Guangdong Aofei Data Technology's (SZSE:300738) Sluggish Earnings Might Be Just The Beginning Of Its Problems

Guangdong Aofei Data Technology Co., Ltd.'s (SZSE:300738) recent weak earnings report didn't cause a big stock movement. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

View our latest analysis for Guangdong Aofei Data Technology

A Closer Look At Guangdong Aofei Data Technology's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

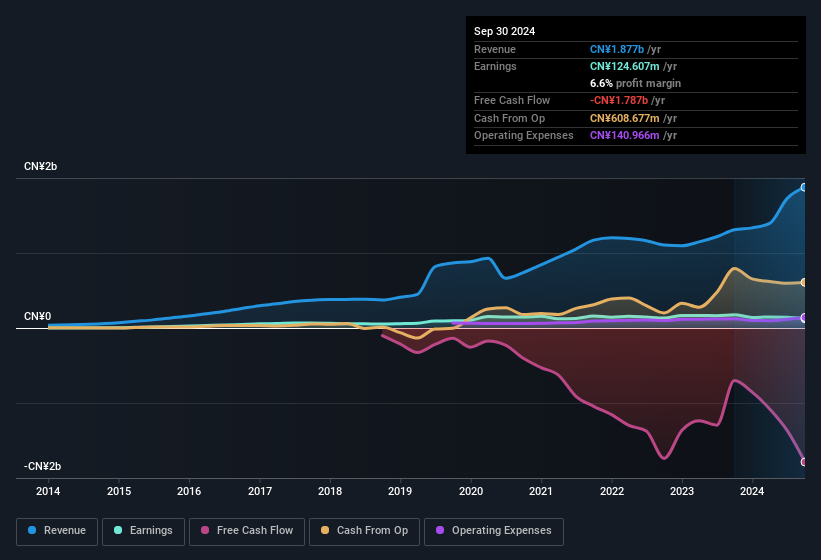

Over the twelve months to September 2024, Guangdong Aofei Data Technology recorded an accrual ratio of 0.26. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, which is hardly a good thing. Over the last year it actually had negative free cash flow of CN¥1.8b, in contrast to the aforementioned profit of CN¥124.6m. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of CN¥1.8b, this year, indicates high risk. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

The fact that the company had unusual items boosting profit by CN¥32m, in the last year, probably goes some way to explain why its accrual ratio was so weak. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Guangdong Aofei Data Technology's Profit Performance

Guangdong Aofei Data Technology had a weak accrual ratio, but its profit did receive a boost from unusual items. For the reasons mentioned above, we think that a perfunctory glance at Guangdong Aofei Data Technology's statutory profits might make it look better than it really is on an underlying level. If you'd like to know more about Guangdong Aofei Data Technology as a business, it's important to be aware of any risks it's facing. Be aware that Guangdong Aofei Data Technology is showing 4 warning signs in our investment analysis and 2 of those are a bit concerning...

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300738

Guangdong Aofei Data Technology

Guangdong Aofei Data Technology Co., Ltd.

High growth potential with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success