Optimistic Investors Push Hangzhou DPtech Technologies Co.,Ltd. (SZSE:300768) Shares Up 27% But Growth Is Lacking

Hangzhou DPtech Technologies Co.,Ltd. (SZSE:300768) shares have continued their recent momentum with a 27% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 32%.

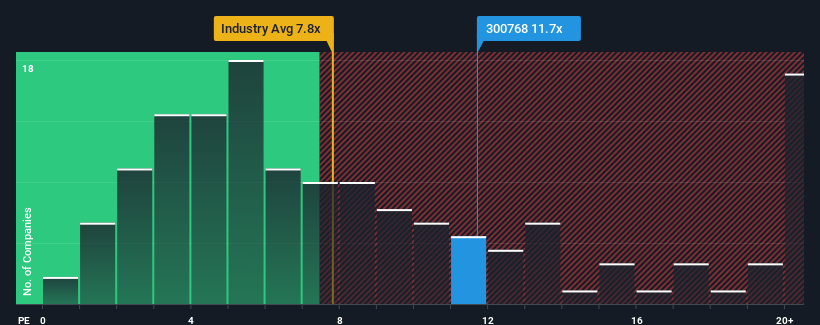

Since its price has surged higher, when almost half of the companies in China's Software industry have price-to-sales ratios (or "P/S") below 7.8x, you may consider Hangzhou DPtech TechnologiesLtd as a stock not worth researching with its 11.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Hangzhou DPtech TechnologiesLtd

What Does Hangzhou DPtech TechnologiesLtd's P/S Mean For Shareholders?

Recent times have been advantageous for Hangzhou DPtech TechnologiesLtd as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Hangzhou DPtech TechnologiesLtd will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Hangzhou DPtech TechnologiesLtd?

In order to justify its P/S ratio, Hangzhou DPtech TechnologiesLtd would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 25% over the next year. Meanwhile, the rest of the industry is forecast to expand by 33%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Hangzhou DPtech TechnologiesLtd's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Hangzhou DPtech TechnologiesLtd's P/S

The strong share price surge has lead to Hangzhou DPtech TechnologiesLtd's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Hangzhou DPtech TechnologiesLtd, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Hangzhou DPtech TechnologiesLtd you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou DPtech TechnologiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300768

Hangzhou DPtech TechnologiesLtd

Together with its subsidiary, Hangzhou Deepin Information Technology Co., Ltd., engages in the network security related businesses in China, Hong Kong, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.