Hangzhou DPtech Technologies Co.,Ltd. (SZSE:300768) Not Lagging Market On Growth Or Pricing

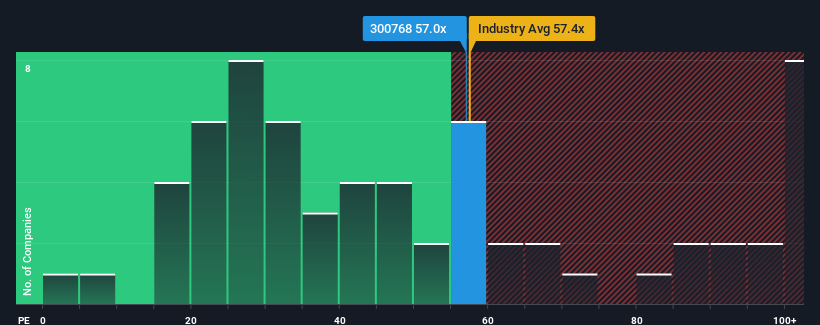

When close to half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Hangzhou DPtech Technologies Co.,Ltd. (SZSE:300768) as a stock to avoid entirely with its 57x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Hangzhou DPtech TechnologiesLtd could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Hangzhou DPtech TechnologiesLtd

Is There Enough Growth For Hangzhou DPtech TechnologiesLtd?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Hangzhou DPtech TechnologiesLtd's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 56% drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 28% per year as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 25% each year growth forecast for the broader market.

With this information, we can see why Hangzhou DPtech TechnologiesLtd is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Hangzhou DPtech TechnologiesLtd's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Hangzhou DPtech TechnologiesLtd that you need to be mindful of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou DPtech TechnologiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300768

Hangzhou DPtech TechnologiesLtd

Together with its subsidiary, Hangzhou Deepin Information Technology Co., Ltd., engages in the network security related businesses in China, Hong Kong, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives