As China's market shows signs of resilience despite weaker-than-expected economic activity, the Shanghai Composite Index and CSI 300 have posted modest gains, reflecting cautious optimism among investors. In this landscape, identifying promising small-cap stocks becomes crucial for those looking to capitalize on emerging opportunities. Finding a good stock often involves looking for companies with strong fundamentals and growth potential that can thrive even in uncertain economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Jinghua Pharmaceutical Group | 0.72% | 5.23% | 39.01% | ★★★★★★ |

| Shandong Link Science and TechnologyLtd | 1.36% | 17.98% | 7.40% | ★★★★★★ |

| Changzhou Zhongying Science & Technology | NA | 11.49% | 22.06% | ★★★★★★ |

| Xuchang Yuandong Drive ShaftLtd | NA | -10.22% | -26.80% | ★★★★★★ |

| Wuxi Taclink Optoelectronics Technology | 1.29% | 24.61% | -1.11% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | NA | -4.19% | 10.47% | ★★★★★★ |

| Hydsoft TechnologyLtd | 9.94% | 18.09% | 11.48% | ★★★★★★ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 1.50% | 22.33% | -6.24% | ★★★★★☆ |

| Guangzhou LBP Medicine Science & Technology | 0.10% | 5.06% | -21.47% | ★★★★★☆ |

| Hubei Sanxia New Building Materials | 29.62% | -17.72% | 10.78% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Changshu Tongrun Auto Accessory (SHSE:603201)

Simply Wall St Value Rating: ★★★★★★

Overview: Changshu Tongrun Auto Accessory Co., Ltd. specializes in the production and sale of automotive accessories, with a market cap of CN¥2.29 billion.

Operations: The company generates revenue primarily from the production and sale of automotive accessories. It has a market cap of CN¥2.29 billion, with significant portions of its revenue derived from these core activities.

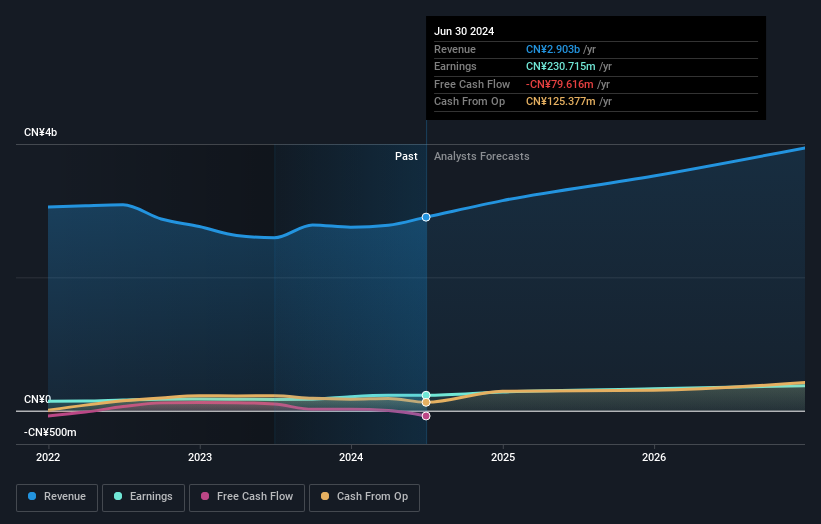

Changshu Tongrun Auto Accessory has shown impressive financial health, with its debt to equity ratio dropping from 177.5% to 29.4% over the past five years and earnings growth of 34.2% last year, outpacing the industry average of 3.5%. The company repurchased shares in 2024, signaling confidence in its value proposition. Trading at a price-to-earnings ratio of just 9.9x compared to the CN market's 27.3x, it seems undervalued with strong future earnings forecasted at an annual growth rate of 18.2%.

Sichuan Joyou Digital TechnologiesLtd (SZSE:301172)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Joyou Digital Technologies Ltd (ticker: SZSE:301172) operates in the digital technology sector with a market capitalization of CN¥3.14 billion.

Operations: Joyou Digital Technologies generates revenue primarily through its digital technology products and services. The company has a market capitalization of CN¥3.14 billion.

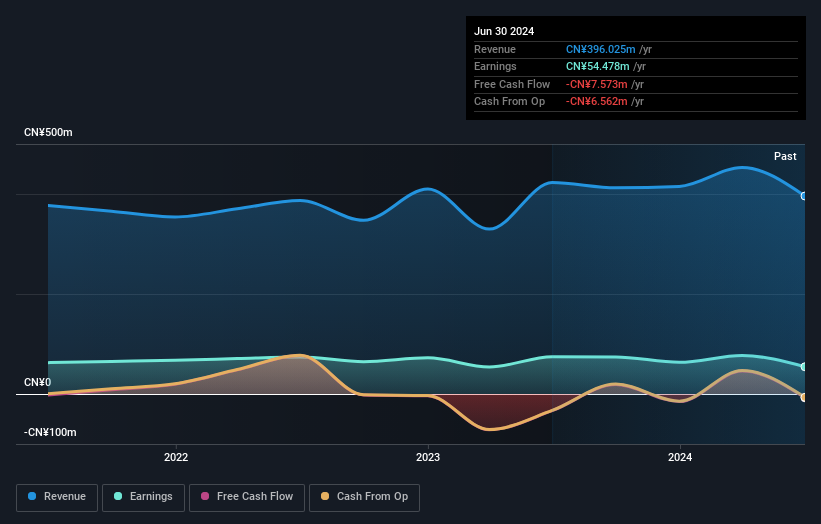

Sichuan Joyou Digital Technologies has shown impressive growth, with earnings increasing by 42.5% over the past year, far outpacing the IT industry's -7.5%. The company is debt-free and enjoys high-quality earnings, highlighting its robust financial health. Recently, shareholders approved various governance changes and a remuneration plan at an extraordinary meeting on August 16, 2024. Additionally, a final cash dividend of CNY 2 per 10 A shares was affirmed for 2023, reflecting strong shareholder returns.

Sublime China Information (SZSE:301299)

Simply Wall St Value Rating: ★★★★★★

Overview: Sublime China Information Co., Ltd. offers information and consulting services in China and has a market cap of CN¥2.37 billion.

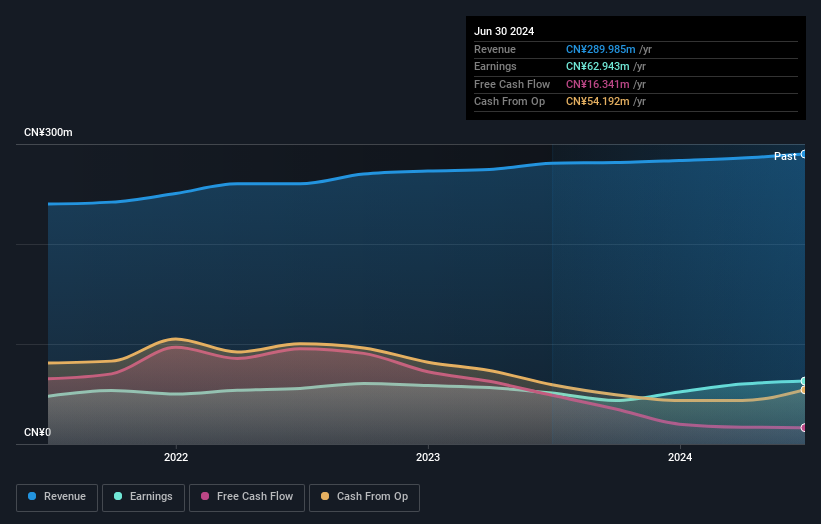

Operations: The company generates revenue primarily from online financial information providers, amounting to CN¥289.97 million.

Sublime China Information has shown strong financial health, with earnings growing by 23.6% over the past year, outpacing the industry’s 1.6%. The company is debt-free and boasts high-quality earnings. Recent events include a dividend increase of CNY 4.50 per 10 shares, payable on August 20, 2024. Levered free cash flow stood at US$16.34M as of June 30, showing consistent positive cash flow over recent years despite fluctuations in capital expenditure and net working capital changes.

Where To Now?

- Click through to start exploring the rest of the 1007 Chinese Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301172

Sichuan Joyou Digital TechnologiesLtd

Sichuan Joyou Digital Technologies Co.,Ltd.

Flawless balance sheet with solid track record.