What You Can Learn From Jiayuan Science and Technology Co.,Ltd.'s (SZSE:301117) P/S

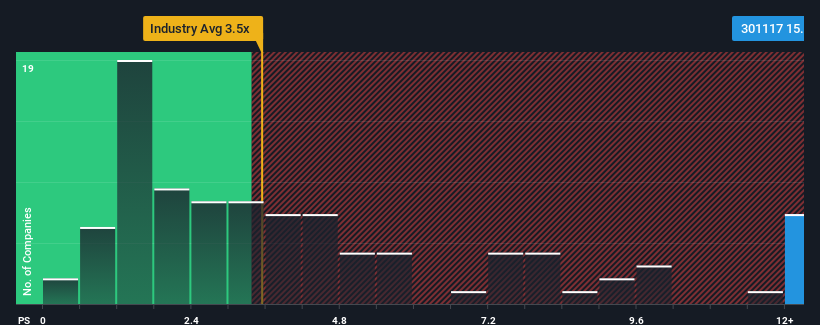

When you see that almost half of the companies in the IT industry in China have price-to-sales ratios (or "P/S") below 3.5x, Jiayuan Science and Technology Co.,Ltd. (SZSE:301117) looks to be giving off strong sell signals with its 15.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Jiayuan Science and TechnologyLtd

How Jiayuan Science and TechnologyLtd Has Been Performing

While the industry has experienced revenue growth lately, Jiayuan Science and TechnologyLtd's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Jiayuan Science and TechnologyLtd.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Jiayuan Science and TechnologyLtd's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 32% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 110% during the coming year according to the three analysts following the company. That's shaping up to be materially higher than the 45% growth forecast for the broader industry.

With this information, we can see why Jiayuan Science and TechnologyLtd is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Jiayuan Science and TechnologyLtd's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Jiayuan Science and TechnologyLtd shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 1 warning sign for Jiayuan Science and TechnologyLtd you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301117

Jiayuan Science and TechnologyLtd

Provides network information security products and comprehensive information solutions.

Excellent balance sheet with low risk.

Market Insights

Community Narratives