- China

- /

- Electronic Equipment and Components

- /

- SZSE:300115

High Growth Tech Stocks In Asia Featuring Three Prominent Picks

Reviewed by Simply Wall St

In recent weeks, the Asian markets have been navigating a complex landscape marked by geopolitical tensions and trade negotiations, with China's stock indices reflecting deflationary pressures despite some positive developments in U.S.-China trade talks. Amidst this backdrop, high-growth tech stocks in Asia continue to capture investor interest as they are often characterized by innovative potential and resilience, making them attractive options during periods of economic uncertainty.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.78% | 30.32% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 24.65% | 26.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| RemeGen | 24.58% | 65.24% | ★★★★★★ |

| JNTC | 54.24% | 87.93% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Olympic Circuit Technology (SHSE:603920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Olympic Circuit Technology Co., Ltd specializes in the manufacturing and sale of rigid printed circuit boards (PCBs) with a market capitalization of approximately CN¥19.21 billion.

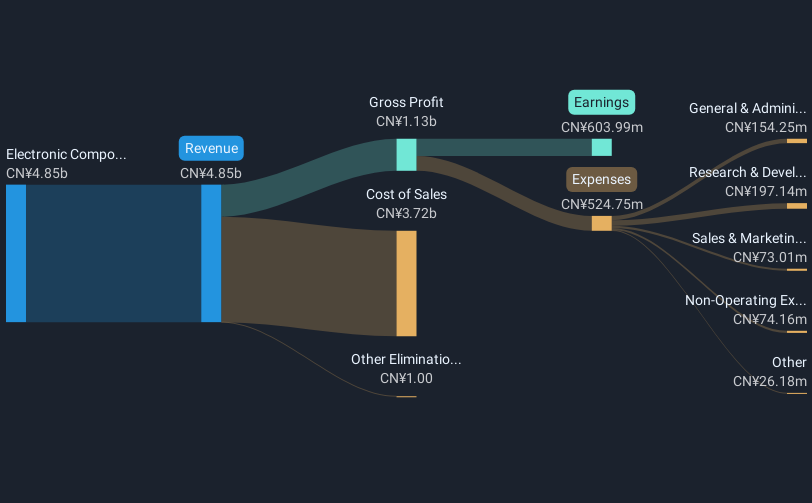

Operations: The company focuses on the production and distribution of rigid printed circuit boards, generating revenue primarily from electronic components and parts, amounting to CN¥5.15 billion.

Olympic Circuit Technology, a standout in the Asian tech scene, has demonstrated robust financial performance with a notable 41% earnings growth over the past year, surpassing its industry's average of 2.8%. With revenue projected to expand at an annual rate of 21.6%, the company is well-positioned above the CN market forecast of 12.4%. Recent strategic moves include a dividend increase to CNY 0.60 per share and consistent shareholder engagement through recent meetings and earnings calls, signaling strong governance and investor relations. This trajectory is supported by significant investment in R&D, ensuring sustained innovation and competitive edge in rapidly evolving tech landscapes.

- Navigate through the intricacies of Olympic Circuit Technology with our comprehensive health report here.

Understand Olympic Circuit Technology's track record by examining our Past report.

Shenzhen Everwin Precision Technology (SZSE:300115)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Everwin Precision Technology Co., Ltd. operates in the precision technology sector with a market cap of CN¥28.78 billion.

Operations: The company generates revenue primarily from precision technology products. It has a market cap of CN¥28.78 billion, reflecting its significant presence in the sector.

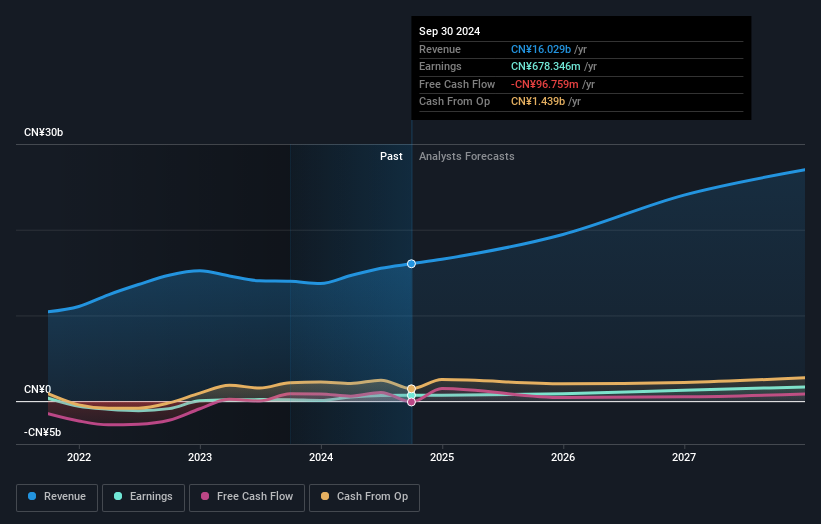

Shenzhen Everwin Precision Technology has shown a robust growth trajectory, with earnings expanding by 27.4% annually and revenue growth surpassing the market at 14.5% per year. This performance is complemented by a significant R&D commitment, accounting for a substantial portion of revenue, ensuring continuous innovation in its tech offerings. Recent strategic dividends and positive earnings calls reflect strong governance and investor confidence. With these factors combined, Everwin stands out in the competitive tech landscape of Asia, poised for future advancements.

Beijing CTJ Information Technology (SZSE:301153)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing CTJ Information Technology Co., Ltd. operates in the software and information technology service industry with a market capitalization of CN¥8.93 billion.

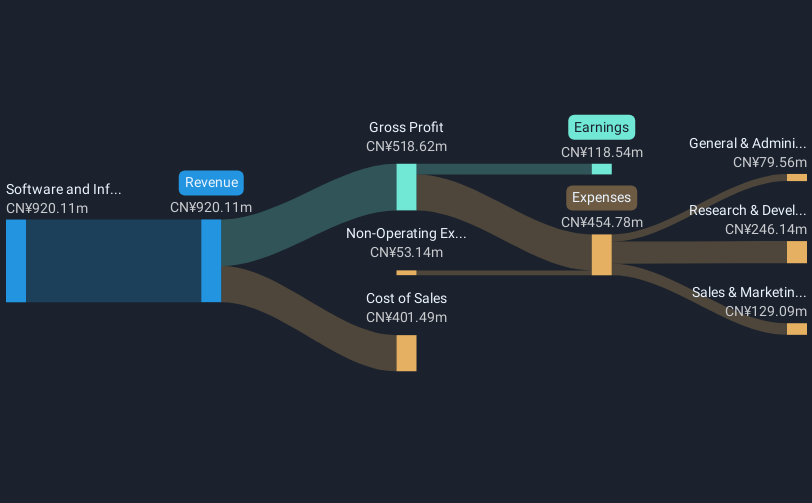

Operations: The company focuses on the software and information technology service sector, generating revenue of approximately CN¥779.86 million from this segment.

Beijing CTJ Information Technology has demonstrated notable growth dynamics, with an annual revenue increase of 25.4% and earnings surging by 45.5%. This performance is underpinned by a robust commitment to R&D, which not only fuels innovation but also aligns with the evolving demands of the tech industry in Asia. Recent corporate actions, including amendments to company bylaws and a proactive approach to shareholder engagement, suggest strategic agility amidst regulatory and market changes. Despite recent fluctuations in net income and dividends as reported in Q1 2025 results, CTJ's forward-looking initiatives indicate potential for sustained growth within the competitive landscape of high-growth technology sectors in Asia.

- Click here to discover the nuances of Beijing CTJ Information Technology with our detailed analytical health report.

Learn about Beijing CTJ Information Technology's historical performance.

Seize The Opportunity

- Delve into our full catalog of 488 Asian High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300115

Shenzhen Everwin Precision Technology

Shenzhen Everwin Precision Technology Co., Ltd.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives