- China

- /

- Communications

- /

- SZSE:300308

Undervalued Chinese Stocks Including Jiangsu Sinopep-Allsino Biopharmaceutical And 2 Others For Potential Investment

Reviewed by Simply Wall St

Despite recent economic challenges, Chinese equities have shown resilience, with indices like the Shanghai Composite and CSI 300 posting gains. This environment may present opportunities for discerning investors to identify undervalued stocks poised for potential growth. In this article, we will explore three such stocks, including Jiangsu Sinopep-Allsino Biopharmaceutical, that could be attractive given the current market dynamics and economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥167.20 | CN¥325.87 | 48.7% |

| Proya CosmeticsLtd (SHSE:603605) | CN¥86.24 | CN¥163.45 | 47.2% |

| Beijing ConST Instruments Technology (SZSE:300445) | CN¥14.92 | CN¥29.64 | 49.7% |

| Beijing SDL TechnologyLtd (SZSE:002658) | CN¥5.38 | CN¥10.32 | 47.9% |

| Jiangsu Hualan New Pharmaceutical MaterialLtd (SZSE:301093) | CN¥19.02 | CN¥37.34 | 49.1% |

| Songcheng Performance DevelopmentLtd (SZSE:300144) | CN¥7.91 | CN¥15.53 | 49.1% |

| Yunnan Botanee Bio-Technology GroupLTD (SZSE:300957) | CN¥44.36 | CN¥84.85 | 47.7% |

| NBTM New Materials Group (SHSE:600114) | CN¥14.33 | CN¥27.40 | 47.7% |

| Hiconics Eco-energy Technology (SZSE:300048) | CN¥4.58 | CN¥8.67 | 47.2% |

| Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥11.41 | CN¥21.79 | 47.6% |

We'll examine a selection from our screener results.

Jiangsu Sinopep-Allsino Biopharmaceutical (SHSE:688076)

Overview: Jiangsu Sinopep-Allsino Biopharmaceutical Co., Ltd. is a biomedical company involved in the R&D, production, sale, and technical service of peptides and small molecule drugs in China, with a market cap of CN¥13.69 billion.

Operations: Revenue Segments (in millions of CN¥): The company's revenue from Medicine Manufacturing is CN¥1.18 billion.

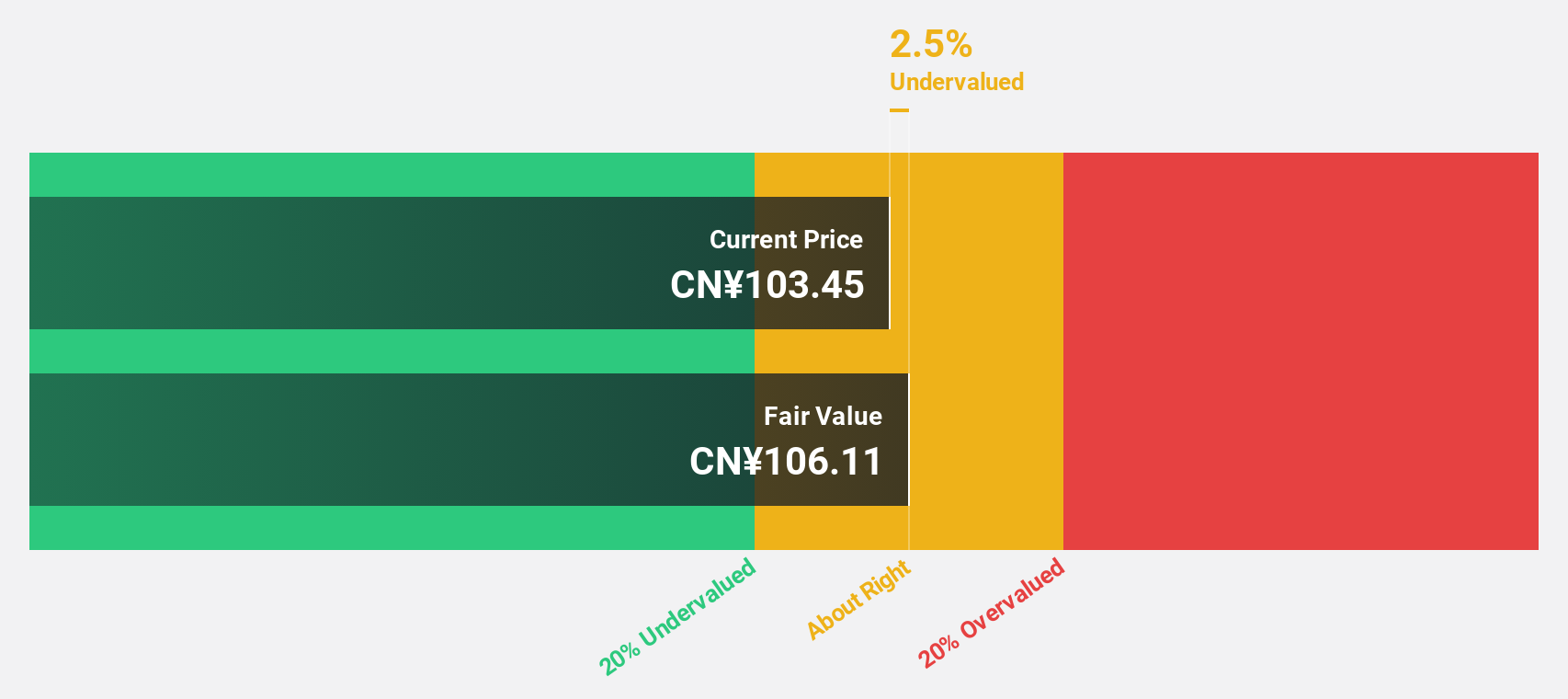

Estimated Discount To Fair Value: 40.5%

Jiangsu Sinopep-Allsino Biopharmaceutical, trading at CN¥62.73, is significantly undervalued compared to its estimated fair value of CN¥105.4. Despite recent shareholder dilution and high share price volatility, the company's earnings grew by 55.4% last year and are forecast to grow 36.4% annually over the next three years, outpacing the Chinese market's average growth rates in both revenue and earnings. The company also boasts a high level of non-cash earnings but has a relatively low forecasted return on equity of 17.1%.

- Our expertly prepared growth report on Jiangsu Sinopep-Allsino Biopharmaceutical implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Jiangsu Sinopep-Allsino Biopharmaceutical stock in this financial health report.

Zhongji Innolight (SZSE:300308)

Overview: Zhongji Innolight Co., Ltd. researches, develops, produces, and sells optical communication transceiver modules and optical devices in China, with a market cap of CN¥131.73 billion.

Operations: The company's revenue segments include optical communication transceiver modules and optical devices, generating CN¥1.38 billion and CN¥0.62 billion respectively.

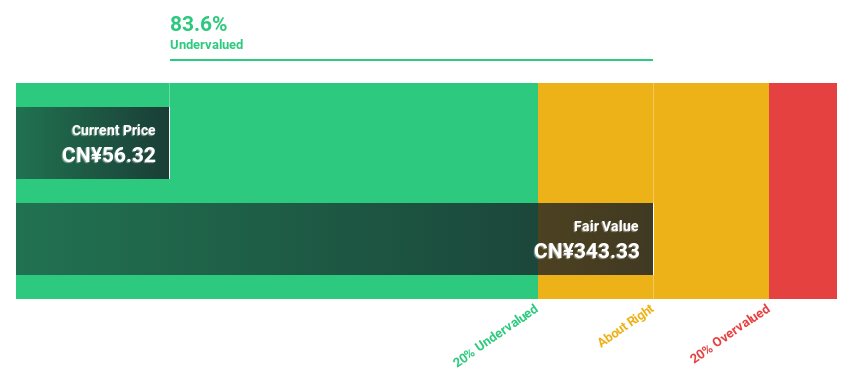

Estimated Discount To Fair Value: 39.5%

Zhongji Innolight, trading at CN¥119.96, is significantly undervalued with an estimated fair value of CN¥198.19. The company’s earnings grew by 133.4% last year and are forecast to grow 32.6% annually, outpacing the Chinese market's average growth rates in both revenue and earnings. Despite its high share price volatility, Zhongji Innolight offers strong cash flow potential with a recent dividend increase of CNY 4.50 per 10 shares approved for distribution in June 2024.

- Our earnings growth report unveils the potential for significant increases in Zhongji Innolight's future results.

- Click here to discover the nuances of Zhongji Innolight with our detailed financial health report.

Wuxi Best Precision Machinery (SZSE:300580)

Overview: Wuxi Best Precision Machinery Co., Ltd. engages in the research, development, production, and sale of precision parts, intelligent equipment, and tooling products in China and internationally with a market cap of CN¥7.34 billion.

Operations: The company's revenue segments include precision parts, intelligent equipment, and tooling products in China and internationally.

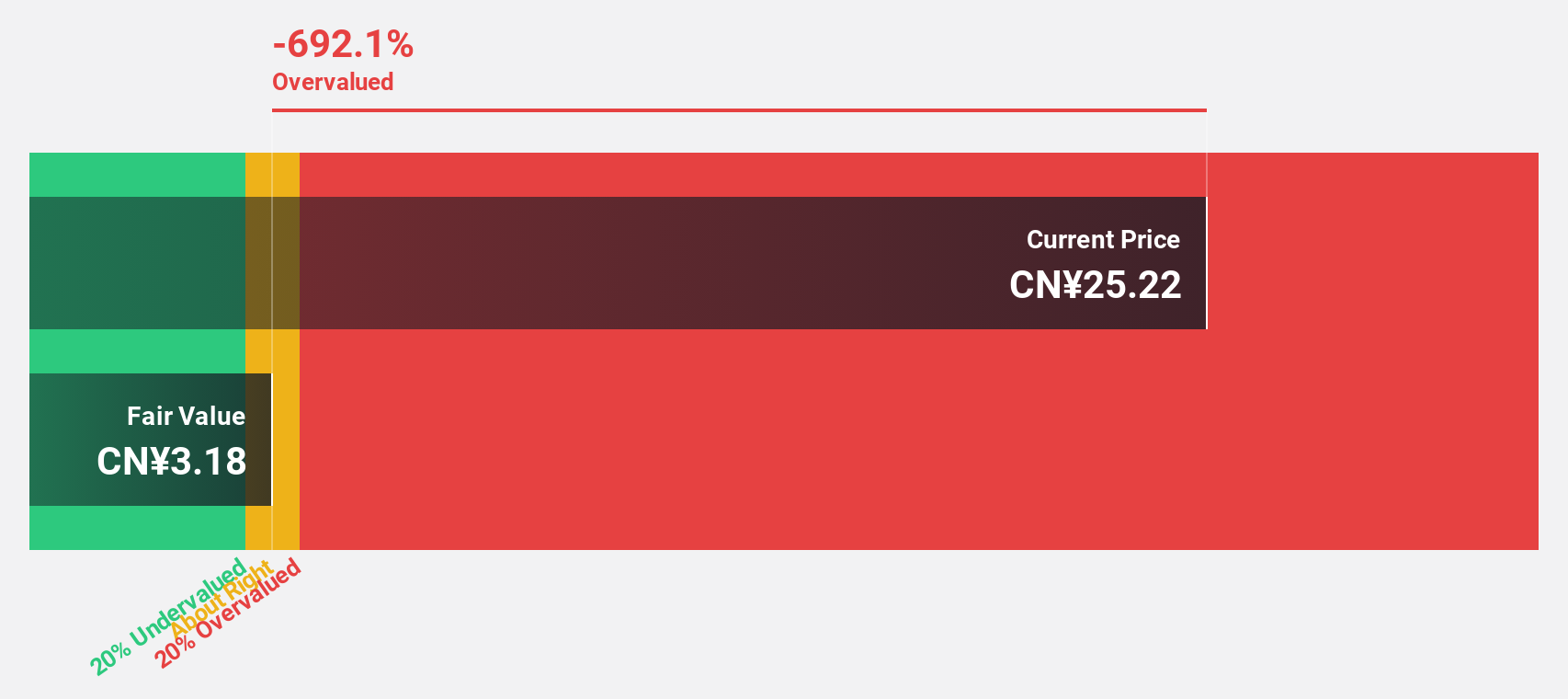

Estimated Discount To Fair Value: 31.2%

Wuxi Best Precision Machinery, trading at CN¥14.71, is undervalued by over 30% with an estimated fair value of CN¥21.38. Earnings are forecast to grow significantly at 26.04% annually, outpacing the Chinese market's average growth rate of 21.9%. Despite a highly volatile share price and an unstable dividend track record, the company's revenue is expected to grow faster than the market at 22% per year. Recent earnings showed improved sales and net income compared to last year.

- Insights from our recent growth report point to a promising forecast for Wuxi Best Precision Machinery's business outlook.

- Navigate through the intricacies of Wuxi Best Precision Machinery with our comprehensive financial health report here.

Summing It All Up

- Unlock our comprehensive list of 104 Undervalued Chinese Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhongji Innolight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300308

Zhongji Innolight

Researches, develops, produces, and sells optical communication transceiver modules and optical devices in China.

Exceptional growth potential with flawless balance sheet.