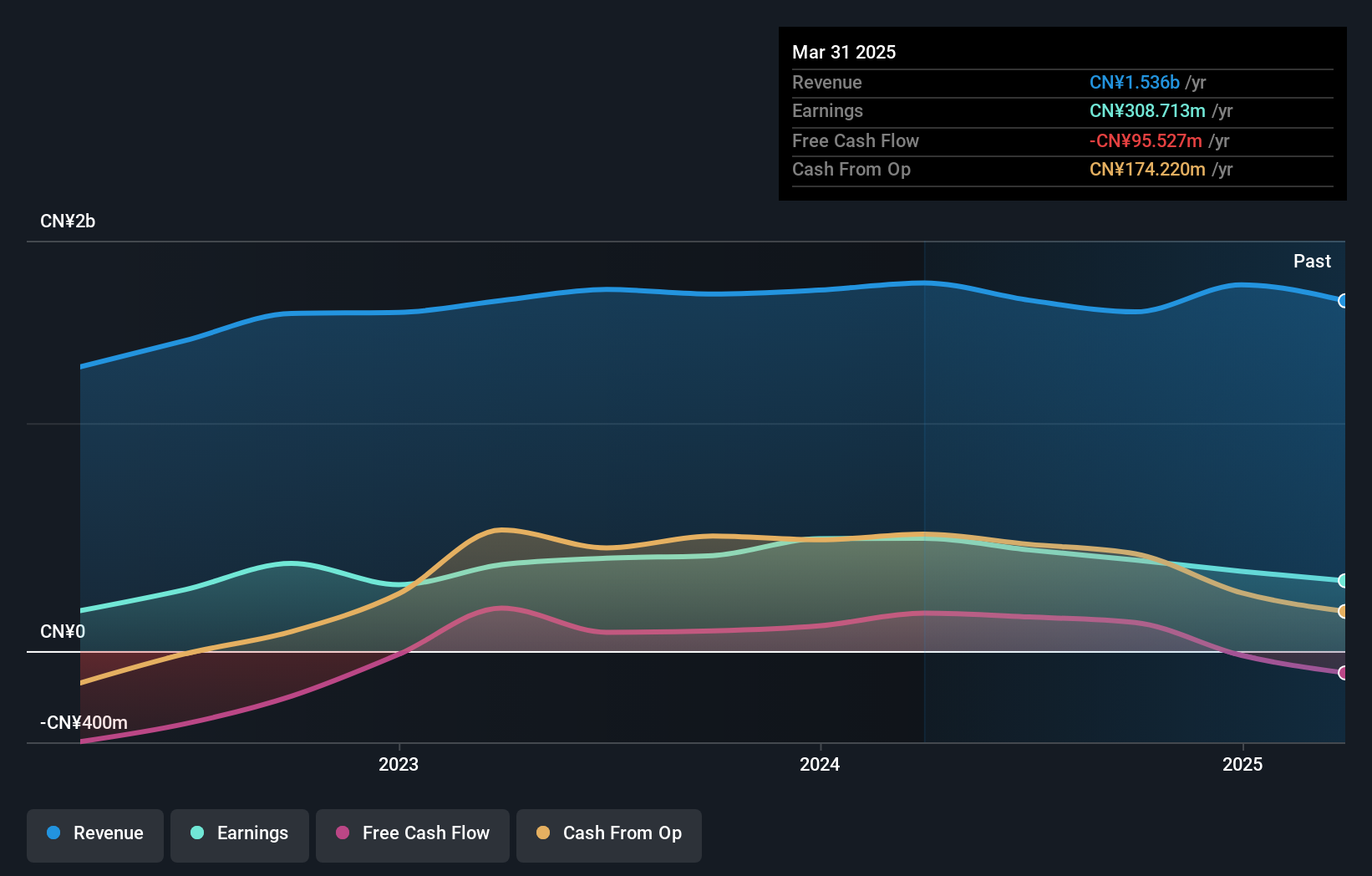

Boai NKY Medical Holdings, a promising player in the medical sector, boasts high-quality earnings and a satisfactory net debt to equity ratio of 2.4%, reflecting financial prudence. The company's price-to-earnings ratio stands at 18x, offering better value compared to the broader CN market's average of 35.8x. Despite facing negative earnings growth of -4.7% over the past year, which is slightly better than the chemicals industry's -5.4%, Boai NKY remains profitable with positive free cash flow and has successfully reduced its debt to equity from 27.4% to 11.6% over five years, indicating strong fiscal management amidst volatility in share price recently observed.

- Take a closer look at Boai NKY Medical Holdings' potential here in our health report.

Assess Boai NKY Medical Holdings' past performance with our detailed historical performance reports.

Next Steps

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4721 more companies for you to explore.Click here to unveil our expertly curated list of 4724 Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boai NKY Medical Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300109

Boai NKY Medical Holdings

Engages in the fine chemical and medical care businesses in China and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives