As global markets experience varied performances, with the U.S. indices reaching record highs and mixed signals from European and Asian economies, the spotlight turns to Asia's tech sector, which continues to intrigue investors with its potential for high growth. In such a dynamic environment, identifying promising stocks often involves looking at companies that are well-positioned to capitalize on technological advancements and market demands while navigating economic uncertainties effectively.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Fositek | 28.74% | 35.42% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 25.04% | 26.89% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.05% | 87.21% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Dmall (SEHK:2586)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dmall Inc. is an investment holding company offering retail digitalization solutions to retailers across China, Hong Kong, Macau, the Philippines, Malaysia, Singapore, Poland, and other international markets with a market cap of HK$9.98 billion.

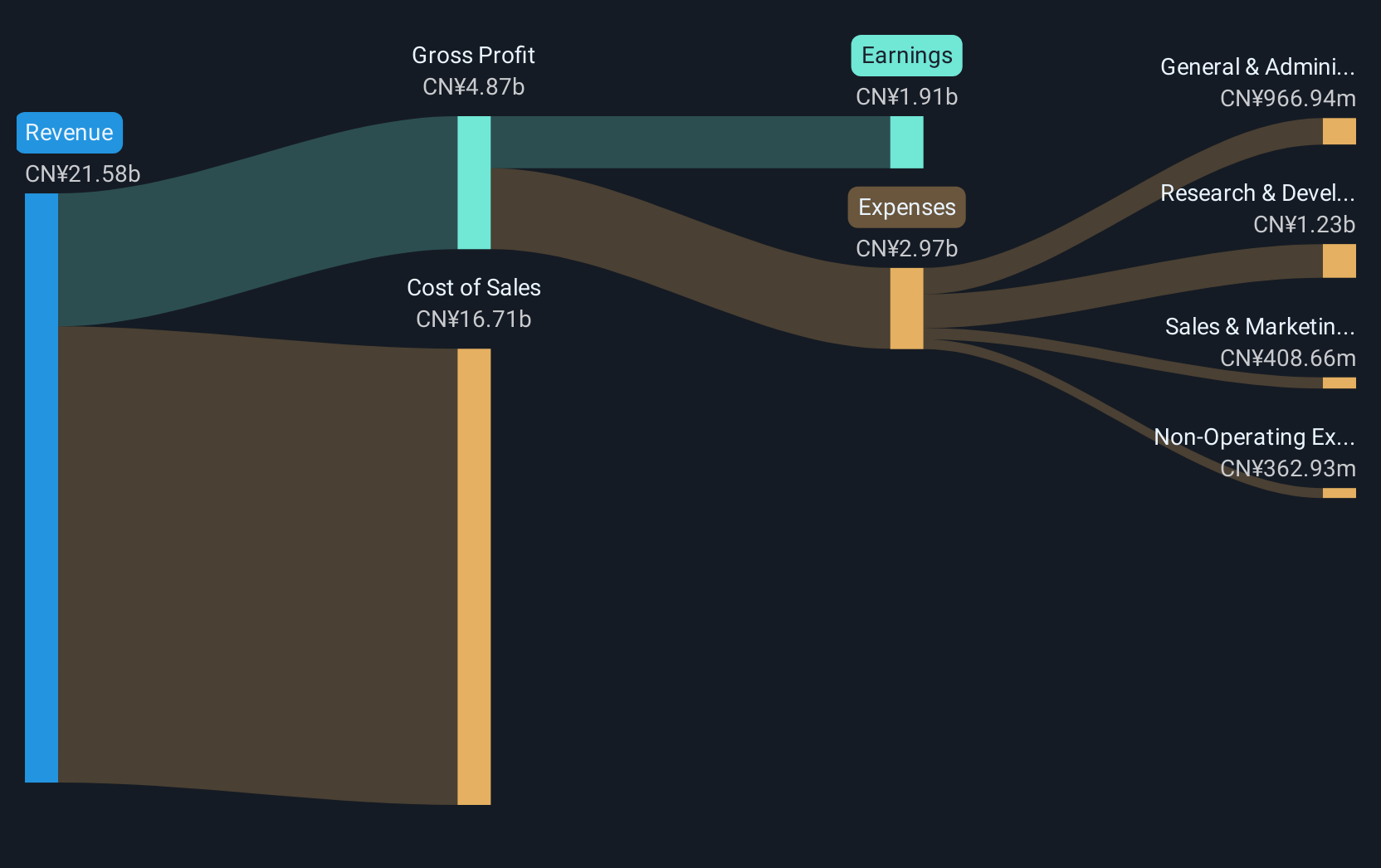

Operations: The company generates revenue primarily through its Retail Core Service Cloud, which accounts for CN¥1.81 billion, and the E-Commerce Service Cloud, contributing CN¥4.28 million.

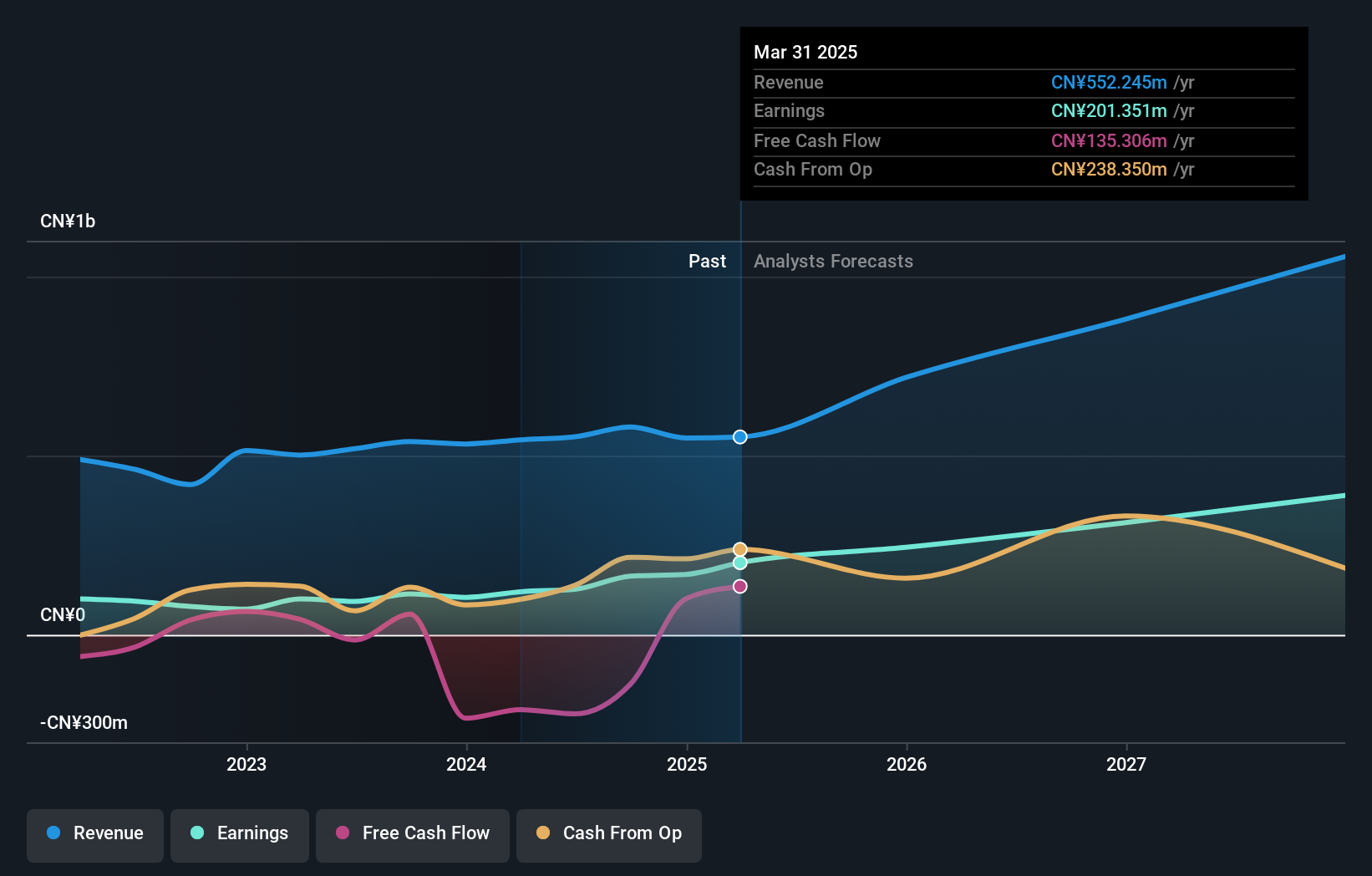

Recently added to the S&P Global BMI Index, Dmall stands out in Asia's high-growth tech landscape, particularly for its robust revenue acceleration and promising profitability horizon. With an annualized revenue growth of 15.5%, it surpasses Hong Kong's market average of 8.1%. The company is also on a trajectory to shift from its current unprofitable status to a projected profit growth rate of 108.6% per year within three years, signaling strong future potential. Despite lacking free cash flow and experiencing share price volatility, Dmall's aggressive R&D investments are set to enhance its competitive edge in the tech sector, fostering innovation that could lead to substantial market share gains and solidify its position in high-growth segments.

- Dive into the specifics of Dmall here with our thorough health report.

Review our historical performance report to gain insights into Dmall's's past performance.

Shengyi TechnologyLtd (SHSE:600183)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shengyi Technology Co., Ltd. is engaged in the development, manufacturing, and sale of laminates in China, with a market capitalization of CN¥72.56 billion.

Operations: Shengyi Technology focuses on the production and distribution of laminates within China. The company's revenue model is primarily driven by its laminate sales, contributing significantly to its financial performance.

Shengyi Technology Co., Ltd., recently included in the SSE 180 Index, is marking its presence in Asia's tech sector with notable growth metrics. Its revenue has increased to CNY 5.61 billion, up from CNY 4.42 billion last year, reflecting a robust annual growth rate of 13.5%. This performance surpasses the Chinese market average growth of 12.4%. Furthermore, earnings have surged by an impressive 46% over the past year, significantly outpacing the electronic industry's average of 2.9%. The firm's commitment to innovation is evident from its R&D investments which are fostering advancements and potentially increasing market share in competitive tech segments. With earnings expected to grow by approximately 24% annually, Shengyi stands out for its potential within high-growth sectors despite a challenging economic backdrop.

- Click here to discover the nuances of Shengyi TechnologyLtd with our detailed analytical health report.

Gain insights into Shengyi TechnologyLtd's past trends and performance with our Past report.

Guomai Technologies (SZSE:002093)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guomai Technologies, Inc. operates in China offering internet of things technology services, consulting and design services, science park operation and development services, as well as education services with a market cap of CN¥12.91 billion.

Operations: Guomai Technologies generates revenue through its diverse offerings in internet of things technology services, consulting and design, science park operations and development, and education services within China.

Guomai Technologies has demonstrated a remarkable financial trajectory, with its latest quarterly reports showing a revenue jump to CNY 117.88 million from CNY 115.06 million year-over-year and a significant increase in net income from CNY 58.65 million to CNY 91.38 million. This growth is underpinned by strategic amendments to its corporate governance structures, enhancing operational efficiencies and shareholder value as evidenced in recent AGM decisions. The company's robust annual earnings growth forecast of 23.9% positions it well within Asia's competitive tech landscape, especially considering the broader market's growth rate of just over 23%. These figures reflect Guomai’s strong potential in sustaining high performance and adapting innovatively in the fast-evolving tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Guomai Technologies.

Examine Guomai Technologies' past performance report to understand how it has performed in the past.

Taking Advantage

- Get an in-depth perspective on all 489 Asian High Growth Tech and AI Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2586

Dmall

An investment holding company, provides retail digitalization solutions to retailers in China, Hong Kong, Macau, the Philippines, Malaysia, Singapore, Poland, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives