What You Can Learn From Wuhan Kotei Informatics Co.,Ltd.'s (SZSE:301221) P/SAfter Its 25% Share Price Crash

Wuhan Kotei Informatics Co.,Ltd. (SZSE:301221) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 28% share price drop.

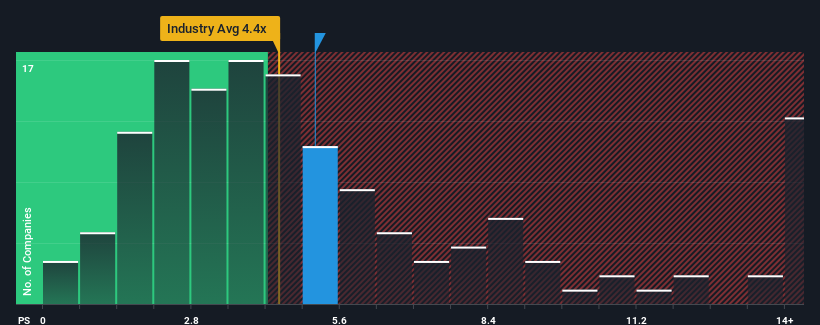

Although its price has dipped substantially, there still wouldn't be many who think Wuhan Kotei InformaticsLtd's price-to-sales (or "P/S") ratio of 5.1x is worth a mention when the median P/S in China's Software industry is similar at about 4.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Wuhan Kotei InformaticsLtd

How Has Wuhan Kotei InformaticsLtd Performed Recently?

Wuhan Kotei InformaticsLtd certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Wuhan Kotei InformaticsLtd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Wuhan Kotei InformaticsLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. The latest three year period has also seen an excellent 91% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 23% each year as estimated by the only analyst watching the company. That's shaping up to be similar to the 24% each year growth forecast for the broader industry.

With this information, we can see why Wuhan Kotei InformaticsLtd is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Following Wuhan Kotei InformaticsLtd's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Wuhan Kotei InformaticsLtd's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Before you settle on your opinion, we've discovered 1 warning sign for Wuhan Kotei InformaticsLtd that you should be aware of.

If you're unsure about the strength of Wuhan Kotei InformaticsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Kotei InformaticsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301221

Wuhan Kotei InformaticsLtd

Provides integrated software solutions for intelligent networked vehicles in China.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives